Money has been an integral part of human civilization for more than three thousand years. Yet money has not always taken the form of the coinage and paper notes that we recognize today; instead, it has evolved over centuries to meet the requirements of each age and Forex is our time’s addition to the timeline.

So how did our modern currencies originate? What provides the underlying value of the coins in our pocket? And how has our understanding of money shaped global markets over the centuries?

Our history of forex will explain all.

The Origins Of Money

Before the widespread use of physical currency, trade was conducted through the bartering of one good for another. However, different products are rarely directly convertible in terms of value, which created obstacles for trade.

Physical currencies became a popular solution because they provide an intermediary store of wealth, capable of simplifying exchanges between individuals.

Defining A Currency

Any item that is agreed to hold an intrinsic value can be used as currency. Cattle was considered currency as long ago as 9,000 BCE and, in ancient China, one of the world’s first currencies was a snail shell known as cowry. The fact that these items are widely accepted as a form of payment is the single attribute required for each to be recognized as a valid currency.

The Creation Of Foreign Currency Markets

The first standardized coins began to appear from the 7th century BCE onwards. And, because each currency represented a different value, markets naturally developed around the buying and selling of one coinage for another.

Although the precise moment of these first ‘forex’ trades has not been recorded, we know that governments, such as the Byzantine Empire, were already controlling and regulating the money markets by the 4th century CE. However, this was not forex trading as we would recognize it today. The first major step towards modern forex trading was the adoption of a gold standard.

The Gold Standard

[pullquote]Great Britain implemented a gold standard for its currency in 1816 as part of the Coinage Act.[/pullquote] A gold standard permits the direct conversion of coinage into a fixed quantity of gold bullion. By 1879, many countries had adopted a gold standard, including the United States. Those which had adopted the gold-backed system were able to easily convert the values of their own coinage directly into any other gold-backed currency. This improved price stability within exchanges, and allowed traders to buy and sell with a greater degree of confidence for many decades.

The Bretton Woods And Smithsonian Agreements

The gold standard continued as long as traders remained confident in a nation’s gold reserves. However, following the Second World War, trust in these reserves began to diminish. The system was replaced in 1944 by the Bretton Woods Agreement.

The Bretton Woods agreement was seen as a significant moment, as it permitted individual currencies to discover their own value on the open market, by decoupling them from gold and the US dollar and allowing price adjustments of up to one per cent.

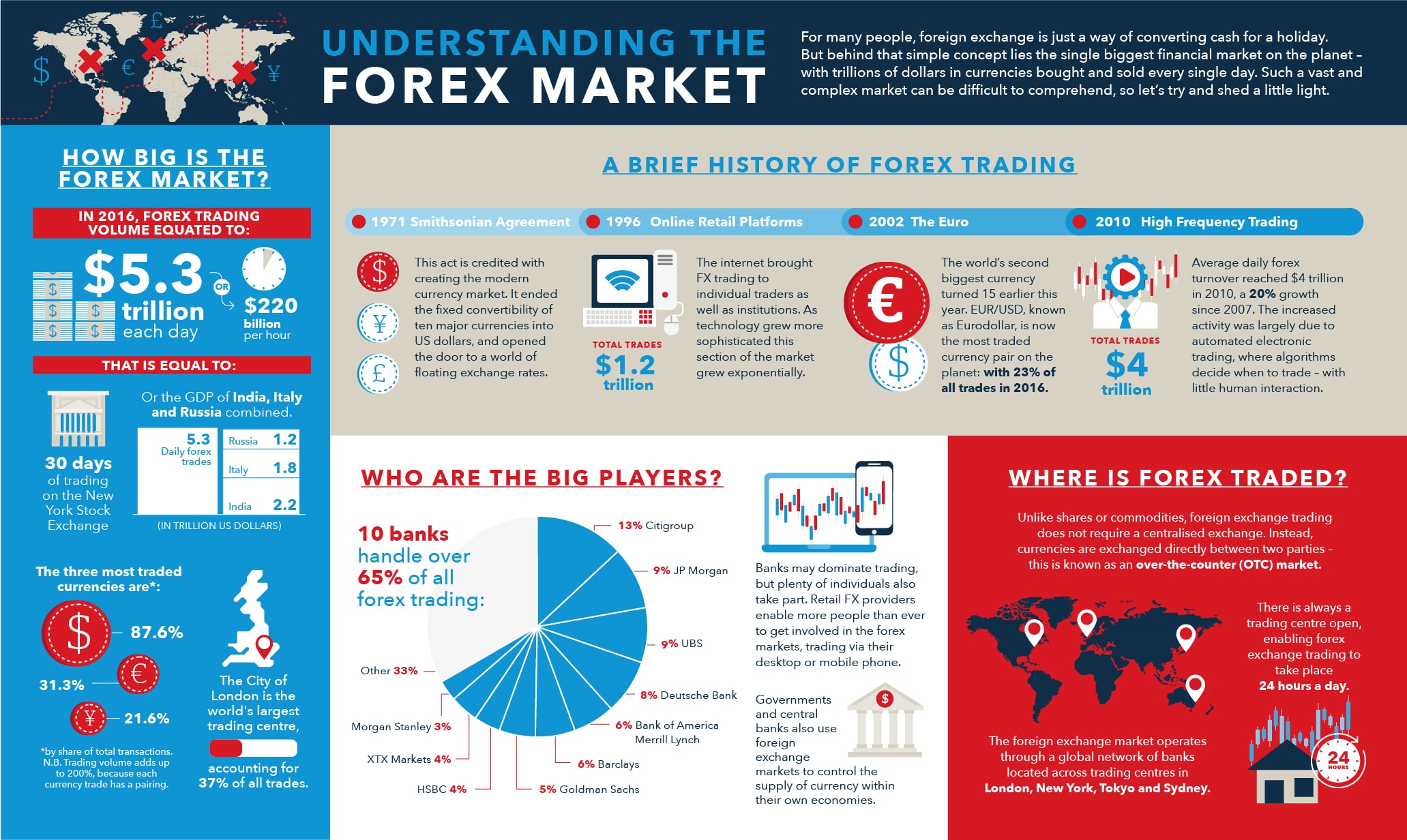

The Smithsonian Agreement of 1971 then expanded the adoption of floating currencies by allowing price adjustments of up to 2.25 per cent against the US dollar. The value of the US dollar in relation to gold was also reduced, removing much of the incentives of converting currency into precious metal. Within a decade, virtually all major world economies were decoupled from gold and were freely floating on the forex markets.

Digital Markets

Yet to fully understand forex trading in the modern age, one must appreciate the unique structure of the market, and how it has been shaped by technology.

The buying and selling of one currency for another occur directly between two parties, without a centralized authority or exchange acting as an intermediary. This is known as an over the counter (OTC) market. It means that trades can occur in any location, and at any time, 24 hours a day.

[pullquote]Decentralization has been a key element of recent growth in forex trading activity.[/pullquote] In the decade which followed the launch of the first web-based trading platform, daily volumes on forex markets more than doubled: from $1.7 trillion in 1998 to $3.98 trillion in April 2010. By 2016, trading in the global forex markets had grown further: to $5.09 trillion – aided in no small part by the emergence of high-frequency trading robots which use algorithms to execute multiple trades every second.

Today’s foreign currency market sees $5.3 trillion worth of transactions each day. A growing share of this activity is carried out by independent traders: participating in global markets and shaping the prices of the world’s currencies while requiring little more than an internet connection.

The way we use money has changed over time; it continues to evolve now, and into the future. At each point in our history of foreign exchange, we have seen how the role of money has adapted to address the needs and uses of contemporary societies. It has helped us to simplify trade, to save and store wealth, and to create more stable societies to live in. The modern forex market is decentralized and democratic and provides access to more traders than any other marketplace on the planet.

For more investment and trading-related articles here on Bit Rebels, click here!

COMMENTS