Listed on the Euronext Paris stock exchange, DG symbolizes the stocks of VINCI SA, a celebrated name in concessions and constructions globally, particularly in Europe.

What exactly is the business of VINCI SA, and how much is its stock worth at the moment? What factors affect the price of DG shares, and what is the forecasted price of this stock in 2022? This article will explore these questions in more detail.

IMAGE: UNSPLASH

What Is VINCI SA (DG)?

Vinci SA, which is corporately styled VINCI, is a French concession and construction company. Founded by Alexandre Giros and Louis Loucheur in 1899 as Société Générale d’Enterprises, it is headquartered in Rueil-Malmaison, Paris, France. The company is known globally for designing, financing, building, operating, and maintaining infrastructure, facilities, and public amenities. These include, but are not limited to motorways, bridges, tunnels, airports, railways, and stadiums.

The company manages three segments: Concessions, Contracting and VINCI Immobilier. In addition to this, its numerous subsidiaries include VINCI Construction, VINCI Energies SA, and VINCI Immobilier SAS.

With a market capitalization of €52.458 billion and shareholders, such as the US fund BlackRock and the government of Qatar, VINCI SA is a popular stock for trading and investment on the Euronext’s Paris stock exchange (EPA). It is also a member of the Euro Stoxx 50 index, a stock index of Eurozone stocks.

What Affects VINCI SA (DG) Stock Price?

There is a range of internal and external factors that can increase or decrease the price of DG shares. Listed below are three of the major factors affecting its price:

- The time that a construction company takes to complete a project affects its revenue. Since such companies charge for the entire project and not hourly, delivery delays can lead to a drastic fall in revenue.

- Supply costs can largely affect how much the company makes from a project. These costs are not consistent, and neither is the availability of the required materials.

- If a project cannot be financed by the company’s own assets, loans taken from the bank or other companies can lead to higher interest rates.

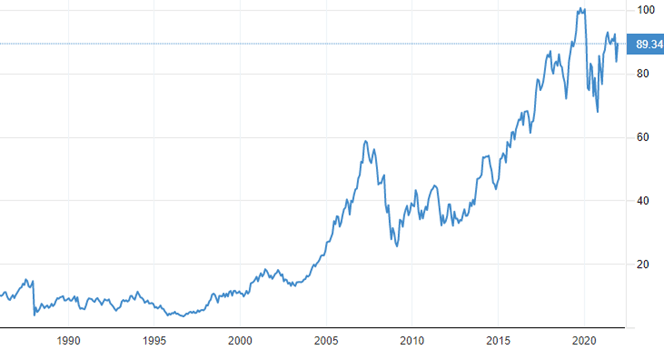

VINCI SA (DG) Price In The Past

Since VINCI SA is over 100 years old and has remained on the EPA for a long time, there have been too many bearish and bullish movements in its history to report briefly. However, a fair idea of its price over the decades and performance on the stock exchange can be gained from the chart below.

The first interesting period appears to be 2005-2009, where a bullish movement led the price to the then-high of €59.57. However, this price sharply started to decline from 2007 until 2009 due to the Great Recession. Despite fluctuations over the years, the graph shows an upward trajectory for DG for almost the next decade.

The price briefly touched the €100 mark in 2019 before being severely impacted by the COVID-19 pandemic, bringing it from its high of €107 to below €60 in a little over a month. While the stock price has tried to recover since the drastic, coronavirus-induced plunge in February 2020, the value of DG still has not been able to reach the pre-Covid high or even cross €100.

VINCI SA (DG) Price Today

VINCI SA (DG) stock price today (23rd December 2021) is €89.77, which is equivalent to $101.59. It has a 1-day range of €87.56 to €89.34, whereas its 52-week range is €75.38 to €96.95. This stock offers a 3.01% dividend yield and is primarily exchanged on the EPA. Although the price of this stock keeps fluctuating regularly, it usually stays between the €85 to €95 range. Yahoo! Finance approximates its volume at 1.06 million.

For more information about the stock, go to VINCI SA (DG) Stock Price Today | Historical Chart & News | Libertex.com.

VINCI SA (DG) Stock Forecast For 2022

Irrespective of the current price, it is important to consider stock price predictions for VINCI SA for 2022 if you are seriously considering buying or selling shares of VINCI SA.

The following table summarizes the VINCI SA stock price forecast of 2022 by Wallet Investor.

As shown in the table, Wallet Investor does not expect any bearish or bullish movements to occur in 2022 for this stock. While the prices vary from month to month, there is negligible change overall. For most of the months, the price is close to the current price of VINCI SA stock. Thus, neither selling nor buying this stock next year appears attractive.

Yahoo! Finance, on the other hand, has a far more optimistic outlook for how 2022 will turn out for the international construction company. It has given a 1-year price target of €102.92, which is a significant appreciation over the current value. If this seems too far-fetched, know that DG stock was valued at over €100 in October 2019.

While the outlook for 2022 appears rather uninteresting, according to the predictions for years beyond 2022, DG price is highly likely to appreciate. With VINCI SA’s earnings expected to increase by 80% over the next few years, the share prices will also rise.

Hopefully, the existing and forecasted data gives you a better understanding of where VINCI SA has been and where it’s heading.

IMAGE: UNSPLASH

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS