Running a business isn’t easy, but it doesn’t have to be overly stressful, either. There are many things you need to focus on, but securing funding when you need it is one of the biggest priorities you have as a business owner. It’s important to know about five business loan mistakes you should strive to avoid.

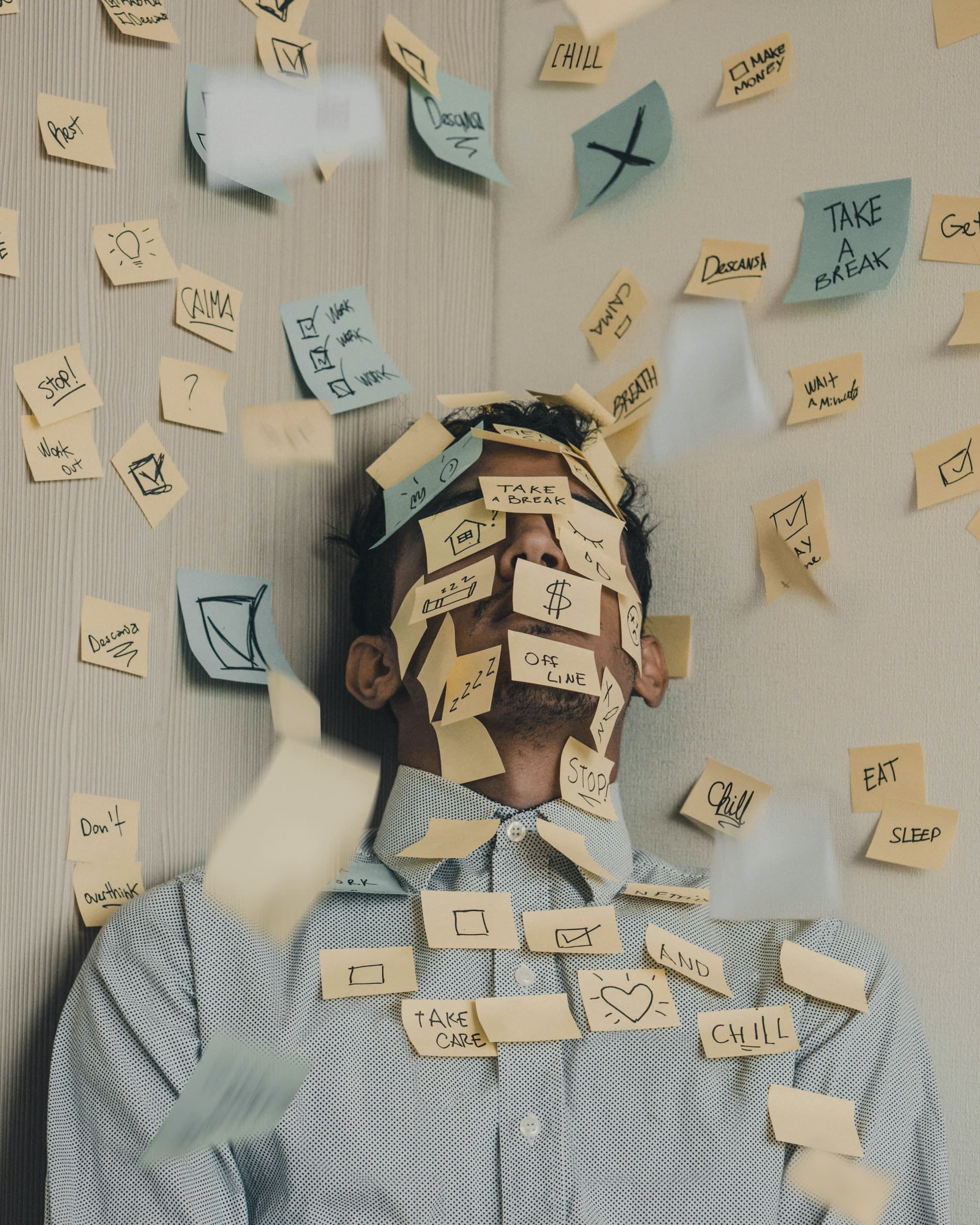

IMAGE: UNSPLASH

Not Having A Business Plan

Another big mistake you can make when you own your own business is to not have a solid, clear business plan in place. A business plan helps you to stay grounded and establish exactly what you expect in terms of your short- and long-term business goals. What do you expect to get out of your business? Where do you expect to be in a year, two years and beyond? Your business plan is essential in ensuring that you have a lens into the future and keeps you grounded. Without a plan in place, you go blindly and have no idea what might happen with your business.

Avoid Rushing Acceptance Of A Loan

One of the biggest financial mistakes you can make as a business owner is to rush to secure yourself a loan without first comparing several. In order to get the best loan for your needs, you should always compare small business loans and thoroughly understand their terms and everything else they entail. Sites like Lantern Credit make it easy to compare pros and cons of lenders and their offering in the same place.

Never rush and apply for one loan and take it without doing your homework beforehand. You can end up making a huge mistake and securing yourself a loan that has an overly heft interest rate and loan terms that are shady. Take your time so that you get the one that’s worth it at the end of the day.

Not Knowing Your Credit Score

Not knowing your credit score is a big mistake many new business owners make. If your credit is in the bad or poor region, it can negatively impact your ability to find lenders who are willing to extend a business loan your way. This is true for both your business and personal credit scores. Lenders take a look at all of your credit history, regardless of whether it’s business or personal, and think twice if it’s poor.

Not Having Collateral

You must have collateral in order to apply for a business loan. This is because lenders want to be assured that you will be able to repay the loan even in the event of an emergency such as cash flow issues. If you don’t have collateral of any kind, you can expect lenders to turn you away when you seek a loan. You can put up many things as collateral, such as liens, real estate property, and inventory.

Exaggerating Your Income

When you’re trying to get a business loan, you might be tempted to exaggerate your income to impress potential lenders. However, this is a huge mistake that can work against you. The lender will look into your business finances when deciding whether you are a good risk for a loan.

You will be seen as dishonest and will not get the loan you need. Likewise, you should avoid minimizing your business expenses as well. Be upfront and honest at all times. You would be surprised at how amenable lenders are toward people who tell the truth about their financial information.

Avoid these mistakes by all means. You will be far better off and can more easily secure the loan you need.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS