As renting becomes increasingly popular across the nation, the credit scores required to rent a home are starting to increase as well. A new study from apartment search website RENTCafé shows that the average credit score of approved rental applicants has been increasing across the country. Currently, at 650, the average credit score has increased by 12 points since 2014.

The same applies to renting in high-end buildings as the credit scores needed to rent a luxury apartment is even higher. Those who applied and got accepted in Class A buildings had an average credit score of 683, significantly above the average score of 647 of those renting in Class B buildings. On the other hand, those accepted in Class C and D buildings had an average score of 624.

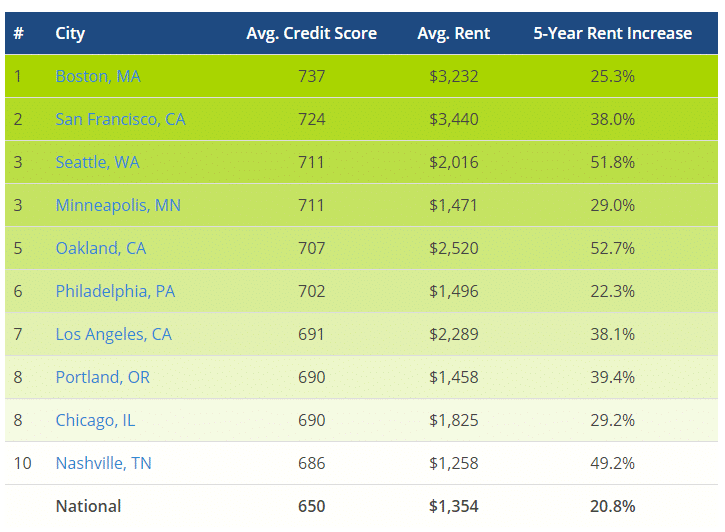

The average credit scores depend very much on the city where you decide to rent. To find out the specifics, analysts at RENTCafé looked at the top 10 U.S. cities that have the highest average scores of approved renters in 2017.

Top 10 Cities With The Highest Average Credit Scores When Renting An Apartment

Boston is at the top of the list, with an average credit score of 737. Those renting here pay on average about $3,200 per month for an apartment. The second city on the list is San Francisco, with a whopping average rent of $3,400 and an average credit score of 724.

Approved renters in Seattle, WA had an average credit score of 711, the third highest score in the United States. The average rent in Seattle has increased by 51.8% in the last 5 years, with tenants paying on average about $2,000 per month.

Similar to the Emerald City, the average score in Minneapolis, MN was 711, although the monthly rent in Minneapolis of $1,500 is much lower than that in Seattle, having increased 29% in 5 years.

Fifth on the list is Oakland, CA where approved applicants had an average score of 707 in 2017. The Bay Area city has seen the average rent increase by 52.7% in a 5-year period which was the highest increase on this top 10 list.

Other cities with high average renter scores are Philadelphia, Los Angeles, Portland, Chicago and Nashville. Even those approved for apartments in Atlanta have the average credit score of 664.

RENTCafé analysts also pointed out the cities with the lowest credit scores, where applicants were approved for apartments with an average score below 590. These are Las Vegas, Memphis, TN, Milwaukee, WI and Mesa, AZ.

By generation, the study shows that Baby Boomer renters are the real winners, because they have the highest accepted credit scores, 683 on average. Millennial and Gen X rental applicants have average scores of 650 and 649, respectively, while the younger Generation Z applicants have an average credit score of 623, the lowest of all generations of renters.

When renting an apartment, analysts also found that there is a 0.96 correlation (out of 1.0 being the strongest correlation) between the applicant’s chances of being accepted and his/her credit score.

If you are interested in even more business-related articles and information from us here at Bit Rebels Then we have a lot to choose from.

COMMENTS