The financial markets are a hive of activity for traders and investors. The 1-year performance of the Dow Jones Industrial Average (21.56%), the S&P 500 Index (16.05%), the NASDAQ Composite Index (25.53%) and the New York Stock Exchange (11.63%) have been nothing short of exemplary. However, the 1-month performance of these markets has been rather lackluster. The Dow Jones is down 4.91%, the S&P 500 index is down 4.37%, the NASDAQ is down 2.24%, and the NYSE is down 5.52%. This begs the question: How can you save money by dabbling in the financial markets given the current volatility?

There are several events driving market activity. These include imminent activity from the Fed.

What Is Driving The Markets?

Note that the Federal Reserve Bank has the dual objectives of price stability and full employment. For the Fed, the benchmark inflation target is 2 percent and the unemployment rate is currently hovering around 4.1%. From the Fed’s perspective, the economy is on song, and it may be necessary to hike interest rates to prevent the US economy from overheating, given the inflationary pressures of increased wages that are now taking place because of the overhaul of the US tax code.

Believe it or not, companies across the board are now paying higher wages and salaries to workers. This has given rise to inflationary pressures, as evidenced by the latest US inflation data.

For January 2018, consumer prices increased by 2.1% year on year, on par with the December 2017 increase, and marginally lower than the November 2017 year on year increase of 2.2%.

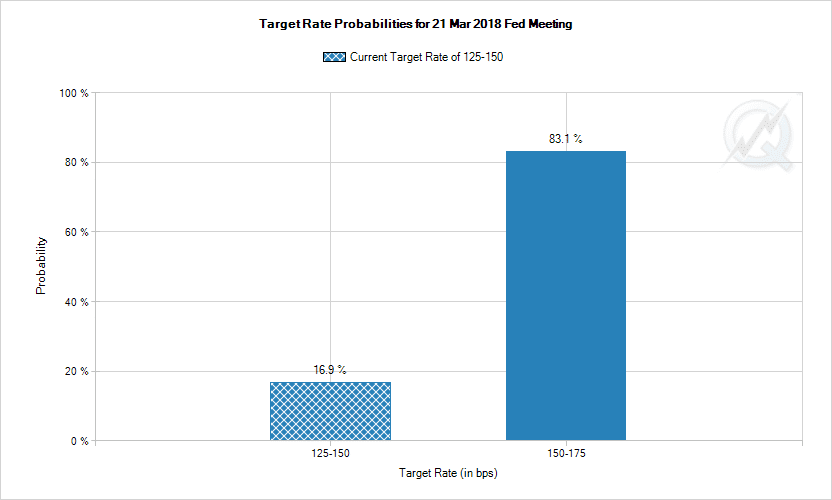

According to analysts from the CME Group FedWatch tool, the probability of an interest rate hike on Wednesday, March 21, 2018, is now 83.1%. If the 25-basis point rate hike comes to pass, interest rates will rise in the region of 1.50% – 1.75%. This is important in many ways. For starters, rising interest rates have far-reaching implications for the stock market. When interest rates are high, the profitability of listed companies decreases.

This is true because the interest-related component of loan repayments decreases profitability. Companies must spend more of their profits paying down loans, and also have to contend with the decreased purchasing power of US households which must now deal with less personal disposable income. These are serious considerations in the current investment spectrum.

Wilkins Finance guru, Harold R. Bellwether believes that there are viable investment strategies that can improve the value of your portfolio, by applying common sense methodology to your trading activity:

“In my experience as a professional trader, I’ve noticed several things. For starters, any outlier behavior in the financial markets is temporary. When we notice rapid price increases in any asset category, we should act cautiously in that regard. It is imperative to set price targets with trading activity. If tech stocks are experiencing a boom, it is important to ride the wave and cash out before it crashes. Precisely where that fine line is, is up for debate.

However, if you set a nominal percentage you can certainly capitalize with 10%, 20%, 30%, 40% in gains. The problem with many traders is they expect the bull markets to continue unabated, or conversely the bear markets to continue unabated. It is important to put emotion to the back of your mind and to plan strategically. Consider that what goes up must invariably come down, and stocks that have been subjected to a correction will invariably enjoy an upsurge in buying behaviour given that these are value-driven investments. When an A-grade stock depreciates through market corrections, it becomes highly sought after as a value investment. This is known as buying on the dip. There is plenty to be gained by cashing in on market corrections.”

Author Bio: James Broth is a business writer, mentor, and personal finance advisor. He has been consulting for SMB owners and entrepreneurs for the past seven years.

If you are interested in even more business-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS