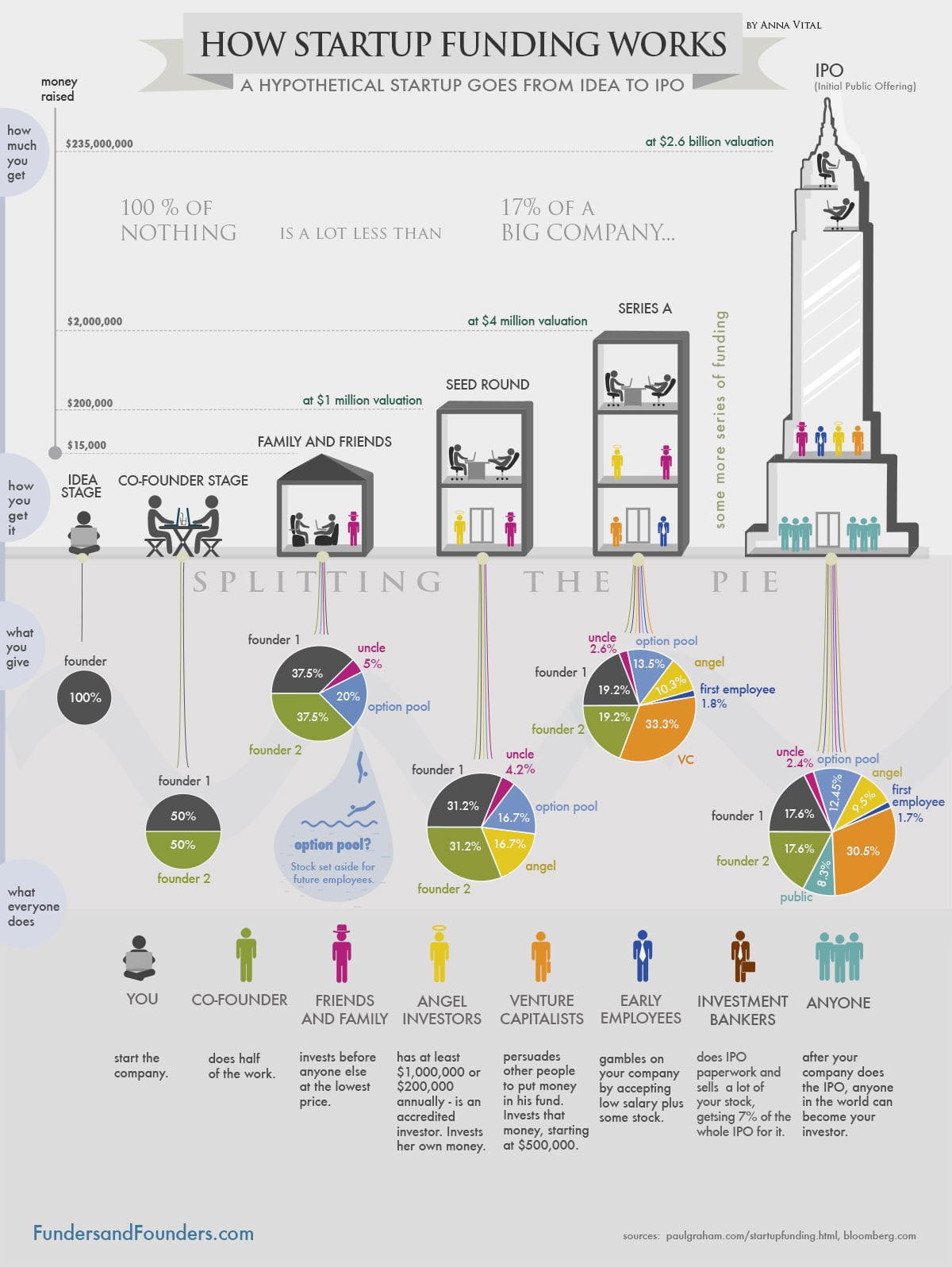

If you think you have the next great idea, you might be ready to begin the process of building a startup company so you can share your idea with the world. Eventually, the topic of finding capital funding is going to come up. This will happen sooner rather than later if you plan to create a tangible product that is labor-intensive. The topic of startup funding can be sensitive since people have different ideas about funding, and when it’s appropriate to take on investors. This chart is the best one I’ve seen on the topic.

When it comes to startup funding, think about it like this…When you first begin, you will own 100% of your company, but it will be very small. When you take on a partner, you will most likely give that partner 50% (or somewhere around that). At that point, you own less of your company. However, since you’ve added someone as dedicated to its success as you, you will have doubled your resources, which will lead to your being able to build the company twice as fast than if you were doing it alone.

Then, as the startup funding process continues, you will give up less and less of your company as you take on investors. That might not sound like a good idea, but the numbers can be deceiving. You may own less of a percentage, but the entire pie will be much larger. In other words, at that point your smaller percentage will be more valuable than a much larger percentage of a smaller company.

For example, when Google went public, Larry and Sergey owned about 15% of the pie each. However, that was 15% of a humongous pie at that time.

This infographic called How Funding Works is by Funders and Founders. If you click over on that link you’ll see that there is a very detailed article that goes into each one of these stages along with what to expect and calculations to help you determine how you should split up your pie. You can also click over to an article I found on Forbes called The Non-Entrepreneur’s Guide To Startup Funding.

Startup Funding & How It Works

(Click Chart To Enlarge)

COMMENTS