Gold and silver belong in every portfolio. Gold and silver are eligible as RRSP investments and they play a very important role when you need to diversify your portfolio. One of the biggest misunderstandings about gold is that it’s a bad investment because it doesn’t produce dividends.

Without using bullion lending to turn gold into investment income, that’s true, but in Modern Portfolio Theory, that’s not why you invest in gold. In an optimal portfolio, stocks, bonds, fixed income securities, and real estate are all included alongside gold and silver. Every investment has a role to play either maximizing returns or minimizing risk. Gold and silver bullion minimize risk – including the risks of a market downturn, high inflation, and third-party risks such as fraud.

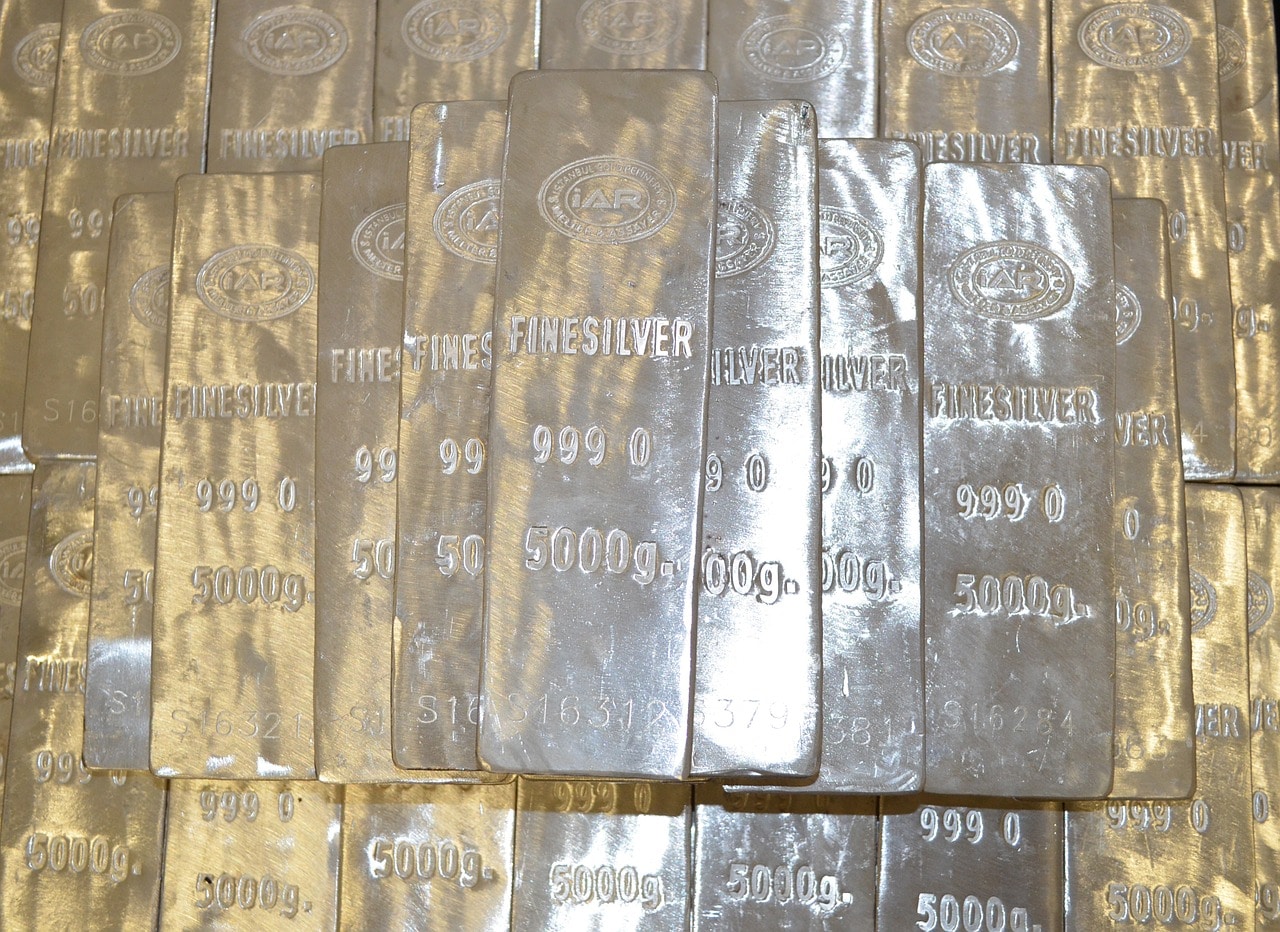

IMAGE: PIXABAY

Why Adding Gold And Silver To Your Portfolio Is A Good Thing

The main principle behind modern portfolio theory is improving your risk-adjusted returns, which are your returns relative to the risks that you take. Risk can be measured by volatility, i.e., daily price fluctuations, or by the chance that you will lose money in the long-term. The Sharpe ratio evaluates your returns relative to the interest rates you can earn on risk-free investments (such as treasury securities).

Gold and silver are considered to have a very low risk. Looking at their 100-year price trajectory shows you why. Over the course of a century, the price of gold and silver has kept up with inflation. It’s one of the major selling points used by gold dealers like Silver Gold Bull to appeal to investors and the numbers back it up. The historical importance of gold and silver as stores of wealth continues to this day.

Investors who are interested in a balanced investment portfolio must consider buying gold and silver. How much of your portfolio is in gold bullion and silver bullion depends on things like how close you are to your retirement and your goals. Younger investors who are farther away from retirement but have smaller savings are typically encouraged to take a more aggressive stance, with higher risks but portfolios designed to bring in larger returns.

For younger investors, between 5-10 percent in conservative investments like gold and silver is usually a sound strategy. One thing to keep in mind is that younger investors will be waiting substantially longer (even decades) before they touch RRSP investments. RRSP gold and silver will preserve their value better than cash or even low-yield investments.

As investors get closer to retirement, their portfolios should reflect larger savings. In addition to income-producing investments that will supplement your retirement, they will also want very low-risk holdings like physical gold bars and silver bars. At this stage, a 10-20 percent investment in gold and silver makes a lot of sense.

Investors should look into gold dealers like Silver Gold Bull that help you buy gold and silver as part of your RRSP. They can also help with storage if you’re nervous about keeping such large investments in your home. Gold and silver are the insurance policy on your portfolio. Protect yourself from risks with a balanced portfolio.

If you are interested in even more investment-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS