After Bitcoin updated its historical maximum value, the cryptocurrency market got rough. The price of the main digital coin fell to $30,000 for two weeks, then exceeded $40,000, after which it fell below $29 thousand.

The crypto portfolios of many depositors began to plummet. Long-term investors can simply wait out the bearish trend, assuming that this will be over soon, or they can take steps to keep their portfolio safe and maximize its return.

Here are some working tips on how to save and multiply investments during a downtrend.

IMAGE: UNSPLASH

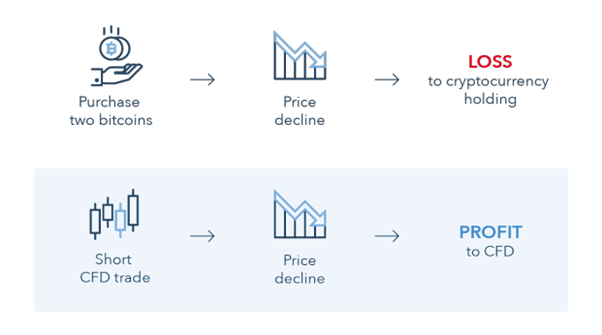

1. Go Hedge

Hedging is a tool that mitigates the risk associated with the adverse effect of market factors on the price of another related instrument.

In simple words, hedging is recouping a loss from one trade with the profit gained from another session. In general, two positions must balance each other, regardless of price movement. Thus, the trader fixes the value of the initial investment.

This strategy is preferred by enthusiasts who believe in the long-term success of cryptocurrencies but are concerned that a short-term correction could damage their portfolio a lot. To avoid this, traders open short positions on cryptocurrency derivatives exchanges, which allow them to open both long and short positions.

IMAGE: IG

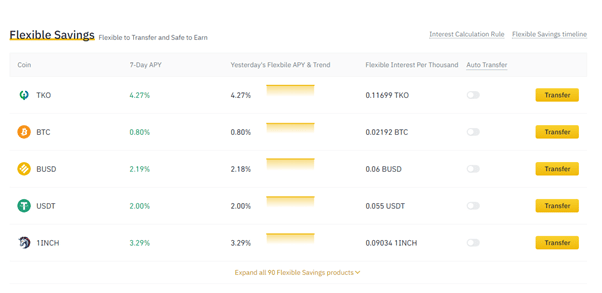

2. Get % From The Remaining Balance

There are many reputable platforms that suggest up to 10% on cryptocurrency deposits. Thus you can increase your balance with almost no risk. Of course, this scheme won’t save you from severe market fluctuations, but at least it will help to recover insignificant losses triggered by market volatility.

IMAGE: BINANCE

3. Drop Volatile Assets

If you want to completely get away from crashing losses, you can exchange volatile crypto assets such as BTC, ETH for stablecoins, for example, Tether.

All in all, stablecoins deserve to occupy 15% of any investor’s portfolio. This amount will be used to reduce the risks of volatility and quickly rebalance the account in the event of a sharp change in the market.

How To Create A Balanced Portfolio?

If we’re talking about the digital asset market, it is worth allocating 30% in Bitcoin. The oldest cryptocurrency is the benchmark for the market. It is bought by both individual traders and large giant organizations such as MicroStrategy, Meitu, and Tesla.

20% can be invested in Ethereum. Altcoin and the Ethereum network are actively used in the field of decentralized finance, which is now on the rise. By the way, DeFi tokens also deserve to take place in the portfolio, for example, 15% of it. These assets are one of the riskiest and promising coins in terms of growth. There is no sense in investing in NTF yet since the technology behind these tokens as well as the areas of its application is rather clouded.

20% can be allocated for altcoins from the TOP-50 by capitalization list, which showed stable growth without sharp drawdowns.

Invest 15% in stablecoins to ensure the balance that we talked about above.

Bonus tip: as they say, among the blind the one-eyed man is king. So all means are great during the crisis. Therefore, when investing in cryptocurrencies, don’t forget about traditional investment tools. For example, gold performed well during the 2020 crisis. Due to the downturn in the stock market, its participants transferred their capital to precious metal. As a result, its quotes rose by 13%.

It should be noted that investors focused mainly on physical gold, and not on “paper”.

Gold is the asset that in any crisis helps to preserve funds. Now the market is experiencing a certain shortage of gold bars and American gold coins, as investors (both large and small) are actively buying physical gold rather than investing in futures contracts or shares of gold mining companies. Famed entrepreneur Robert Kiyosaki, author of the bestseller Rich Dad Poor Dad, also suggests investing in physical gold to save money from inflation and currency devaluation.

Final Words

No one is immune from the market turmoil, the main thing is to remain calm. For sure, price fluctuations can drive people crazy, but if you’re going to panic and act heedlessly when the asset’s price begins to fall, it’s better to give up investing right away.

Stay cool-headed and analyze the market – this formula will help you make the right investment decisions in any situation.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS