As a potential Florida homebuyer, it’s important to be prepared before jumping into the market. There are many things to consider when purchasing a property, such as location, budget, and desired amenities.

Following these eight simple steps can make buying a house in Florida less daunting and more enjoyable. Let’s get started.

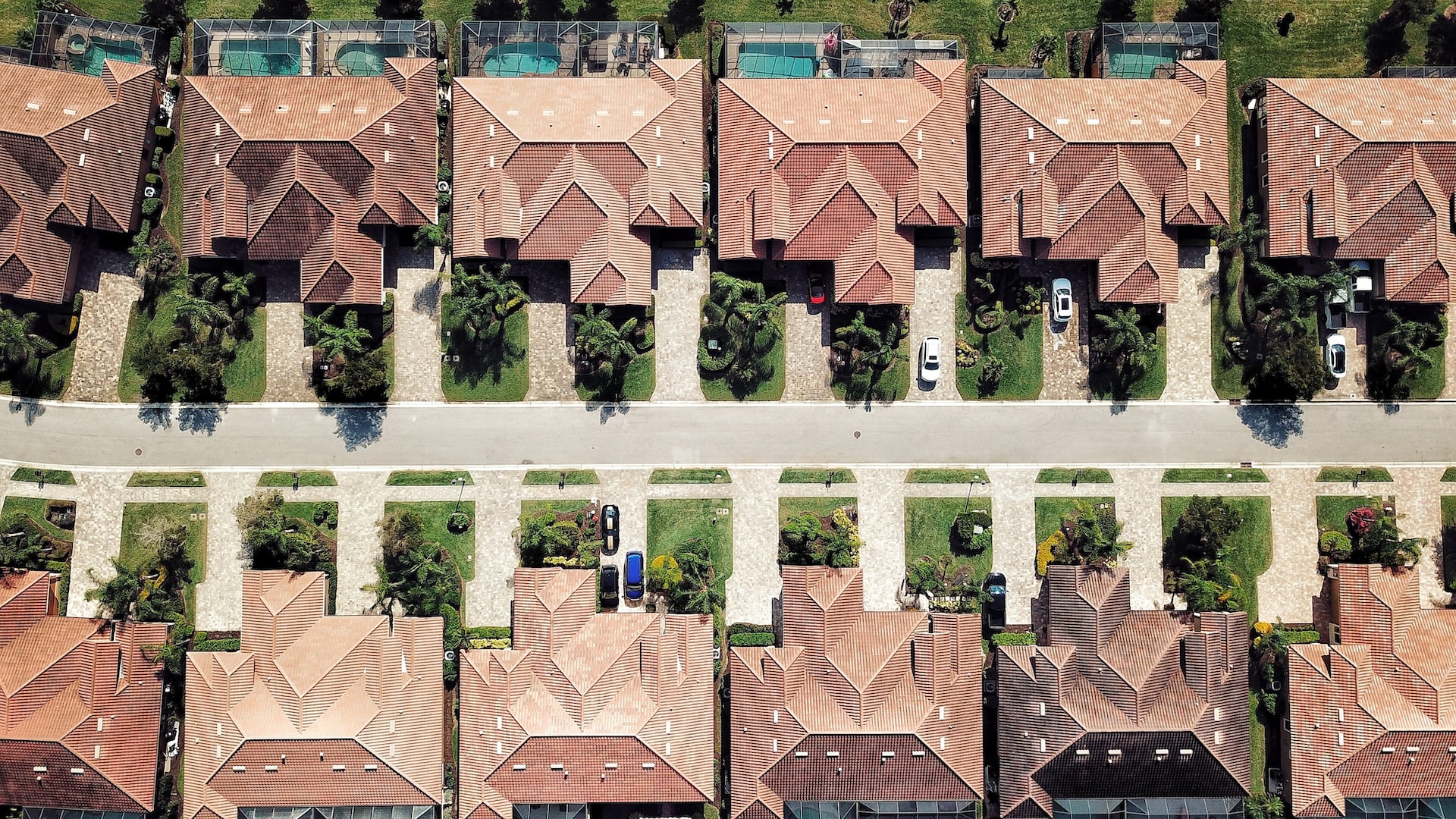

IMAGE: UNSPLASH

1. Determine Your Finances

To help determine the finances for buying a house, reach out to Top Orlando Realtors to get the best deal.

The first step to buying a Florida house is determining your finances. This includes considering your credit score, down payment, closing costs, and extra homeownership costs. Your credit score will give you an idea of what interest rates you’ll be offered on a mortgage. Down payments can range from 3% to 20% of the purchase price.

A. Credit Score

The next step to buying a house in Florida is to determine your credit score. Your credit score is important because it will affect the interest rate you are offered on your mortgage. A higher credit score means you will get a lower interest rate, which can save you thousands of dollars over the life of your loan.

B. Down Payment

You’ll also need to save for a down payment. A down payment is the upfront money you will need towards your new home. The amount you will need for a down payment depends on the type of mortgage you get.

For example, if you are getting an FHA loan, you will only need 3.5% of the purchase price for a down payment. However, if you are getting a conventional loan, you will need 20% of the purchase price for a down payment.

C. Closing Costs

Closing costs are the fees associated with getting a mortgage and buying a house. These fees can add up to several thousand dollars, so it is important to factor them into your budget.

D. Extra Homeownership Costs

In addition to your mortgage payment, other costs come with owning a home. These include property taxes, insurance, and maintenance. You will need to factor these costs into your budget to make sure you can afford to own a home.

2. Get Pre-Approval For The Mortgage

Now that you know how much house you can afford, it’s time to get pre-approved for the mortgage. This is an important step in the home-buying process because it will give you a clear idea of what you can expect to pay for your new home.

Getting pre-approved for a mortgage is a simple process that can be done online in just a few minutes. You’ll need to provide personal information and financial documents to get pre-approved. This includes your Social Security number, employment history, income and asset information. Once you’ve provided all the required information, you’ll receive a pre-approval letter from the lender.

A mortgage pre-approval letter is usually valid for 90 days. It indicates that the bank expects you to qualify for the loan, and they’re ready to proceed with getting you a mortgage as soon as you have a house in mind.

A pre-approval letter in hand when you start looking for homes will give you a big advantage over other buyers who don’t have one.

When it comes to mortgages, keep the following in mind:

- Interest Rates: Lower interest rates are ideal because they can save you money in the long term. Your interest rate will be lowered if you have a good credit score.

- The down payment required: Some loans demand large down payments, while others only need 5% (particularly if you are a first-time buyer).

- Terms: Most mortgages have either 15- or 30-year terms. Mortgage payments will take longer to pay off, but you’ll save money every month if you pay more over time.

3. Pick A Great Neighborhood

Now that you know your budget and what type of home you’re looking for, it’s time to start thinking about where you want to live. The neighborhood you choose will play a big role in how happy you are with your new home, so it’s worth finding the perfect one. Here are a few things to keep in mind as you’re looking for the ideal neighborhood:

Location

The old real estate adage still holds the most important factor in choosing a home: its location. When picking a neighborhood, think about things like the commute to work, the quality of the schools, the proximity to shopping and entertainment, and anything else important to you.

Safety First

One of the most important factors in choosing a neighborhood is safe. When looking at potential neighborhoods, pay attention to things like the crime rate, the amount of traffic, and whether there are any environmental hazards nearby.

Know Your Neighbors

Another important factor in choosing a neighborhood is the people who live there. Spend time talking to your potential neighbors and get a feel for the community.

Consider The Future

When choosing a neighborhood, it’s important to think about the future. Is the area growing? Are there plans for new development? These things can greatly impact the value of your home and the quality of your life.

Get To Know The Area

Once you’ve narrowed your list of potential neighborhoods, it’s time to start exploring. Drive around the area, check out the local businesses, and get a feel for the overall vibe.

4. Choose A Florida Real Estate Agent

The process of finding and choosing a real estate agent in Florida is an important one. You want to find someone knowledgeable about the area you are looking to buy and who you feel comfortable working with. Here are eight steps to help you find the right real estate agent for you:

Get Recommendations

Ask friends, family, and co-workers if they have any recommendations for real estate agents in Florida. If you are relocating from out of state, you can also check with your current real estate agent for referrals.

Do Your Research

Once you have a few names, do some research on each one. Check their website, read online reviews, and see if they have local awards.

Interview Candidates

Once you have narrowed your list, set up interviews with the remaining candidates, this is a great opportunity to get to know them better and to ask any questions you may have.

Ask For References

After your interviews, be sure to ask each candidate for references. This is a great way to get an idea of their past work and to see if they are someone you would be comfortable working with.

Check Credentials

Once you have your list of references, be sure to check their credentials. Make sure they are licensed and insured in the state of Florida.

Compare Offers

After interviewing all of the candidates and checking their credentials, it is time to compare their offers. Be sure to take into consideration the services they are offering, as well as their fees.

Make Your Decision

Once you have compared all the offers, it is time to make your final decision. Choose the agent you feel is the best fit for you and who you feel comfortable working with.

Start Working With Your Agent

Once you have chosen your real estate agent, it is time to start working with them.

5. Begin Searching For Your Home

Now that you have been pre-approved for a loan, it’s time to start shopping for your new home! This is usually the most exciting part of the home-buying process. There are many ways to search for homes. You can hire a real estate agent, search online, or drive around looking for For Sale signs.

If you hire a real estate agent, they will do most of the work for you. They will help you find homes that meet your criteria and schedule appointments to see them.

If you search online, many websites allow you to search for homes by location, price, number of bedrooms, etc. Once you find a home you’re interested in, you can contact the listing agent to schedule a showing. If you enjoy driving around and looking for homes, this is also a great way to find homes for sale.

You can drive around neighborhoods you’re interested in and look for For Sale signs. Once you find a home you’re interested in, you can contact the listing agent to schedule a showing.

Whichever way you search for homes, make sure you take the time to find a home you love. This is a big decision, and you want to be sure you’re making the best choice for you and your family. If you’re struggling to find a Florida home that checks all your boxes, consider it more cost-effective to build one custom-tailored to your needs.

6. Submit Offers

The next step is to submit an offer on the house you want to purchase. To do this, you’ll need to work with a real estate agent. They will help you determine how much you should offer and help negotiate the terms of the sale.

Once you’ve submitted an offer, the seller will have the option to accept, reject, or counteroffer if they accept your offer! You’re one step closer to owning your own home.

If the seller rejects your offer, don’t be discouraged. It’s common for buyers and sellers to go back and forth a few times before agreeing.

If the seller counters your offer, they will typically come back with a higher price or different terms. For example, they may ask for a shorter escrow period or request that certain repairs be made before the sale is final.

7. Do Appraisals And Inspections

The appraisal is a professional estimate of the value of the property. The inspection thoroughly examines the home to identify any defects or needed repairs. Lenders require an appraisal and an inspection before approving a mortgage loan.

Appraisals are generally ordered by the lender and can be done by any licensed appraiser. The borrower typically pays the cost of the appraisal.

Inspections are generally ordered by the buyer and can be done by any licensed inspector. The buyer typically pays the cost of the inspection.

Appraisals and inspections are not required in all transactions, but they are highly recommended.

If you’re buying a home in Florida, do your homework and order an appraisal and an inspection. Doing so will give you a clear picture of the home’s value and condition and help you avoid any nasty surprises down the road.

8. Final Checks And Closing Agreements

The final step in buying a house in Florida is to complete all of the necessary paperwork and make any final arrangements for your mortgage. You will also need to have a home inspection done at this time. Once everything is in order, you will be ready to close on your new home.

Conclusion

You’ve just learned about the 8 steps you need to take to purchase a house in Florida. By following these steps, you can be sure that you’re making the best decision for yourself and your family. Buying a home is a big investment, but it can also be one of the most rewarding experiences of your life.

To get the best deals while purchasing a house, contact Best Realtors In Florida to make every penny invested in a solid deal.

IMAGE: UNSPLASH

If you are interested in even more lifestyle-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS