In hard times, both ordinary people and enterprises seek financial support. It’s essential to maintain monetary stability and overcome further difficulties. When it comes to taking loans, most users struggle with documentation, legal issues, and other difficulties – which factors influence the lender’s decisions, how to choose the profitable option?

The most essential factor is the credit score. It can be either personal and business and used for different purposes. That’s why people often mix these two numbers and their impact on finances. Sort out which is what, and how these different measures influence your applications.

IMAGE: UNSPLASH

Does Personal Score Influence Your Enterprise

Starting a venture, people often borrow at private lenders – use loan express, payday, or installment options. It leads to confusion between the two scores. See how it truly works, and whether two factors influence each other.

What Is Personal Credit Score and How It Works

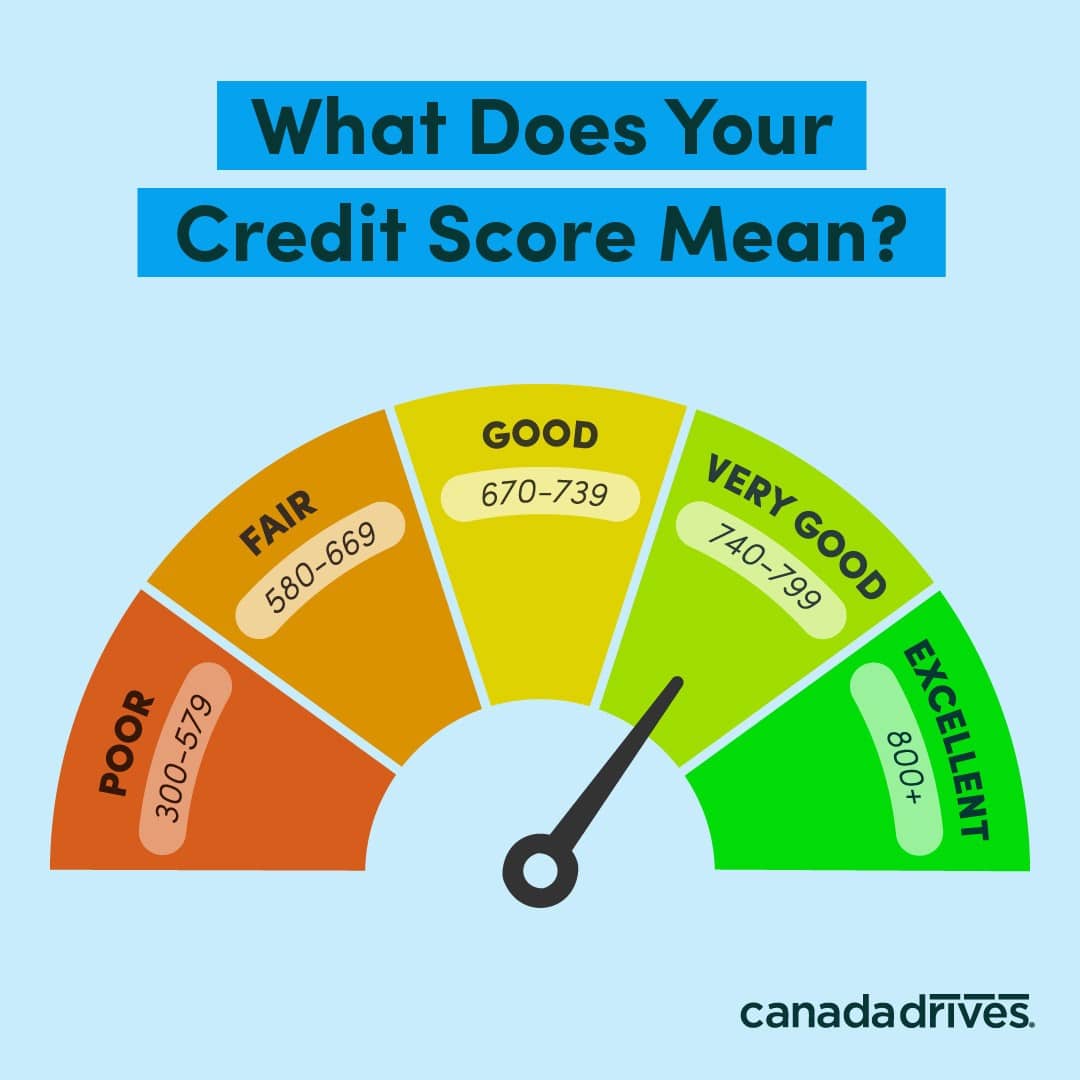

In short, it is a number from 350 to 800, determined by national agencies. It shows how reliable the human is in borrowing money. Working on your application, the lender analyzes this report and makes decisions concerning repayment conditions.

It is formed by several factors:

- the history of previous debts: how many credits you took and how you repaid them;

- the number of present debts and the way of repayment: the number of delays and prolongations;

- the number of applications at the moment – the more money you need, the worse is your financial position.

This indicator is essential when you take a personal loan – funds, intended to solve your private troubles: purchases, debt consolidation, life events, and emergencies. Most commonly, banks use this range:

Is It Connected With Your Business

Officially, these two factors are separated. Both persona and its project are independent of each other: borrow money, repay debts, have reputation and rate.

However, the lender has access to all of your data. Sometimes, even if you take funds for the commercial project, they look through both scores just to make general conclusions about the client. When is it possible?

1. You Use Traditional Banks

National institutions are extremely thorough in checking your papers. They work only with reliable customers and require excellent rates. it’s justified by lower interest and soft conditions. However, if your position leaves much to be desired, stop at private creditors.

2. You Start A Small Project

Taking funds for a startup or small venture, you have no papers and history to provide. That’s why the lender needs the borrower’s info to have an idea about your perspectives and reliability.

In such a case, personal loans would be a better decision – chances to obtain them are much higher at the very beginning.

3. Your Credit Score Is Extremely Low

The way you treat private money usually reflects your attitude to assets. No lender would trust a business with a bad credit owner.

Before starting a venture, settle your own budget and learn to manage money smartly. It’s the only way to make the right impression and get a beneficial offer.

How Borrowing For Business Affects Your Daily Life

Working on commercial projects, people often worry about its impact on their life. Whether business debts prevent them from taking personal credits?

How Business Credit Score Works

This indicator is similar to the personal one – it determines your ability to borrow. The number is formed based on the business credit history. It’s a record of all transactions, operations and debts, and the general well-being of the project.

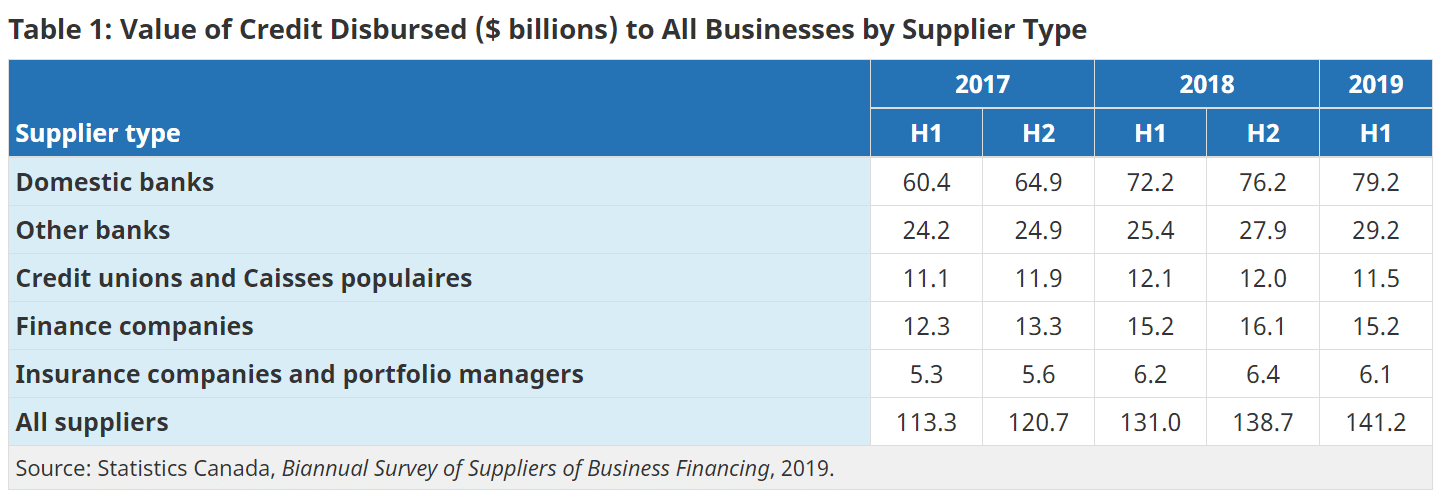

It’s especially actual now when Canadian entrepreneurs seek help after the pandemic. Numbers show all types of lenders from banks to private services, give more and more loans to companies all over Canada. The popularity of this lending type is rising, and some borrowers even noticed the relaxation of repayment conditions.

Does It Influence Your Daily Life?

Legally, the business score cannot influence you as a person. Still, there is a case when troubles with enterprise affect other life spheres – secured loans.

This option offers lower interest and a long-term of repayment. However, they require your property as collateral – compensation for risks. If you used accommodation, a car, or another asset to borrow some money for the venture, the lender may withdraw it in case of non-payment.

Where To Take Money For Enterprise

“Any time is a good time to start a company” – Ron Conway, Noted Angel Investor

If you cannot apply at banks, try alternative sources:

- Business loans are the most common type, given to buy technical equipment, extend the staff or rent a new office and warehouse. It implies large sums for a long period.

- Smaller types are used by beginners to obtain temporary support.

- Startup funds are the riskiest ones, but essential to start a new project.

Can Your Borrow Money With Low Scores

If you need some money to survive hard times and help your venture, loans are an essential measure.

Loans For Individual needs

Don’t expect support from the banks – they ask for perfect papers and a financial state. Still, you can try private services. They offer a higher interest rate but give approval to almost every customer.

These options include a huge variety of offers depending on your needs:

- Payday options were developed to obtain quick money for a short time. Usually, var from 100$ to 5000$ and should be repaid in one-two weeks.

- Cash for special purposes like marriage, celebration, divorce, and other unpredictable charges offer flexible conditions;

To make large purchases, use installment loans. These imply large sums and can be repaid in several payments during 1-3 years.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS