The USD has had mixed fortunes against other currencies in 2017. For example, many traders expected the GBP/USD pair to come under tremendous selling pressure what with all the Brexit uncertainty plaguing the United Kingdom’s economy. In fact, sterling managed to pull itself out of the doldrums from a trading level of 1.23 at the start of the year to its current level of 1.34. The $0.11 appreciation is a remarkable feat for a currency under pressure.

Trading Indicators & Statistics

In percentage terms, sterling appreciated by 8.94% against the greenback. It is worth noting the performance of the USD against other currencies, including the South African rand (ZAR), Euro (EUR), Japanese Yen (JPY), and the Australian dollar (AUD).

- USD/ZAR – the South African rand has generally been a poor performer in 2017, what with significant macroeconomic pressures on the SA economy. For example, the negative outlook on the country and credit downgrades by Fitch and Moody’s have influenced the economy and the currency. Political pressures are mounting on President Jacob Zuma and his possible successor in 2019. Currently the USD/ZAR pair is trading at 12.6686 – marginally worse than at the start of the year. Prospects of new leadership are helping the ZAR to rally.

- EUR/USD – at the start of the year, the EUR/USD pair was trading at 1.05, and it is currently at 1.1849. This represents a strong deterioration of the greenback against the European currency. In percentage terms, the $0.13 weakening represents a 13.22% deterioration of the greenback for the year to date. This is in line with the general trends we are seeing in other currency pairs with the USD.

- USD/JPY – the US dollar and Japanese Yen currency pair is currently at 113.39. For the year to date, the USD/JPY has depreciated from 116.79. While the absolute percentage is minimal (3.4 for the Japanese Yen) at 2.91%, this deterioration dovetails with the general trends for the USD in 2017.

- USD/AUD – the US dollar versus Australian dollar is another important currency in global markets. At the start of the year, the USD/AUD pair was trading at 1.39, and it is now at 1.3042. This indicates that 1 USD can buy less AUD now than at the start of the year. The USD has depreciated by AUD $0.0858 or 6.17% since the start of the year.

Trends For The US Economy Heading Into 2018

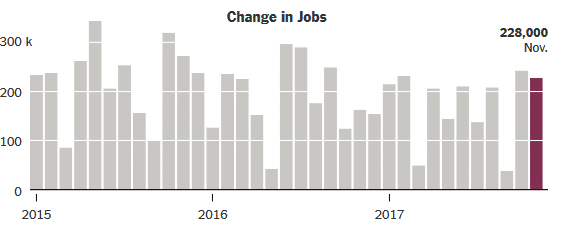

Given these broad trends across multiple economies in Asia, Africa, Europe and beyond, we can expect the USD to continue weakening over the short-term. Some positive news from the US economy bodes well for USD bulls. According to the latest US unemployment data, the total unemployment rate in the US is 4.1% and the civilian labor force in the US is 159.19 million people. The unemployment rate reflects the active labor force seeking employment, but unable to find it. In November, the US economy added 228,000 new jobs, in line with general trends since mid-2016.

A robust economy is reflective of what to expect for the USD moving forward. Now that Congress passed the $1.5 trillion tax cuts, the US economy will gain dramatic momentum from this move. Currently, the House and the Senate passed the sweeping tax reforms. For USD bulls and USD bears, the broader picture (the strategic perspective) is certainly positive for 2018.

According to Olsson Capital trading specialists, it’s pretty clear what a major tax overhaul could do for the US economy: “Companies that can retain more of their earnings after tax will certainly benefit from new legislation. The tax plan will boost the attractiveness of the US economy to foreign investors and generate massive and unprecedented growth. Many clients already expect the US economy to boom under Trump, despite all the naysayers who despise his draining of the swamp. Massive infrastructure projects could be on the cards once a tax plan overhaul is passed and signed by President Donald J. Trump.”

If you are interested in even more trading-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS