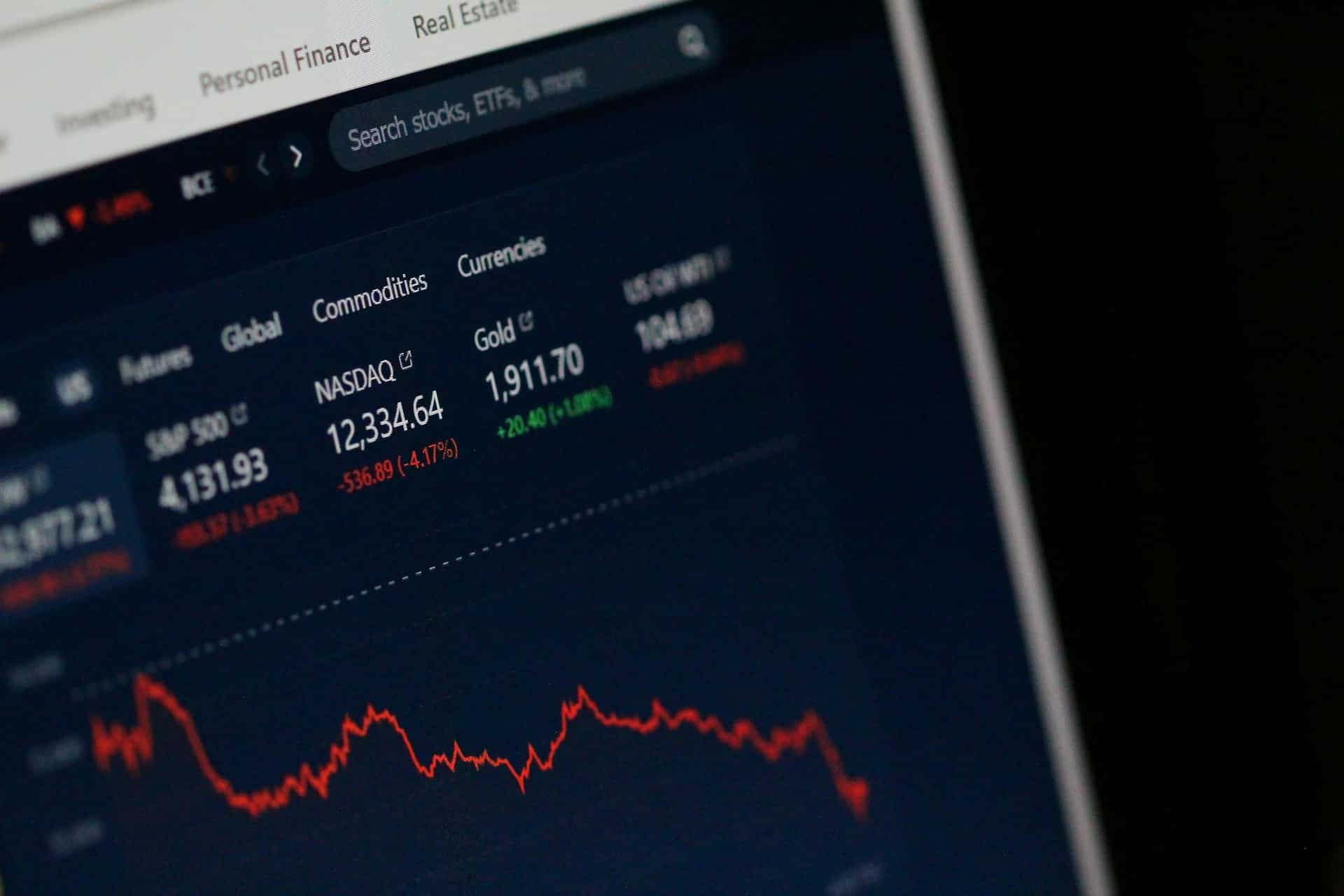

With the S&P 500 reaching an all-time high and US GDP growth rates exceeding analysts’ most pessimistic forecasts, there are risks of a repeat of the 2008 stock market crash. This time the scale of the crisis may be even more devastating.

The first signs of an impending recession will appear in just a month and a half – the world will face a second wave of the fall of systemically important banks.

At the same time, we also hear quite optimistic, but not entirely substantiated, forecasts about the further growth of Bitcoin to $46,000 or even $52,000.

These expectations are based on the growth in Bitcoin ETF trading volume, which amounted to $25 billion in the first 10 days, as well as on comparisons with companies like BlackRock and Fidelity, which took just a couple of weeks to acquire over 80,000 BTC through their spot funds.

And the recent statement by the famous cryptocurrency critic Peter Schiff about the possible growth of Bitcoin to $10,000,000 in the event of a collapse of the dollar generally looks fantastic.

“Given that Schiff has repeatedly made sharp negative comments about Bitcoin, the current forecast sounds, if not shocking, then certainly unrealistic,” Lado Okhotnikov, a founder of the Meta Force metaverse.

…”Despite the favorable indicators, problems in the global financial system remain. An increase in debt burden, instability of financial instruments and uncertainty in the geopolitical situation can lead to unpredictable consequences,” Lado emphasized.

IMAGE: UNSPLASH

Moreover, Before This, Schiff Spoke Out Very Controversially

…”After the hype around spot Bitcoin and the decline in initially increased demand, the cryptocurrency prices are likely to draw down even deeper.”

Lado Okhotnikov advocates equality between cryptocurrency and the traditional financial system. During a period when many projects were put on hold or closed, Lado decided to go further and launched his own metaverse.

His decision to give new impetus to the crypto business and offer an alternative to centralized structures has exploded stereotypes, restoring faith in the promise of decentralization.

Lado Okhotnikov On The Disadvantages Of Centralization

Why when big American banks were collapsing, some projects were growing and even showing some results. Lado Okhotnikov suggests that in the spring the US Federal Reserve System may terminate the emergency bank lending program.

“Then we will be able to see true “centralization,” Lado Okhotnikov ironically stated the efforts of the banking sector to save the sinking ship, that is, the dollar.

Let us recall that during the crisis last spring, this program helped ensure the stability of the entire financial system. Simply put, it was thanks to the support of the Fed that many banks avoided collapse.

Yes, back then Signature, First Republic, Silvergate and Silicon Valley went bankrupt. The last one on this list even provoked a 14% decoupling of the USDC stablecoin, which scared many cryptocurrency market participants, but not Lado.

Lado Okhotnikov has never relied on outside help: in the entire history of the platform, he has never conducted any IPO, IDO or ICO. Because of this, Lado did not experience pressure from investors, all the work was carried out at his own expense. Only this fact helped the project survive what “killed” many on the market.

What Was Achieved – Lado Okhotnikov About Meta Force

At a time when the crypto market was not in the best shape, Lado worked hard on internal projects and the result was not long in coming.

“A lot has been done. We have made significant progress in implementing the virtual world program Real Estate where real life will finally move into virtual reality. We have developed a crypto wallet Force Wallet and a Marketplace with a new line of NFTs,” Lado Okhotnikov emphasized the good results.

The Tactile program upgrade has been completed. This will unlock the true potential of the ecosystem, as together with the integration of Tactile Goods and Loyalty, the updated direction will bring even more profit to partners.

At the same time, Lado did not disclose all the details of the update. But he promised that users would reach a new level of income, and their businesses would become even more reliable and sustainable.

Bankfall 2024

There are rumors that the management of the US Federal Reserve System does not mind reducing the number of American banks at the expense of the collapse of small regional branches.

It is assumed that the money will be accumulated in large top-tier financial institutions — Goldman Sachs, J.P. Morgan and others.

It is important to understand that this time everything can be much more serious, and the banking crisis will spread to Europe and Asia. Something similar was already observed last year, but then it was only a child’s play.

The Fed management can abandon these plans only under pressure from the upcoming presidential elections. The rating of current US President Joe Biden is rapidly declining, and a new round of the financial crisis is practically depriving him of his chances of re-election.

According to experts, the head of the Federal Reserve System, Jerome Powell, against this background, is unlikely to terminate the liquidity support program for banks that have suffered hundreds of billions of dollars due to the depreciation of government bonds after the cycle of raising interest rates.

Lado Okhotnikov: Why The Dependence Of A Product On Your Own Name Prevents You From Doing Business

Along with success comes attention, and an army of “well-wishers” comes with it. This is not because the project is bad or because it does not produce results. In the business world, competition often pushes envious people towards doing mean things.

My Experience Tells Me That You Need To Be Prepared For Anything

To some extent, it was the example of Changpeng Zhao, the founder of Binance, that helped realize the risks. Therefore, analyzing the situation allowed me to develop a strategy that would neutralize any consequences.

With all this in mind, sharing responsibilities and establishing clear procedures will mitigate the risks associated with the management and dependence on one person, ensuring a more sustainable and manageable project development.

Opinion: Decentralization Is A Reliable Support For The Global Financial System

Lado Okhotnikov complained that he often hears how many people misinterpret the definition of decentralization. Many people think that autonomy contradicts leadership and that decentralized systems can cause chaos.

Rather, decentralization provides a new kind of leadership and promotes more sustainable development, he said. Instead of one figure, there is a large number of participants who show initiative and leadership qualities.

This is precisely what contributes to a broader and more diverse base, where everyone can contribute to the development of a particular project.

In addition, decentralization allows you to avoid the so-called “single point of failure”, when there is one element in the system that, if it fails, causes the collapse of the entire structure. Which is exactly in line with the expected spring bank crash – the collapse of one participant can destroy the entire centralized financial system.

For those who still doubt the prospects of cryptocurrencies and pay attention primarily to its price, and not to its practicality, Lado Okhotnikov reminds.

“The growth in value is determined primarily by fundamental factors – limited emission, the functionality of cryptocurrency and a decrease in trust in fiduciary, that is, traditional currencies secured only by trust.”

Samson Mou, crypto investor, entrepreneur, CEO of Pixelmatic, also speaks about this. According to him, the launch of bitcoin exchange-traded funds (ETFs) is a secondary event that can strengthen the position of the cryptocurrency, but will not be a determining factor in the long-term trend of its price growth.

Moreover, he states that:

…”Many people have entered the industry, and the recent pullback in BTC price is an expected correction in the GBTC market…”

Decentralization is not just a buzzword, but a principle that will ensure long-term sustainability and successful development. We continue to move in this direction, striving to create a future where reliability and independence remain at the forefront.

Well, in case of another crisis, an even greater flow of capital into cryptocurrency is inevitable, as investors will finally want to find salvation from the hegemony of the dollar.

Perhaps we will witness a new Bretton Woods agreement, when Bitcoin will become the measure of international currency settlements and storage of reserves.

Banks Zeroing – Conclusion

Due to optimistic statements about US GDP growth in the 4th quarter of 2023, being 3.3% higher than expected, as well as the market’s postponement of expectations for a Fed rate cut from March to May, it seems that the conclusions about the decline in the economic recession are hasty.

After all, the positive dynamics of economic growth over one quarter does not mean anything: an analysis of long-term trends is necessary. In addition, the forecasts of the regulator and market participants may change significantly given the high uncertainty of the current situation.

There are significant risks of a slowdown in growth rates, including high inflation, disruptions in supply chains, and geopolitical tensions that can play a cruel joke.

Premature optimism is fraught with incorrect economic and investment decisions, so caution is now more important than ever in assessing the prospects of the American economy.

Disclaimer: The above references an opinion of the author and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. Invest responsibly and never invest more than you can afford to lose.

IMAGE: UNSPLASH

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS