If 2017 was the year of Bitcoin, then 2018 will definitely be the year of Bitcoin Cash! 2017 was a crazy year for cryptocurrencies as every month it seemed a record was being made. For all those that were saying it’s a bubble and all of this is going to crash, well it hasn’t crashed at all and if this truly was a bubble, it probably should have crashed long ago. Is Bitcoin immune to a crash? Absolutely not but if you ask the people that have not just own Bitcoin but understand how it works, they’ll tell you as well once you learn about how it works, the ‘aha’ moment will hit you and you’ll realize why cryptocurrencies are most likely going to change how the way we do banking and handle money. FIAT currency as we know it could be made obsolete in 5 years.

The current prices listed at wallet21.com at the time of writing this article:

- BTC: $16187.15

- BCH: $3769.48

- ETH: $783.56

What’s The Difference Between Bitcoin And Bitcoin Cash?

On August 1st, 2017 a hard fork happened with Bitcoin where after the split, Bitcoin Cash was born. What most people don’t realize is that Bitcoin Cash actually resembles the original bitcoin where the current Bitcoin has changed substantially. At the moment, the public is buying blindly into Bitcoin and this is the real risk in getting involved. The reason why the fork happened in the first place is that Bitcoin was maturing fast and the transaction fees were getting higher and it was taking very long to process transactions. The situation only got more dire as Bitcoin started to climb from $1k, to $2k, to $3k, to $4k then to $5k in the first 7 months of the year.

Is It Too Late To Buy Bitcoin Or Bitcoin Cash?

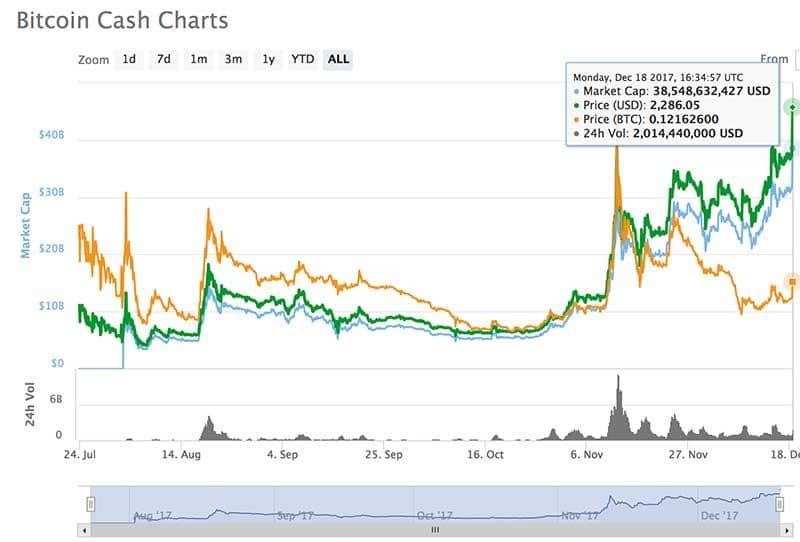

It is never too late but you definitely should educate yourself on how the whole thing works before you consider buying any cryptocurrencies. If you have say $500 or less you want to buy then spending it on Bitcoin doesn’t make a lot of sense as you’ll pay over 5% in fees alone and if fees keep going up then you’re getting hit again on the next transaction. At the moment Ethereum is now running up in fees which is making Bitcoin Cash the ideal coin to pick up. While writing this article, within a few hours the price of Bitcoin Cash jumped by from $2036.76 to $2251.16 and on December 20th, 2017 Bitcoin Cash broke through and hit 4k. Bitcoin Cash has fees that are around under 20 cents per transaction so you could buy in for a smaller amount where your $500 is just under 0.25 BTC. While Bitcoin Cash remains low, this is the one coin we recommend people pay attention to.

Why Do Bankers Fear Cryptocurrencies?

This is a 2 part complex answer. The first problem with both bankers and investors that make statements about Bitcoin is that many simply don’t know what they are talking about. By that we mean that they haven’t researched how it works and when you fail to do the research, it does look like both a bubble and a ponzi scheme. However, when you study what blockchain is and how the whole ledger system works with Bitcoin, Bitcoin Cash and Ethereum, this is when you realize that these new currencies have the power to replace FIAT currencies and decimate these banking institutions that we used to think were invincible. This article highlights what bankers don’t get about Bitcoin. So because bankers are not understanding the power of cryptocurrencies, they do fear banking might be disrupted but they have no idea on what scale this is possible. The short answer to this is that cryptocurrencies give the power of banking to the user: you control your money and store it anywhere you want, in an online wallet (this is like a bank really), in an exchange (risky in theory) or on your computer. You can even print it out on a piece of paper and lock it up in a vault.

So bankers should fear cryptocurrencies but many just haven’t bothered to dive into it to understand what makes them so powerful. It would help explain why the price of Bitcoin has gone up as high without much of a major correction.

So Why Is Bitcoin Cash Special And Expected To Be Strong In 2018?

When it comes to comparing Bitcoin to Bitcoin Cash, there are many groups and organizations that are not really neutral as they either have all their money in one of the 2 or they have invested in a company that profits from one over the other. So you actually have many groups that are trashing the other and it usually comes down to saying Bitcoin is better or Bitcoin Cash is better. People, of course, need to make their own decisions as to what is best but it’s hard to ignore some facts:

- Bitcoin has higher transaction fees over $20 USD and slower processing times

- Bitcoin Cash has lower transaction fees under $0.20 USD and faster processing times

Bitcoin Cash is expected to grow in so many areas in 2018 and beyond and the processing fees is going to be part of that lead. Many online casinos that have adopted Bitcoin are likely to switch over to Bitcoin Cash casinos instead. We had Valve drop Bitcoin as a payment method because it was too expensive. You wouldn’t buy a coffee with Bitcoin but you would and could with Bitcoin Cash where transaction fees are very reasonable. It is this major divide between the 2 cryptocurrencies which is going to start to slant Bitcoin Cash in favor of Bitcoin in 2018. It’s not to say that Bitcoin Cash will be the new #1 but if you had to put the 2 together in a race, Bitcoin Cash (BCH) is probably going further if you are looking to buy any coins and sit on them.

Bitcoin Cash has hit a $4000 price in December 2017 so it is already creating a bigger buzz for 2018. The price surge was due to an announcement from Coinbase about allowing trading for BCH so this is showing that BCH has room to grow within the cryptocurrency community and it’s drawing more interest.

In the meantime, the public is blindly following Bitcoin and because it is the biggest, this is where a lot of money is still flowing into but all it takes is for a few news articles from major media sources to shine the light on the others and people will realize that maybe there is a better alternative towards buying coins.

If you are interested in even more cryptocurrency-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS