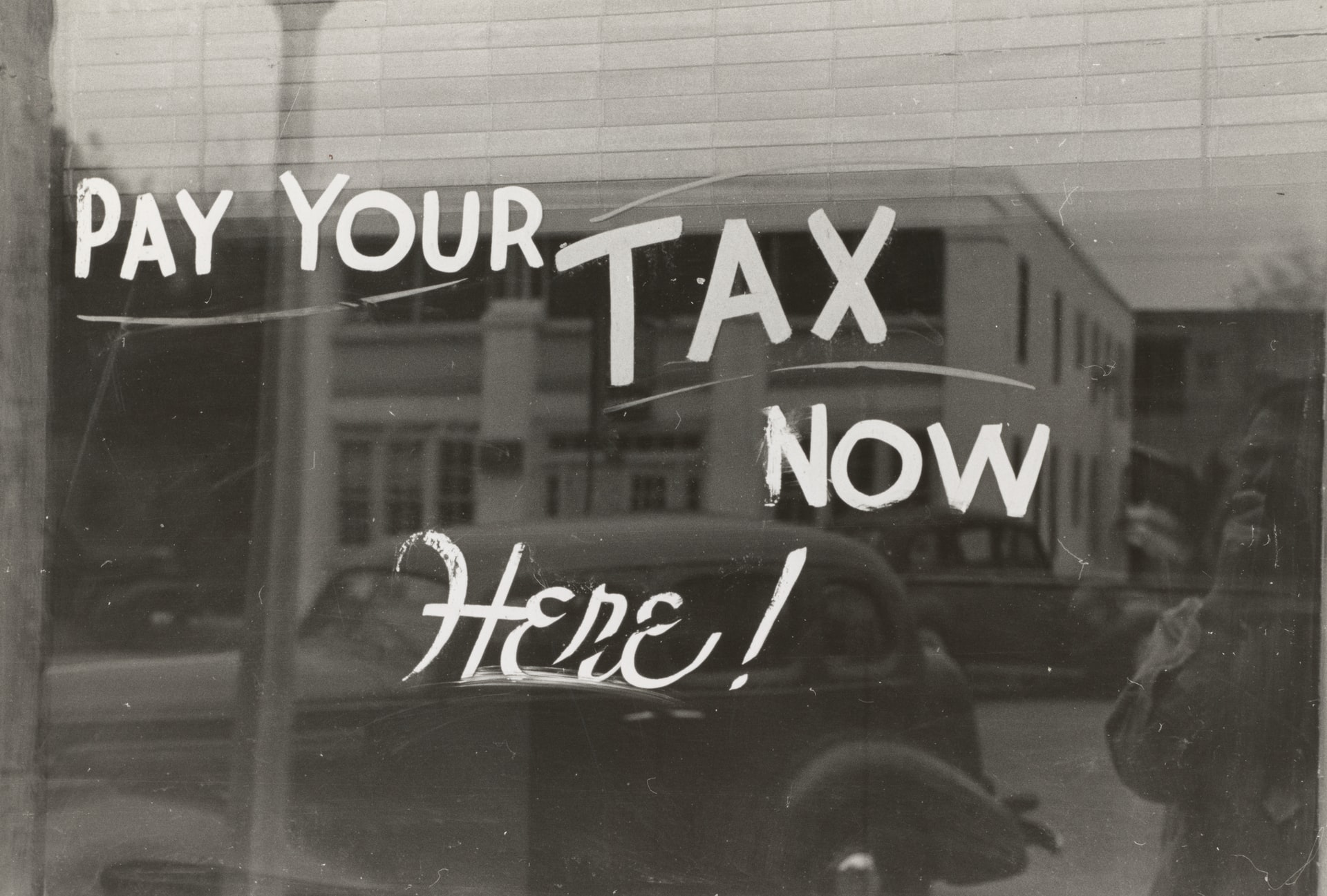

Taxes, taxes, taxes – and more taxes. Going through your paperwork and statements, all you can think about is that dreaded word, taxes. No one is going to play make-believe and say that tax filing is fun, nor is it something to look forward to, but as Benjamin Franklin famously said, “…nothing is certain except death and taxes,” so it is impossible to ignore. Without harping on the tax process too much, you also owe yourself the duty of getting this done in a timely manner.

It might not seem like it, but doing your taxes earlier has a lot more advantages than simply helping you be more punctual with your responsibilities. Tax filing ahead of time has many hidden benefits that anyone can take part in if they simply get to work filling out their 1040s and W2s instead of complaining about this inevitable part of their lives. Alright, one last time, taxes are not fun, but if you want to ease the boredom, here are some intriguing things to look forward to for early tax filers.

The one everyone wants to hear is that they will be getting their return quicker. Tax filing does have a silver lining in that you will get the return much quicker than people who wait until the deadline. Getting your return back quicker could help with paying bills, and if you click here, you can figure out how much you will be getting in return.

Putting that tax return to good use and fast allows you to bypass everyone getting theirs so you will not be waiting long to have it come in the mail or pop-up in your bank account. This is also a great way to recoup on bills that accumulate just after the holidays as your spending is going to go up, so receiving the return quickly helps you get back to your normal financial situation quicker.

Speaking of bypassing everyone, you want to file ahead of time because the tax season rush makes it harder to get your taxes filed. You may have filled everything correctly, accounted for all your taxable assets and income, but it all comes down to how many people are being processed at once. This is especially important if you still mail in your tax forms through the post.

Getting it in well ahead of schedule also helps you avoid the fear of missed deadlines, a major reason for tax season anxiety, and all the issues it comes with. People often cite this as a particularly stressful part of the year, so giving yourself that cushion protects your mental well-being and the other benefits you will get.

When no one is doing their taxes, CPAs (chartered professional accountants) and other tax specialists have plenty of time on their hands to assist you. Being among the few (thousands, really) people who are eagerly ready to file their forms allows you to pick the litter for your choice of tax specialists or services. Having this access to more help gives you better options when it comes to fees and gives them more time to go over all of your information to make sure it is accurate and helps you avoid any mistakes.

Filing your taxes well before the deadline has the advantage of allowing you to adjust what you are claiming on taxes. What you are claiming, otherwise known as tax burdens, includes things like capital gains, charitable contributions, and deductibles like property taxes and business expenses. This allows you to adjust what year you would make those deductibles filed under depending on what makes more sense and protect your money the best. It gives you extra time to reduce the amount of income that needs to be claimed, helping you reduce what you owe.

Avoiding the rush and getting better access to tax help both allow you to avoid making mistakes which is the benefit you get from early filing. These mistakes can lead to what is known as an amendment, which could lead to an audit. Causes for amendments that can be avoided when you file early include missing out on the proper forms because they came in too late (especially by mail).

Inaccurate information or mistakes that the bank or financial institutions you are with missed, inaccurate entries to your taxes by yourself, and updates to any tax laws. Making errors on your tax return can result in that amendment, then a possible audit, which is manageable if you prove they were simple mistakes, but it is best to just avoid that whole mess and get it done right early and properly.

The rush to get taxes filed causes people to get pretty hectic to find their information and process it as fast as possible. A noticeable problem is that people will trust any tax service they find not being aware that they could be getting scammed out of highly sensitive information like their social security number, personal information, and financial statements. This breach in security has terrible consequences, especially if you hand over your SSN to a fraud service who can then assume your identity.

Filing early protects taxpayers because fraud services are not as privy to these periods, January and February, as they are around April and closer to the deadlines. If you file your taxes beforehand, you can possibly save your sensitive information from falling into the wrong hands.

Taxes are no one’s example of a good time, save for accountants and tax services, but they represent some pretty stressful thoughts for the average person. The most stressful part is getting all of your taxes done before the deadline so you can avoid any trouble with the IRS. Thankfully the solution to these woes is filing ahead of time. Early tax filers can expect some pretty handy benefits, and now that you know what they are, you might be rethinking when to file your taxes too.

If you are interested given more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

Warehouses are changing fast, pushed by rising demand, tighter safety standards, and the constant shuffle…

Cybersecurity is no longer a task for governments and large corporations in the connected world…

Fame is a powerful force that extends beyond a celebrity’s lifetime. Icons like Marilyn Monroe,…

In an era where sustainability, transparency, and corporate responsibility are paramount, businesses are under mounting…

In today’s fast-paced and competitive business environment, managing intellectual property (IP) is more crucial than…

Working in tight or confined spaces is one of the most common challenges in modern…