By now, it’s no secret to anyone familiar with cryptocurrency technology that Bitcoin has a serious structural problem. The mining process that forms the backbone of the transaction verification function that the system relies on is having quite a bit of difficulty scaling up as the volume of transactions increases. In fact, during the run-up to cryptocurrency’s record high last December, the enormous backlog of transactions pushed the average cost per transaction up to an astounding $37.

Fortunately, the high transaction costs didn’t last long. As the value of Bitcoin fell, so did the volume of transactions, easing the strain on the network. At the time of this writing, the Bitcoin network still has a transaction backlog of over 5000 transactions, but that corresponds with Bitcoin losing half of its value since the high in December. For users of the cryptocurrency, that’s not exactly an acceptable long-term solution. It is clear that Bitcoin is unsustainable in its current form. Let’s examine the problem, as well as a possible solution.

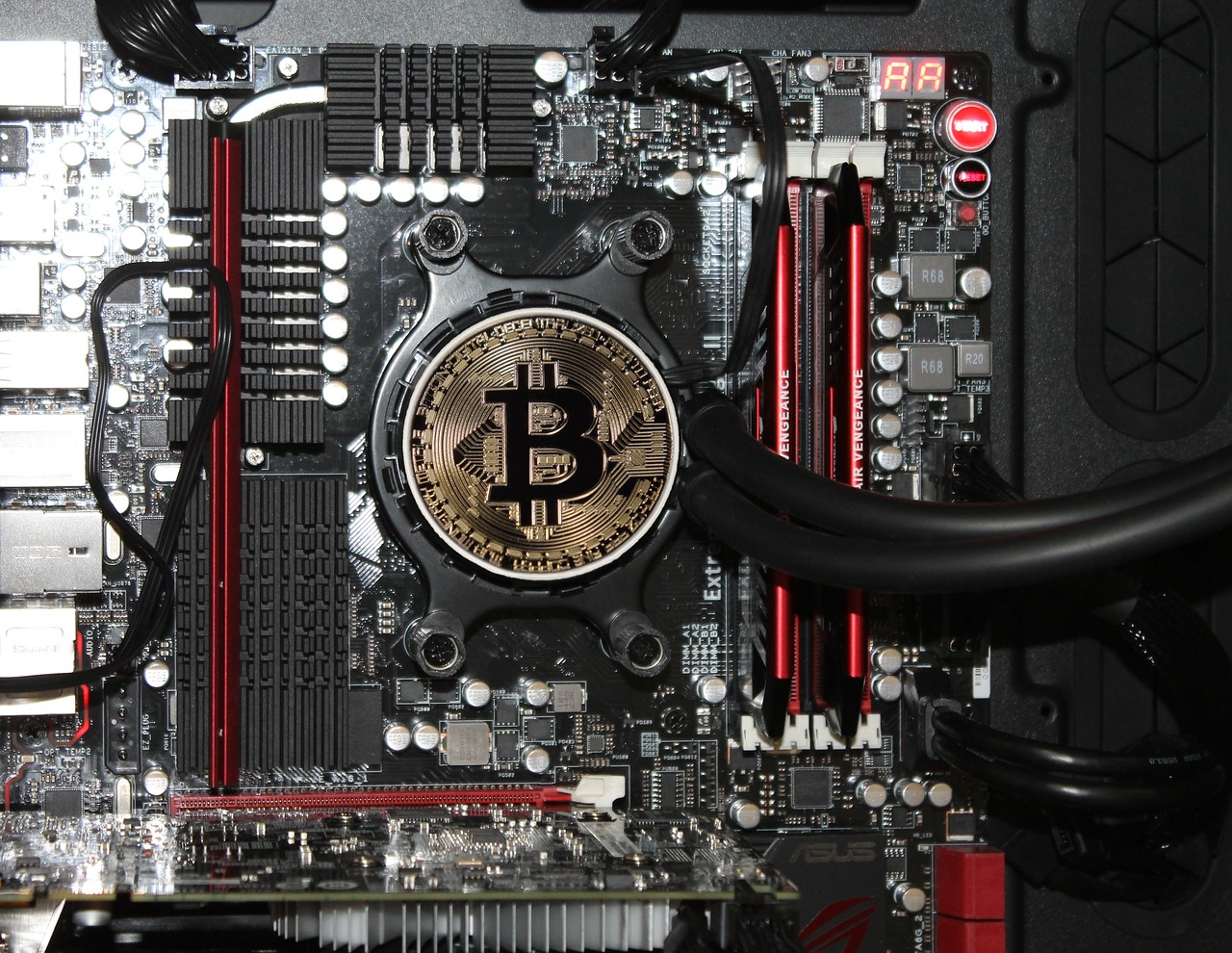

IMAGE: PIXABAY

Old School vs. New School

The Bitcoin system is revolutionary in its design, creating a decentralized and encrypted transaction network beholden to no single entity. The benefits in terms of security and transparency are obvious. The problem is that the network isn’t very efficient. The Bitcoin network is currently capable of processing between three and four transactions per second (at maximum throughput). When compared with the transaction processing power of global credit card issuer Visa, the scope of Bitcoin’s problem becomes clear.

According to representatives from Visa, their transaction network handles an average of 1667 transactions per second. That average alone is over 400 times the maximum rate that Bitcoin’s network is capable of. That’s just an average, though. Visa estimates that their system is capable of handling up to 56,000 transactions per second at maximum throughput. While Bitcoin doesn’t need that kind of processing power just yet, something must be done to solve Bitcoin’s scalability issues in order for it to remain viable.

Bitcoin Transactions At Lightning Speed

The good news for Bitcoin users is that there is a solution already being tested. In a nod to the problems it aims to solve, it is called Bitcoin Lightning. Rather than seeking to make changes to the underlying structure of the Bitcoin network, as others had tried and failed to do previously, Lightning functions as a bolt-on code that establishes a secondary network for one-to-one transactions that exists off of the main blockchain.

The idea is that users could establish these trust networks among small groups (such as with the coffee shop they frequent every day or a regularly visited supermarket). As the number of these off-blockchain trust groups multiply, they would form an interconnected web, similar to the way internet routing takes place today. That would make transactions almost instantaneous and would eliminate the scalability problem Bitcoin is currently facing since the traditional blockchain network would be used only for batch confirmations and recording of the results returning from the Lightning network.

Resistance Slows Progress

Although Bitcoin Lightning has already matured to the point that it is able to process live transactions, there is still significant resistance to its use in the market. Most of it is coming from miners themselves, who aren’t eager to see transaction rates, and therefore transaction fees, falling. With any luck, they will soon realize that the potential for growth in the Bitcoin system enabled by Bitcoin Lightning will more than offset their losses in fees.

If they don’t, Bitcoin may be in trouble. Other competing cryptocurrencies like Ethereum and Dash are already starting to deploy solutions to solve their own scalability issues, so Bitcoin users may begin to flee to them seeking faster processing and lower fees. For now, though, Bitcoin will remain locked in a battle with itself, and the outcome of that battle may well determine the fate of the world’s first cryptocurrency.

If you are interested in even more cryptocurrency-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS