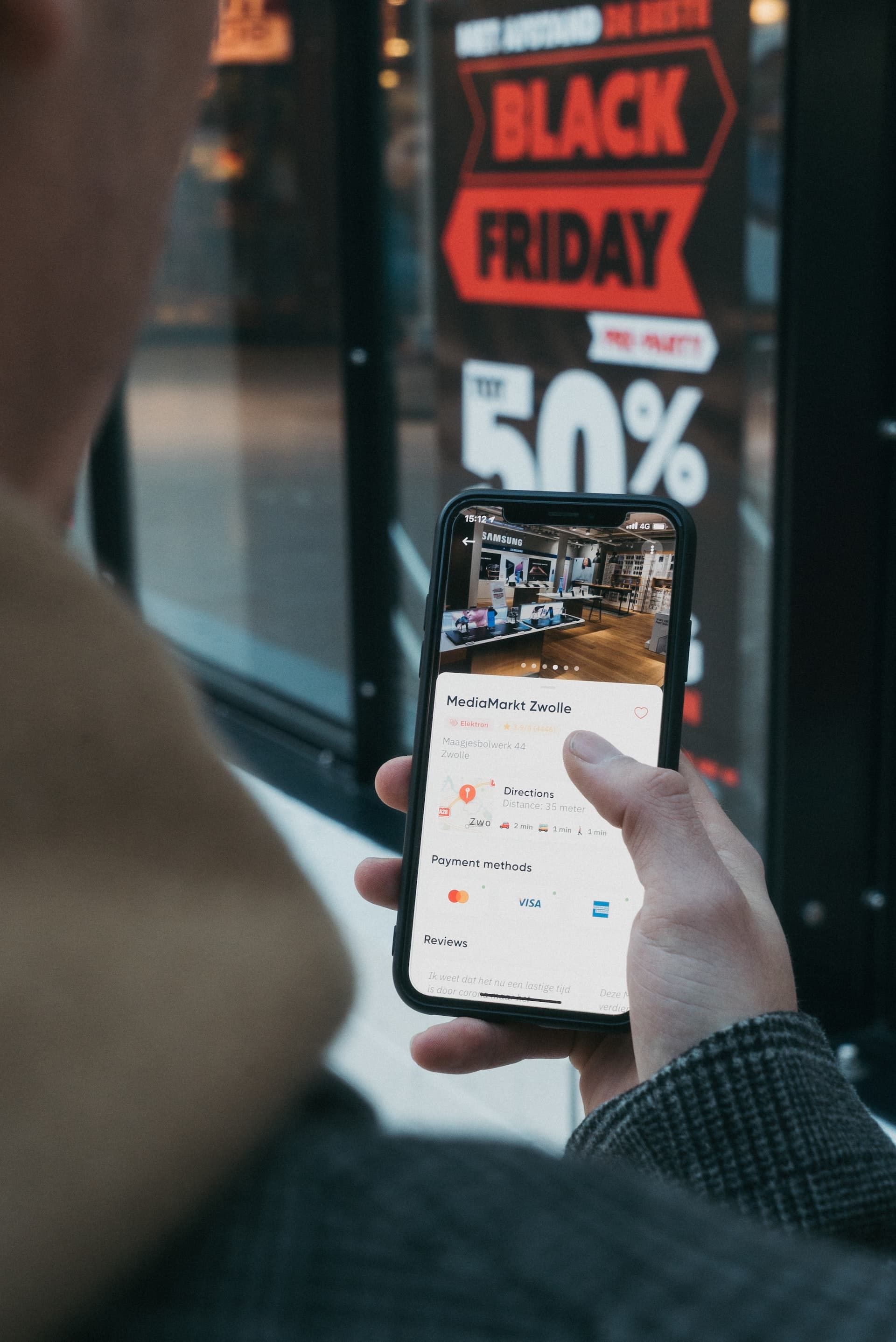

While the rise of digital and online payment systems has brought numerous advantages, it has also opened up new doors for fraud. Criminals always search for new ways into computer systems in order to steal sensitive information.

The use of digital payment methods also exposes customers to additional security threats, including the possibility of data breaches. As a result, customers must take additional safety procedures to protect themselves.

This guide provides the most useful guidance possible to consumers who are concerned about maintaining their safety while utilizing digital payment methods. Here is a list of 10 precautions that you ought to take.

IMAGE: UNSPLASH

1. Enable Two-Factor Authentication (2FA) For All Transactions

Considering the surge in the frequency and sophistication of cyberattacks, it is crucial that users enable two-factor authentication via SMS to prevent account takeovers that could result in fraudulent financial transactions.

The one-time password code sent through SMS that is required to check in to a digital payment app or site is sent exclusively to the user, even if the original PIN is stolen or leaked. This prevents hackers from gaining access to user accounts.

2. Get In The Habit Of Checking Your Bank Statements Frequently

In spite of being the first and easiest line of defense against fraudulent charges, checking your statement is often overlooked by customers. The inconsistencies will become apparent if you do this on a frequent basis.

You should immediately send a query to your bank and/or challenge a charge if you don’t recognise it. It’s obvious that this is a fundamental principle, but if you forget to check your bank statements, all other efforts become moot!

3. Set Up A Dedicated Payment Method For Online Purchases

The greatest way to protect yourself is to keep track of all of your financial dealings. . If you want to make this process as simple as possible, use only a single credit card or method of payment for all of your online purchases, and don’t use that card or method of payment for anything else.

Verify your internet purchases with your credit card bills and consider purchasing fraud insurance for your online transactions to secure yourself from any and all illegal charges. You will also then have an easier time locating abnormalities.

4. Invest Some Time Into The Verification Of Payment Receipts

Verifying the identity of the recipient is a straightforward yet essential operational security feature that all users of digital payment systems should put into practice. In many cases, digital payment systems do not come equipped with the checks and balances that are customary for more conventional payment methods.

If you send money to the wrong person or address, it is possible that the money will be lost permanently. In order to prevent this from happening to you in the future, you can ask the recipient to send you a request for payment.

5. Utilize A VPN Service And Purchase A Dedicated IP Address

When it comes to streaming and unblocking different movies/TV shows libraries, most users opt to use a free VPN for Netflix to watch their favorite content, and think the benefits end there. That’s not true. VPNs, particularly, their premium alternatives have many use-cases.

In addition to providing you security and anonymity, VPN providers offer dedicated IP addresses as an add-on. Assigning a dedicated IP address or a set of IPs to your online banking service is by far one of the most effective ways of protecting your sensitive data.

6. Make Sure To Double-check QR Codes In Public Spaces

Make sure a separate (and perhaps malicious) QR code hasn’t been placed over the original one before scanning a QR code, especially if you are performing a transaction in a public space. This can be verified by scraping the printed material a bit from the corner.

If you use a QR code to pay for something (at a store, ATM, parking meter, etc.), hackers might easily swap in a malicious one that would reveal your banking or financial account information to them (including your Social Security Number).

7. Whenever Possible Try Utilizing Biometric Authentication

Make sure a safe method of authentication is selected. Authentication methods focused simply on convenience are likely to be convenient for criminals as well (e.g., not requiring a pin for credit card transactions).

If you can, employ a biometric authentication mechanism instead of a credit card or phone number because it demands something specific to each user and makes it less likely that a theft of your credit card details will result in a loss.

8. Ensure That Your Vendor Is PCI DSS-Compliant

Be sure your vendor complies with PCI DSS, ideally at the highest certification level possible. As cybersecurity best practices evolve, it’s crucial that you work with a vendor that stays abreast of industry trends and consistently acquires and renews relevant cybersecurity certifications.

The takeaway here is that before making a payment to a vendor, consumers should always inquire about the safety precautions they have put in place. Being PCI DSS-compliant ensures that you can trust them when conducting a transaction online.

9. Never Use Your Debit Card For Any Online Transaction

If you want to avoid disclosing your banking information to the place of business where you are making a purchase, you should always use a credit card instead of your debit card. Because your money is insured by your credit card company, you will have an easier time getting it back in the event that there is an issue. If a fraudulent charge was made using your debit card, it may take your bank up to a month to refund the money that was taken from your account.

10. Only Perform Online Transactions On Apps You Trust

It is essential to make use of reputable apps as the widespread adoption of digital payments continues. Additionally, you should think about activating transaction notifications and other security measures. If you want to be able to cross-reference transactions, I would even go one step further and allow notifications for any cards that are associated with the app.

There are situations in which people choose convenience over safety, and as a result, they wind up paying a hefty price for their decision.

Wrapping Up

Consumers who are concerned about maintaining their safety while employing digital payment methods will find this guide to be quite helpful. Remember, banks and other financial institutions may shoulder the monetary risk, but customers must take responsibility for protecting themselves from identity theft.

IMAGE: UNSPLASH

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS