An emergency can end up costing you a small fortune. Not everyone has a savings fund they can dip into, and it can seem impossible to make ends meet when a cost appears out of the blue, especially if you’re already on a tight budget.

An unexpected event could be something as simple as the washing machine breaking before payday or a surprise bill dropping through the letterbox. But whatever it is, if it’s unexpected, you may well need help handling it. Here are some tips to help you deal with unexpected financial events.

If you find yourself in this situation, start by discussing your options with the lender you owe money to. You may be able to pay the bill at a later date or a come up with a payment plan, allowing you more time to find the money or a way of incorporating it into your monthly budget until it has been paid off.

If you explain the situation and give them a set date that you will pay them on, they may be more lenient with time. If you find that you’re struggling to keep up with monthly bills from your providers, it may be time to start thinking about switching to a more cost-effective plan or changing providers altogether.

IMAGE: PIXABAY

Your Financial Alternatives

If you have no savings and are unable to borrow money from a friend or relative, consider flexible and fast options, such as short-term credit from a loan provider, or a 0% interest credit card. These are often a lifeline when it comes to unexpected events, allowing you to pay for all of your unexpected cost straight away, and repay what you’ve borrowed in small repayments each month afterward. When you have to find money instantly, this can feel impossible for many people – especially those with a family or dependents to care for. This type of loan can be ideal if you need the money fast, want to avoid the tight payment schedule of a payday loan and can’t dip into savings or make changes to your current expenses to find the cash.

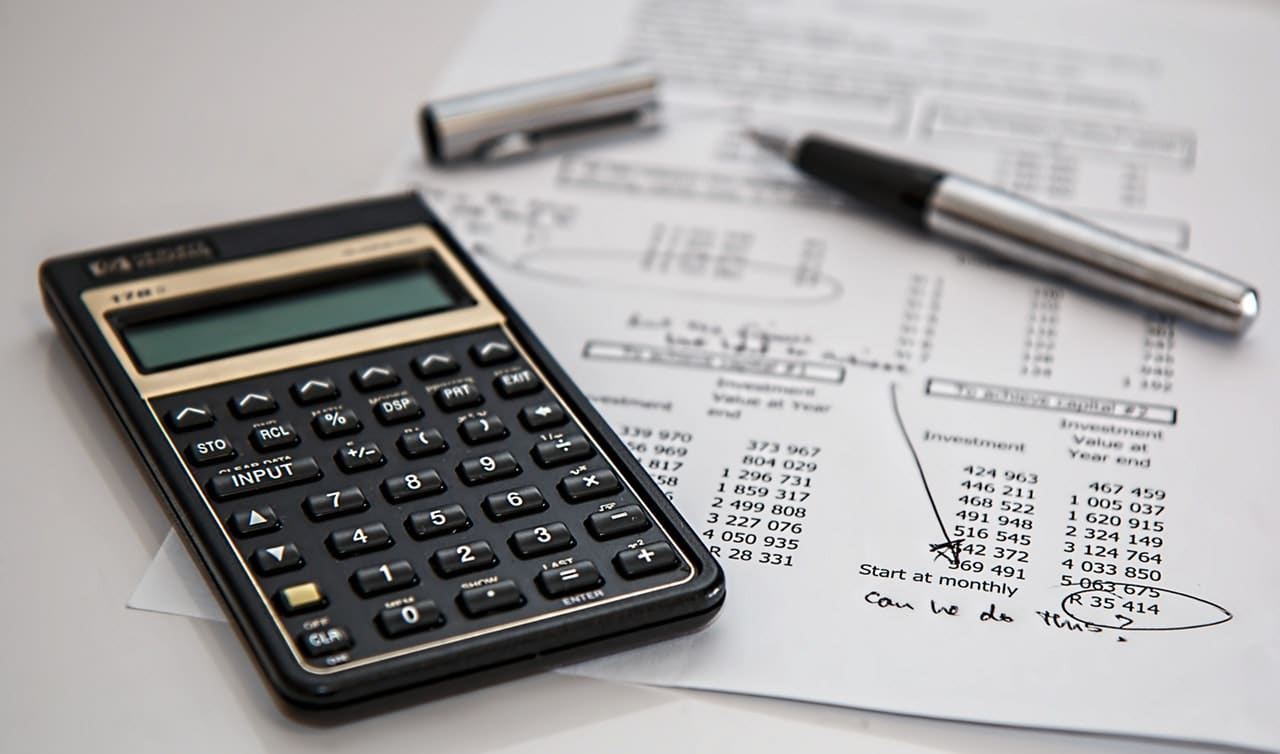

Next, go through your income and outgoings to create a budget that works out how much money you’ll have left after you pay for the unexpected cost, what you need for essentials, and find opportunities to cut back on luxuries so that you can cover everything. Making changes to your everyday habits can help you stick to this budget – you would be surprised at how much small costs add up. Another example of changing everyday habits to free up money is lunches – according to The Guardian, buying a ready-made lunch every day could add up to £1,288 a year. You could simply bring homemade lunches to work for a fraction of the price, either by making larger dinners and boxing up the leftovers or batch cooking for the week. Adjusting your habits, even temporarily, can leave you with more money to help you stick to the tight budget often needed to make ends meet.

Another solution to managing unexpected costs is to boost your income by taking on part-time work or a side hustle. Freelancing can be a great way to earn a bit of extra money in your spare time – some people even make enough that they can give up their day job! There are plenty of professional websites and community social media pages that you can offer your services on. If you’re a writer, sign up to a site such as Contena or put your CV on a site such as Upwork where businesses look for freelancers for a number of reasons – from customer service to accounting. It’s easy to make quick cash by advertising your skills, especially if you have had training in the area. From gardening and decorating to marketing and graphic design, there are always local people needing help who are willing to pay you for it.

According to This Is Money, half of under-35s wouldn’t be able to afford an unexpected bill of just £250, so you aren’t alone. If you are able, saving and planning for costs in advance as far as you can is a good way of ensuring you have a buffer in your account to cover the cost of an unexpected event. Be aware of the possible expenses that could crop up over the year and have a plan of action for getting them sorted before they happen.

Once you’ve handled that emergency expense, take some time to reflect on how you did it. Did you borrow money? Or, did you compromise on some of your other expenses to cover it? Perhaps you’ll discover habits you don’t even miss that you can kick completely and start a new habit of putting aside some money every month to help with future unexpected expenses that fall outside of your budget.

If you are interested in even more business-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS