When it comes to crypto investments, there are various methods that will ensure your money is safe. It is important to carefully consider the method you are using to invest in this space, especially if it involves investing large amounts of money into relatively new technology.

Reasons for choosing the safest possible strategy could include:

- You want to be certain all of your money invested can be returned at any time

- You are uncomfortable with the idea of crypto volatility

Many strategies exist to ensure that your crypto investment is safe, and many users utilize a combination of methods. In this article, we will discuss various methods for ensuring that your money is kept secure while you invest in cryptocurrency.

There is never one size fits all when it comes to financial advice, but there are clear trends that will help you make better decisions when trading on Bitcoin Motion. Here are three safe cryptocurrency investment strategies for beginners.

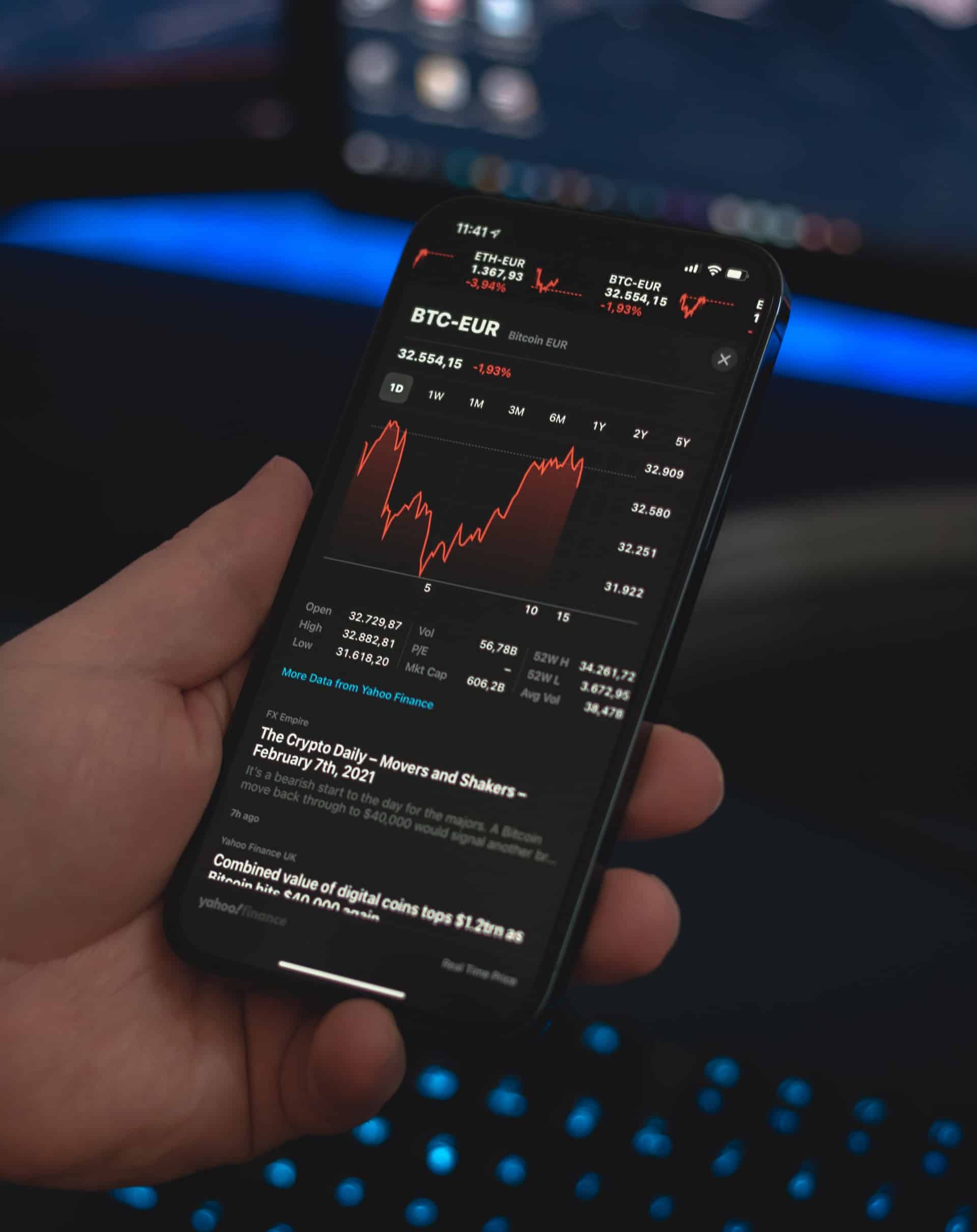

IMAGE: UNSPLASH

1. The HODL Wave Strategy

The HODL wave strategy works like this: You set up an account on a site and buy Bitcoins. You allow the Bitcoins to appreciate, reinvesting your Bitcoins when you reach a set threshold. When you’ve reached that next threshold, you cash out and go back to step 1.

The benefit of this strategy is that it’s safe. It locks in some of your gains by buying back in periodically while the value of Bitcoin continues to rise. However, the drawback is that it can be time-consuming to cash out, so for this reason the HOLD wave strategy works well in tandem with another investment strategy.

2. The OTC Coin Investment Strategy

OTC coins are so-called because they take place outside of exchanges, which makes them harder to track. They also require peer-to-peer meetings, which makes them more time-consuming.

The benefit of this strategy is anonymity, at least to an extent. The drawback is the increased risk involved in meeting strangers. This is a high-risk, high-reward investment strategy that might be for those with some experience under their belt.

3, The Bubble Strategy

This strategy requires you to buy low during a bubble and sell high when it pops for an even bigger gain. The best time to implement this strategy is during a bubble so large that you can’t help but get in on the ground floor without feeling too much risk.

The benefit of this strategy is that it requires comparatively little experience or knowledge about Bitcoin itself, and it has a potentially high reward factor.

The drawback is that bubbles pop, and you could end up buying at the peak, which means you lose money.

How To Choose A Crypto Investment Strategy

Your choice of a crypto investment strategy should be based on how much risk you’re willing to take and the amount of time you can afford to devote to your investment. As always, never invest more than you can afford to lose.

The three strategies outlined here are all relatively safe ways to make some profit from Bitcoin even if cryptocurrency itself is unpredictable. The most important thing to remember is that there are several different ways to approach cryptocurrency investments, so it’s vital to do your research before investing in anything. Only invest what you can afford to lose, and once you’ve made your purchase, leave your coins alone until they reach a really high valuation.

Closing Remarks

Don’t ever treat your crypto coins as expendable cash, because the more you use them, the less valuable they become. You need to consider Bitcoin an investment that has its ups and downs but is worth pursuing for most people.

Investing can be fun if you know what you’re doing, so have fun.

COMMENTS