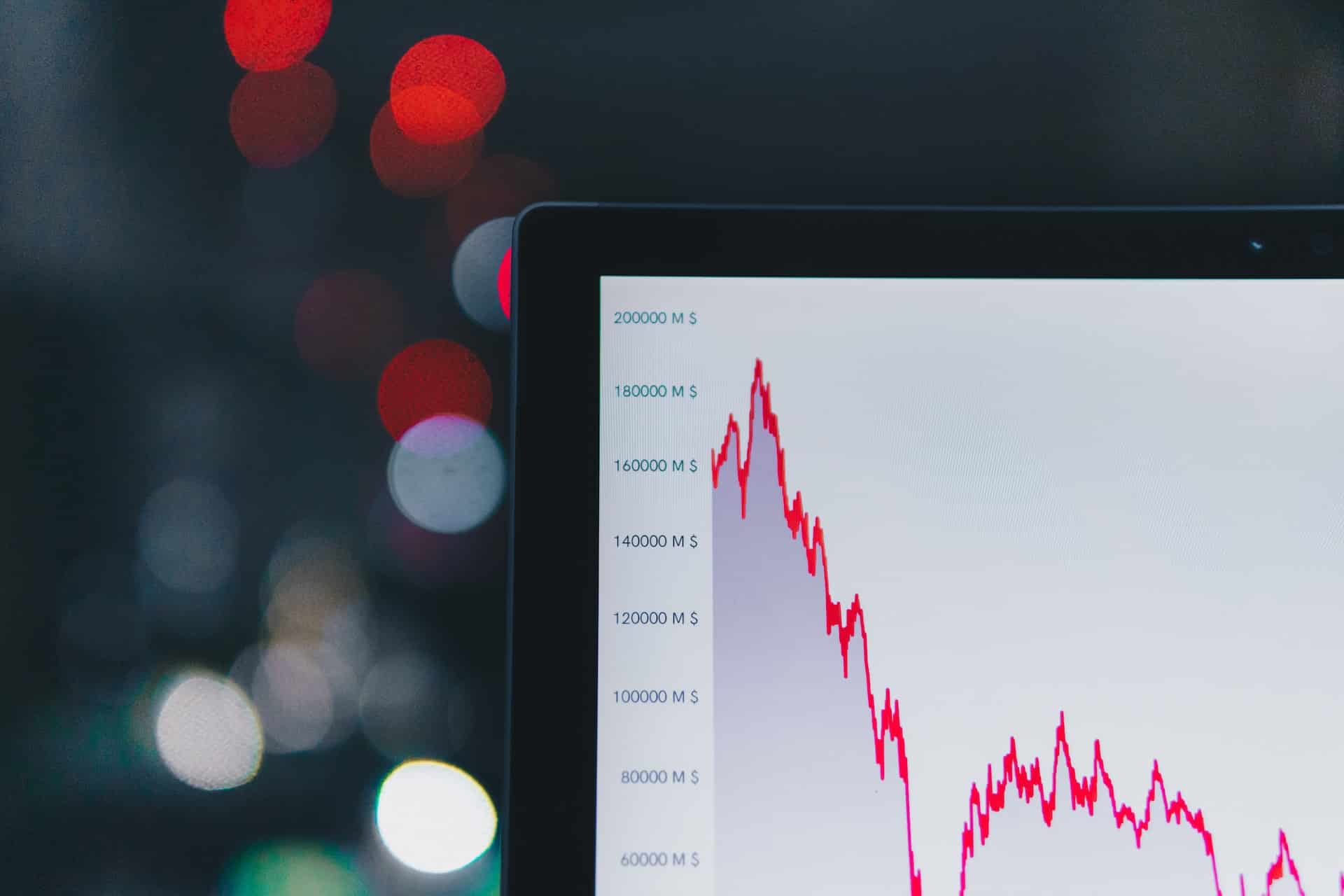

A stock market crash can happen at almost anytime, any moment. Hence, to tackle the same and avoid a financial ruin, you must have a plan B in your pocket. So, can you opt for Cryptocurrency in this aspect?

Well, in this article, we’re going to talk about precisely that and some more. Thus, if you’re interested in it, don’t forget to keep reading till the end.

Although Cryptocurrency is almost like the stock market, it works a bit differently than usual. For example, it’s not regulated by the government. Therefore, no one is there to protect you if something gets stolen from your online wallet.

On the other hand, as it’s not regulated by anyone, you won’t have to pay anything additional to the government. Even if you are transacting through a trading platform like BitAlpha, you will only need to pay a small fee for that. There’s nothing too expensive here.

Finally, as Cryptocurrency is being traded in a decentralized platform, it’s impossible for any person to trace it during the transaction. Thus, the risk of losing your hard-earned money will be much lower than usual. However, we’ll still ask you to be wary of your situation.

Diving in the world of Cryptocurrency, especially while the stock market is down, can be an excellent option. However, it can still be quite risky for you. For instance, most of the Crypto wallets available out there aren’t too secure, TBH. Hence, it might be better for you to opt for a cold wallet instead.

As the name suggests, they are offline. Hence, it’ll be impossible for anyone to get access to it. Nonetheless, it won’t be an ideal option if you want to trade whenever possible. Another issue with the Cryptocurrency market is that it can be highly volatile. Therefore, it’ll be possible for you to lose your money from here as well.

Cryptocurrency can, indeed, seem like quite an excellent strategy to counter the stock market plummeting as a while. But, if you don’t have a strong plan backing you, it won’t be possible for you to earn anything from here. Instead, it might end up backfiring.

Stablecoins, a part of the Crypto universe, are quite popular in the market due to the stability they bring on the table. How do they do that, though?

Well, in essence, stablecoins are backed by fiat currencies, such as gold US dollar, and other Cryptocurrencies as well. Hence, as long as they aren’t losing their backing, they aren’t going to lose their value anyhow. However, there’s a hitch.

Whenever there’s a war or a natural calamity of the same level, the overall expense of any fiat currency can get reduced to some extent. This might affect the stability of the stablecoins. So, they’re not a solution as well.

Well, investing in the Cryptocurrency market can, indeed, be a decent solution. Nonetheless, if you want to achieve that feat, you’ll need to focus on a few aspects. These are –

The Cryptocurrency market has been quite volatile since the beginning. Hence, even if you’re careful enough, you might still end up losing some of your money.

However, there’s no need to be wary of that. It’s quite natural and might happen again. You’ll just have to be sure that you’re making the right judgment when it comes to investment. We hope you’ll be fine, otherwise. Just don’t get your hopes up and consider Crypto as some sort of savior that can help you with the stock market crash. That’s all.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

Pinterest and Instagram have flooded our timelines and head spaces, exposing us to awe-inspiring designs…

In this article, we’ll discover a Custom CRM, why it’s crucial for groups, and what…

Efficiency in business operations directly impacts growth and customer satisfaction. Businesses today require seamless transaction…

When your truck needs repairs, choosing the right aftermarket parts can mean the difference between…

The healthcare industry is at a crossroads. As technology continues to revolutionize the way we…

Dennis Pappas is a landscape architect with a clear mission—make cities greener, healthier, and more…