So, August 1st has passed, making the last couple of weeks very intense and saturated for Bitcoin. Not only SegWit was launched, but the hard fork took place as well. At the beginning, the steadiness of Bitcoin was pleasantly surprising, but then it went shocking. The first cryptocurrency has hit an all-time record of $3500. It was hard to predict that such a “hard time” for Bitcoin would result in its price rocketing up so swiftly. Meanwhile, the second Bitcoin called Bitcoin Cash has set the record of the fastest market capitalization of cryptocurrency ever. And now, CEX.IO has started trading Bitcoin cash. More on that below.

What Happened To The Chain Split On CEX.IO?

At that time, Bitcoin holders were up to the ears splitting their coins. What this means is if you had 1BTC before the hard fork, you get another one in the blockchain of Bitcoin Cash (BCH). So, altogether you would hold 1BTC and 1BCH. In case Bitcoins were held in a personal wallet, the process of coin splitting was quite challenging for a regular person and could end up losing potential BCH coins.

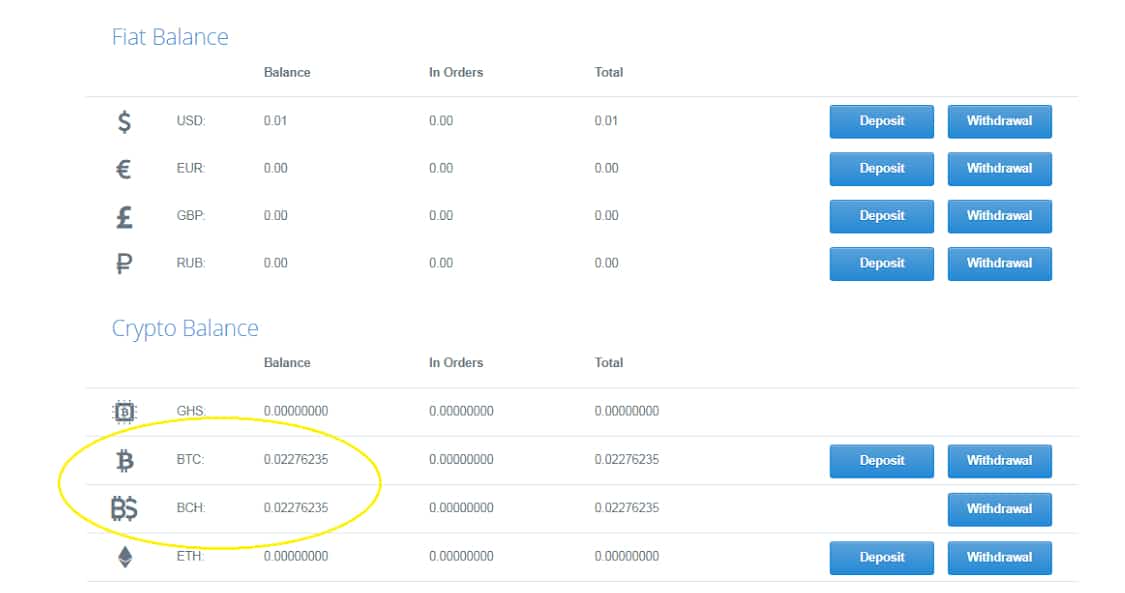

On the other hand, some exchanges that didn’t accept the hard fork — they simply ignored the chain split and their users were left without Bitcoin Cash. Whereas, the CEX.IO exchange supported the hard fork and provided its users with additional coins in their wallets. Moreover, you didn’t have to do anything, but wait before the development team does the whole process. So, eventually, users got the additional wallet with the same amount of coins in it. It’s that simple. Here’s what it looks like in your account.

What Does The Launch Of BCH Trading On CEX.IO Mean?

That’s quite an obvious thing that if an exchange managed to split all users’ coins, it must give an opportunity for the users to somehow take advantage of them. In this way, CEX.IO was one of the first exchanges on the market to launch the trading pairs of BCH/BTC, BCH/USD, BCH/EUR and the very first with BCH/GBP.

[pullquote]Although Bitcoin Cash has shown very good results considering its market cap within days, yet people feel insecure about it.[/pullquote] That’s why as soon as major exchanges opened trading with Bitcoin Cash, its price has dropped by more than one third but recovered over a short period of time. At the moment, the price is extremely unstable, so it’s hard to make a long-term assertion whether it will continue increasing or drop down. Bitcoin Cash holders have different strategies considering the situation. Some prefer to sell coins at the earliest opportunity, while others hold them until the price changes positively. And some traders believe that Bitcoin Cash will overtake Bitcoin… very uncertain about this one, but every idea can happen to be reasonable.

It is important to keep in mind that every issue is an opportunity. In our case, Bitcoin Cash can definitely be this ‘issue’. You only need to dispose of it right. This kind of volatility featured by Bitcoin Cash is the best instrument for a good trader. Considering the fact that at some points the growth rate of Bitcoin Cash was even higher than Bitcoin’s — the trading makes even more sense.

Furthermore, the profits of traders will be even twice higher if CEX.IO eventually finds it worthwhile to launch BCH margin trading. For now, there is a comment on their blog that margin trading can possibly be launched, but it depends on the network activity and demand.

It’s Not Over Yet. How To Rest Easy On Your Funds?

What does this mean? It’s all about Segwit. It was launched on August 1st. The protocol lock-in occurred 7 days later. However, the final activation is dated on the late August, approximately the 22nd. In some measure, such delay is necessary for the Bitcoin community, especially, for the services such as wallets and exchanges. Because they need time to update software so that they could complete transactions of a new type.

In case software of a certain wallet or an exchange is not updated by the time Segwit activates, it won’t share the new updated network, thus won’t be able to take part in it. [pullquote]If you are not able to send your money – it basically means you lost them.[/pullquote] So, wherever you hold your Bitcoins be sure that this service takes care of an upcoming Segwit activation. It’s not a crucial moment such as a hard fork, but still, must be taken into consideration. Seeing the success of CEX.IO in coin splitting, after which all users were provided with additional coins in the Bitcoin Cash blockchain, this exchange proved to be credible and reliable in challenging times.

It’s hard to know the potential of Bitcoin Cash. Maybe it will become one of the top cryptocurrencies, or it is a short-term shot that will fade away, but enrich the participants on its path. For now, the fact that major exchanges accept it and launch trading platforms definitely makes some sense. The main rule is to avoid the rush and make only informed decisions. Following this one will bring you a stable income that is not affected by the market and currency fluctuations.

For more cryptocurrency-related articles and news from us here at Bit Rebels, click here!

COMMENTS