The Apple hype train comes in at least once a year now, and we know it creates a sizable media fuss, but what impact does it actually have on consumers and how does it compare to their rival Samsung Galaxy handsets?

However you look at the Apple product releases, there is no denying that they are quite the buzz machine. Every product release comes shrouded with mystery, having the media guessing the latest devices features and thirsting for any form of leaked information. This creates considerable volumes of chatter online, to phrase it better, it creates a fan frenzy with anticipation of the announcement day.

In a recent study sent to Bit Rebels by Ash Turner, the trade-in comparison site BankMyCell gathered consumer-based search queries from Google trends from the iPhone’s inception to now.

Highlights Of The Study

- Apple fans “twice as electrified by events” the site states.

- The iPhone product launches have increased purchase-related searches as high as 230 percent.

- Since the iPhone 6 launch, the data shows a considerable decline in user interest, however, the sales remain strong. The site suggests it may be Apple’s closed ecosystem of linked devices keeping consumers tied in maintaining brand loyalty.

- The iPhone X event provided higher increases to the charted interest spikes, it seems the redesign of the X breathed new life into fan curiosity.

- The iPhone SE was the biggest anticlimax in terms of the online chatter, this is understandable as budget phones tend to not have any new features that spawn excitement.

- The top five American states that want new iPhones over time are Louisiana, New York, New Jersey, Florida, and Delaware.

- The top five trade in conscious states looking to cash in are Nevada, Oklahoma, Louisiana, Delaware, and New York.

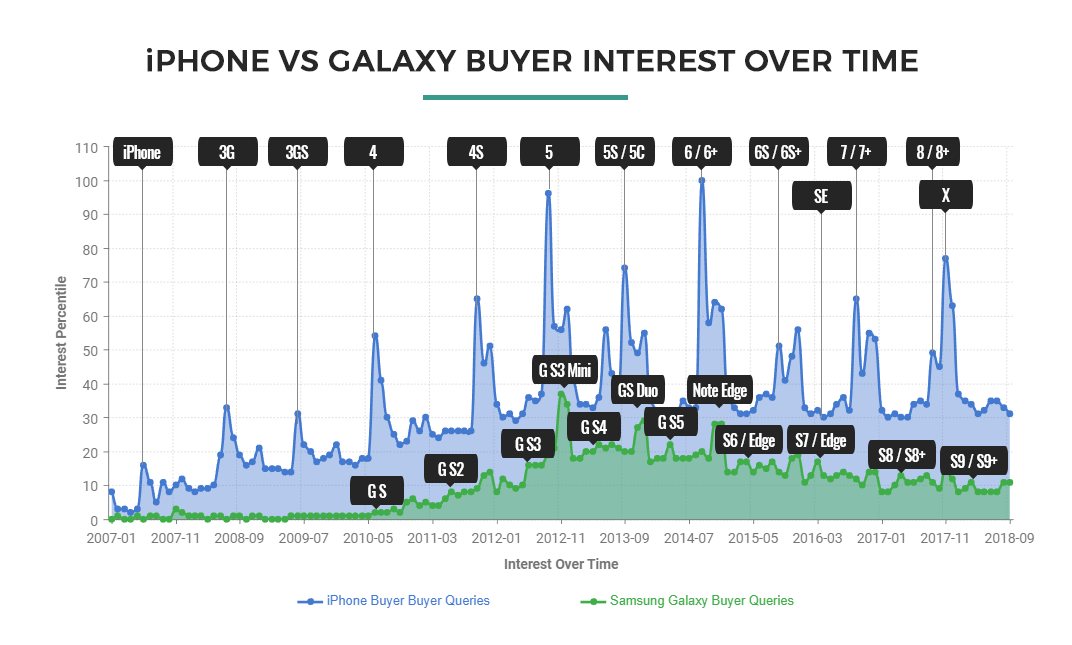

Buzz War – iPhone vs Galaxy Product Launches

According to the sites Google Trend analysis, iPhone releases have created such a buzz online that they have over doubled the interest of the popular Samsung Galaxy range. The graph illustrates a similar growth curve and declines around the consumer interest, but what’s interesting is how drastic the iPhone product launch spikes are in comparison to the Galaxy S releases.

The iPhone announcement and launches have boosted global user search queries by as much as 230 percent with the iPhone 6 / 6 Plus when compared to previous monthly consumer interest. Samsung’s most notable device that caused a buzz was the Galaxy S3 Mini, doubling the search volumes.

Most other releases of the Galaxy range look to be causing 20-60 percent spikes and with most being released near the holiday seasons, look to be lasting over a two month period.

It’s worth noting that this is not a reflection of Samsung and Apple’s device sales, in fact, Samsung’s focus as a company is primarily on affordable handsets in emerging markets and are the largest handset manufacturer. Recently, Huawei overtook Apple to become the second largest smartphone brand for the exact same reason and did so with limited access to the US market.

What iPhone Releases Aroused Fans The Most?

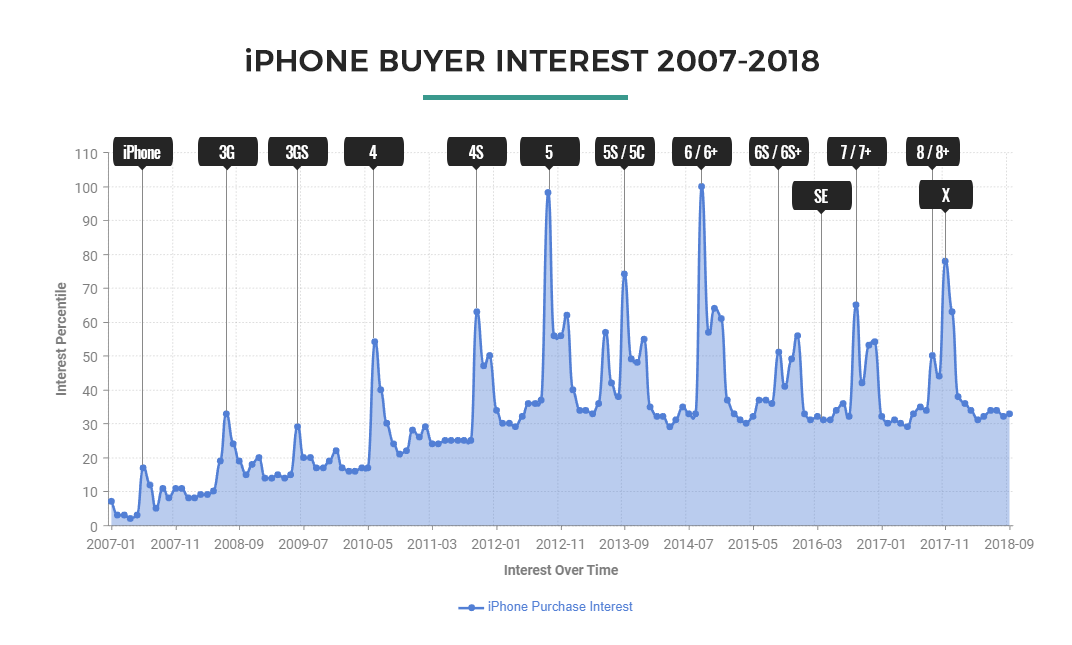

Among the findings, the research company segregated iPhone search queries with buyer intent to illustrate the upsurge in consumer interest.

- From the original iPhone launch to the iPhone 6, both the general online interest and the impact of the product launches continued to increase.

- Following the iPhone 6 launch, the explosiveness of these releases and the peak of general interest queries began to decline with the SE, 7 and 8.

- The iPhone X had one of the largest spikes in online interest, widely associated with the redesign and new features released with it.

Official iPhone Release Dates

For reference, these are the exact corresponding iPhone release dates

- iPhone – June 29, 2007

- iPhone 3G – July 11, 2008

- iPhone 3GS – June 19, 2009

- iPhone 4 – June 21, 2010

- iPhone 4S – October 14, 2011

- iPhone 5 – September 21, 2012

- iPhone 5C – September 20, 2013

- iPhone 5S – September 20, 2013

- iPhone 6S/6S Plus – September 25, 2015

- iPhone SE – March 31, 2016

- iPhone 7/7 Plus – September 16, 2016

- iPhone 8/8 Plus – September 22, 2017

- iPhone X – November 3, 2017

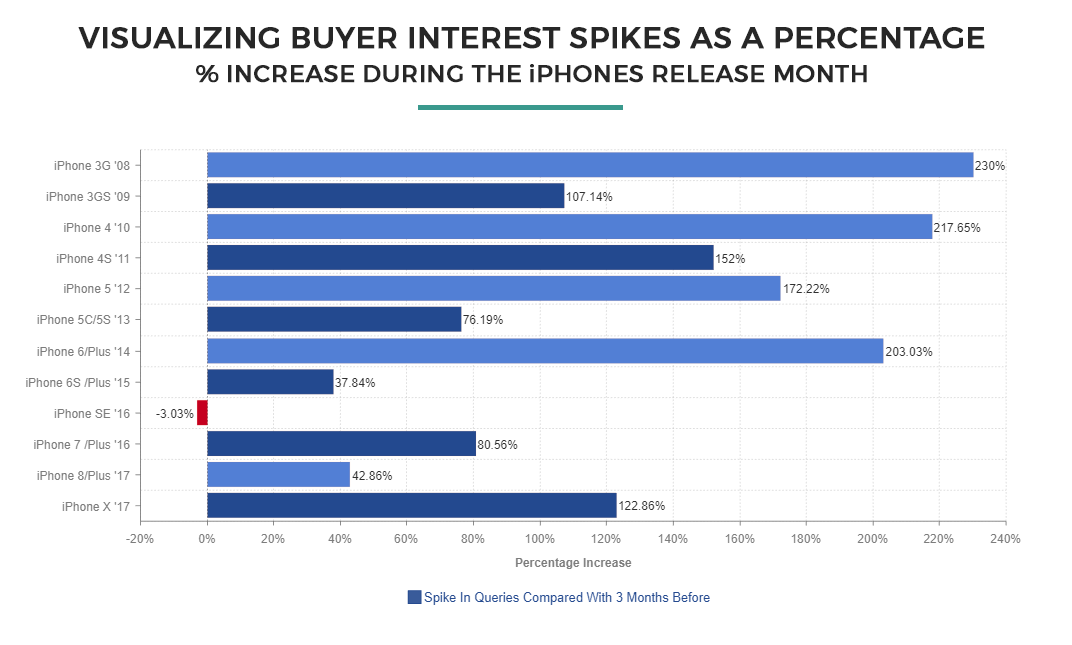

Percentage Increases In iPhone Buyer Intent 2007-2018

Among the research conducted, BankMyCell provided us with figures that illustrate the percentage increase in Apple fans buyer related searches compared with a normal trading period 3 months before.

The most considerable increase in iPhone buyer intent queries between 2007 – 2018 are not quite what we expected. The iPhone 3G caused a big buzz back in 2008, increasing searches by 230 percent (being the first Apple device to actually use the 3G broadband cellular network). Likewise, the iPhone 5 release in 2012 was the first iPhone to integrate with the 4G network and saw a generous 172.22 percent increase in queries.

Detaching the major cellular network upgrades from the pack, the iPhones that caused the most buzz through design, functionality, and marketing were the iPhone 4 (2017.65 percent), the iPhone 6/6Plus (203 percent), the iPhone 4S (152 percent) and finally the iPhone X (122.86 percent).

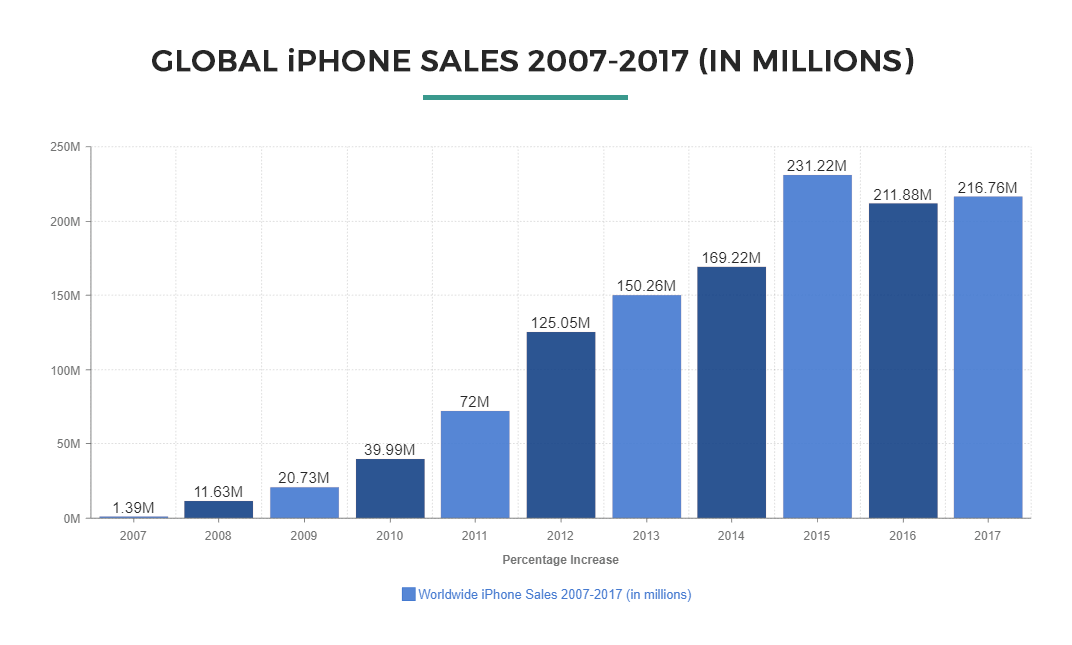

How Does This Compare To iPhone Sales?

The decline in buyer interest related searches would suggest that sales could take a hit too. However, the iPhone 6S is one of the lower interest spikes at 37.87% and was released in 2015 when the company had their biggest iPhone sales to date at 231.22 Million.

Where the decline in interest does seem to impact the revenue is from 2016 onwards where Apple recorded two consecutive years where they earned 15-20 million less. These were the first years since the iPhone launched where Apple did not show a considerable revenue increase.

We had a look at Apple’s quarterly sales for this year and they are down on Q1 but increases on Q2/Q3. The success of this new launch will tell if this is the start of a positive upturn. So far it looks like they will be slightly above 2017, though the largest quarter for sales is in Q1, this is where we will see if the new iPhone XS, Max and XR will kick off a revenue revival.

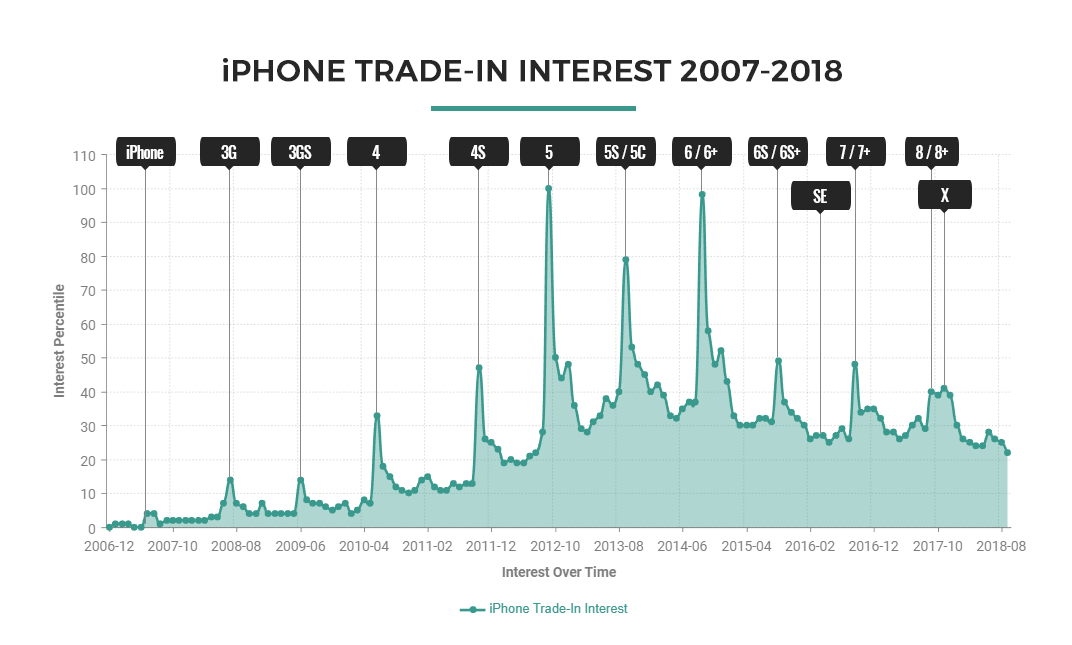

How Do Product Launches Impact iPhone Trade-ins?

The next set of data sent to us is focused on resale related queries. The cell phone trade-in site aimed to show how the iPhone releases impact consumer enthusiasm, getting them to value their old devices and potentially trade in or sell through online marketplaces.

The site’s data reports that the periodic timeline between the iPhone 4 and the iPhone 6 showed the highest upsurge in consumers wanting to value and sell their old devices. The iPhone 8/X releases were announced at the same time but released 2 months apart so their spike is more of a molehill, showing that if they were released at the same time it would no doubt be the largest increase since the iPhone 6 launch.

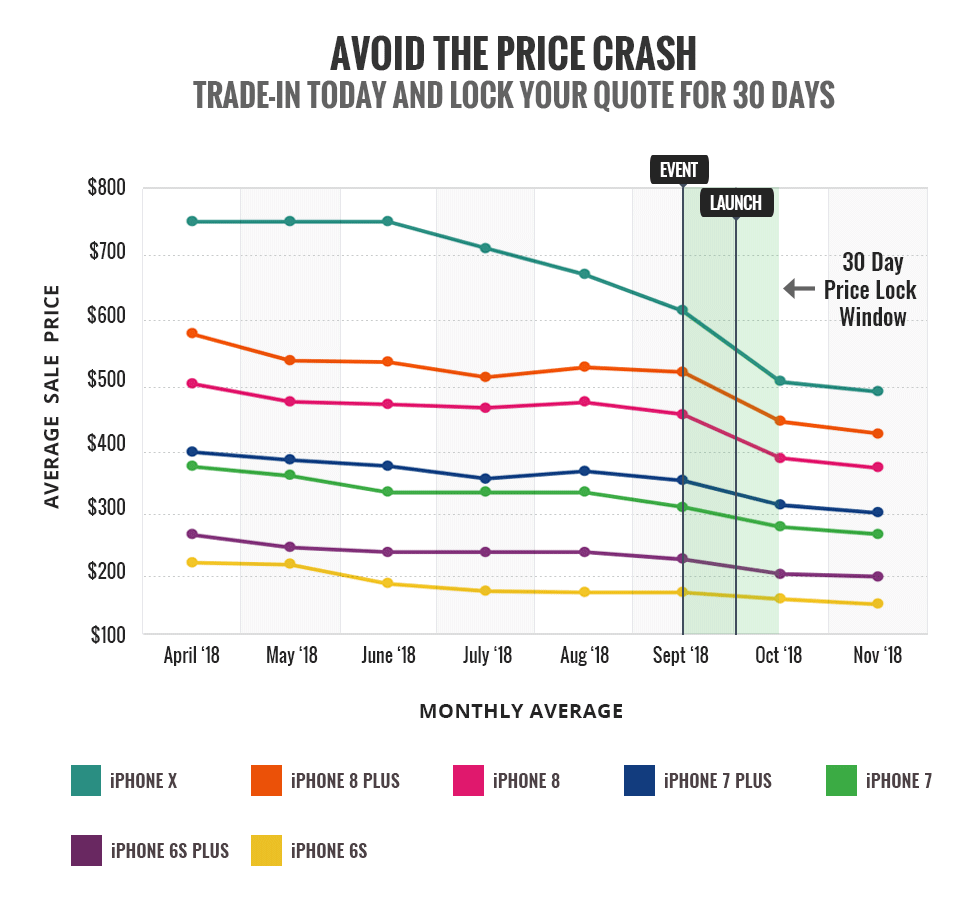

In the press release we received from BankMyCell, it noted that the iPhone keynotes always cause major declines in the resale value of your old Apple device. Following the announcement event, last year’s iPhones suffer the most losing up to 20 percent of their value in the first two weeks. So if you’re looking to upgrade to the new iPhone, the company recommends trading in now where you get a price lock for 30 days, plenty of time to get your new phone but freezing today’s quote.

We would also recommend looking around other resale avenues such as:

- Facebook marketplace

- eBay

- Craigslist

Even though the simplicity and price lock sounds appealing, it’s good to get an unbiased idea of where to get the most money for your old iPhone.

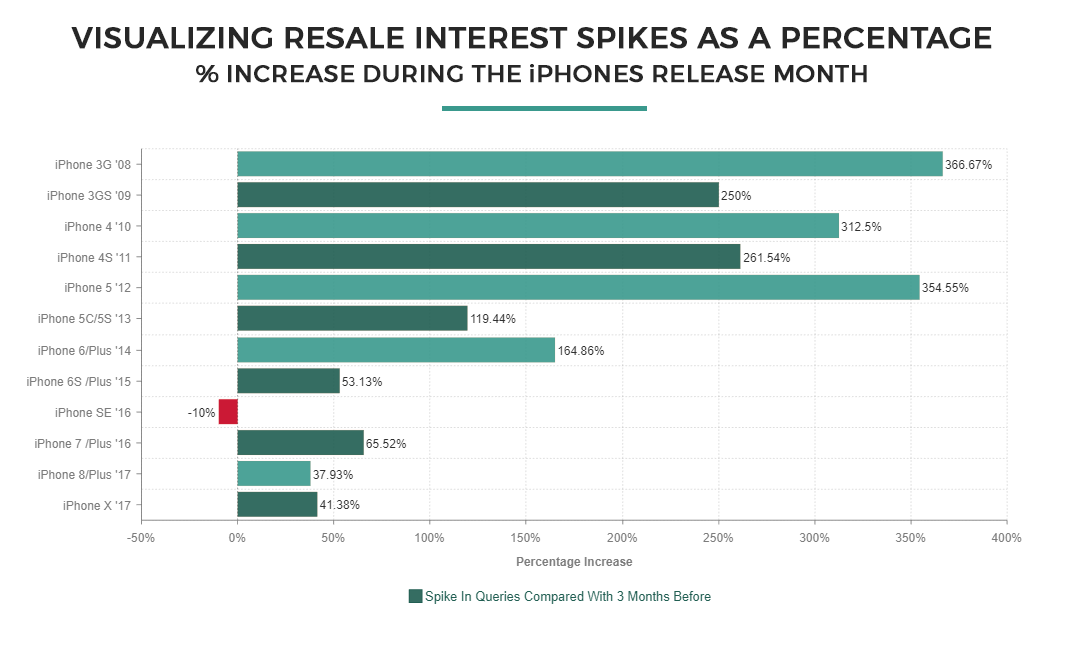

Percentage Increases In iPhone Trade-ins 2007-2018

In addition to the iPhone buyer queries, BankMyCell provided us with figures that illustrate the percentage increase in Apple fans trade-in related searches compared with a normal trading period 3 months before.

The most considerable increase in iPhone trade-ins during this period was again the iPhone 3G (366.67 percent) and iPhone 5 (354.55 percent) – the devices that first adopted the 3G and 4G cellular broadband networks giving users faster speeds when disconnected to Wi-Fi.

The other notable growths in resale queries come from the all iPhone devices before the iPhone 6/6 Plus release. Following this, there is a notable decay in user interest with spikes never going above 65.52 percent, even with the new iPhone X.

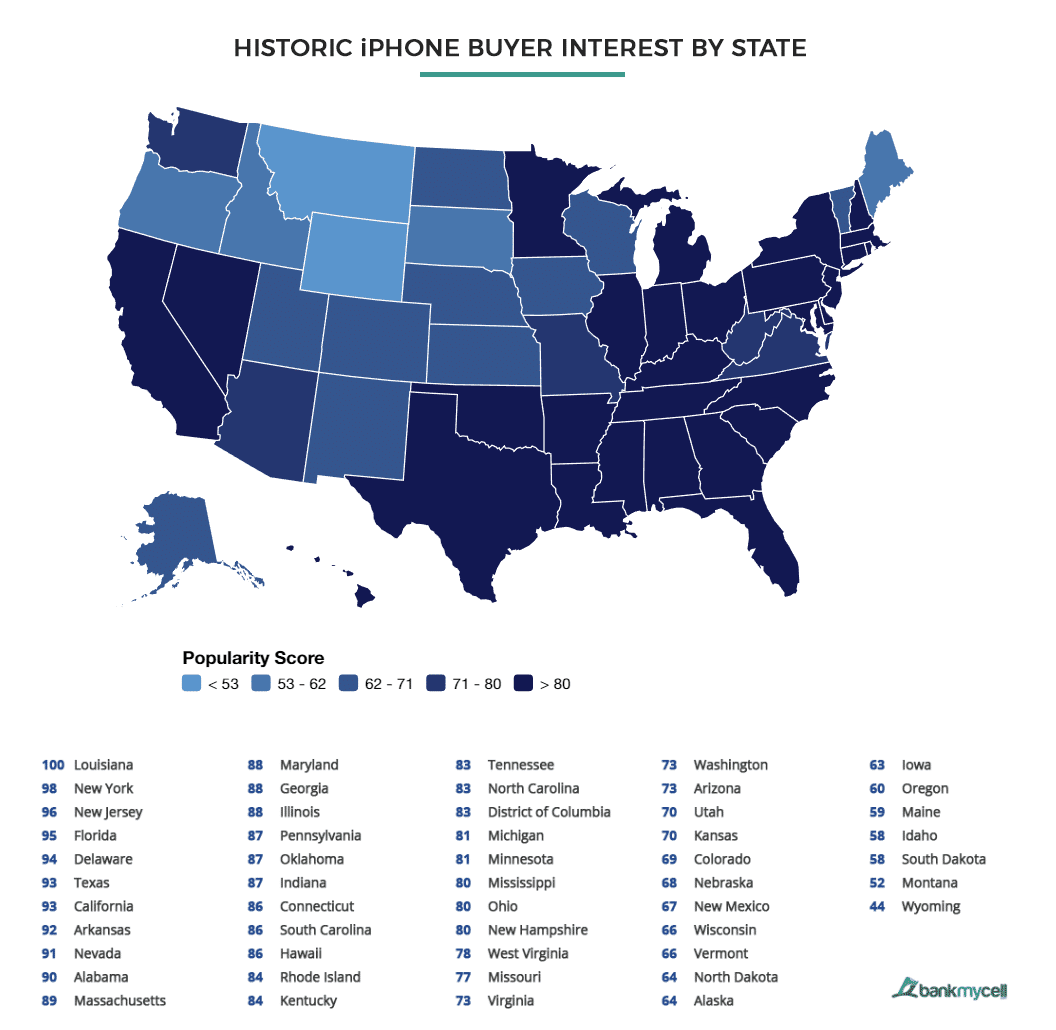

Which US States Have Apple’s Vote

Lastly, the company looked at the periodic search patterns by US state from 2007-2018 for both buyer and resale queries. The states with the highest interest in Apple iPhones over this time period are:

- Louisiana (also top 5 for trade-ins)

- New York (also top 5 for trade-ins)

- New Jersey

- Florida

- Delaware (also top 5 for trade-ins)

Regardless of these search-based visualizations, it is undeniable that Apple will still shift huge volumes of their new devices. Their new iPhone XR budget device will provide consumers the similar technology to the iPhone X with a much friendlier price tag. That said, it will be interesting to see what trend impact the iPhone XS and XR provide compared with this historical data.

It’s early days to comment on the potentials of the latest batch of iPhones, but fortunately, the upturn in consumer interest following the iPhone X release is great news for Apple. According to BGR, the company is set to make around $30 from each device via apps sales, content purchases, and Apple music. They continue to note that by 2023 these on device purchases could account for around 60 percent of the business revenue.

What impact do you think these new releases will have and do you think Android fans will ever be as excited about the new releases? Let us know your thoughts in the comments section below.

If you are interested in even more technology-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS