eCommerce undergoes a major expansion during the coronavirus pandemic. With the rising demand for online shopping opportunities, payment providers need to change with the emerging market needs. At the same time, brand new banking startups spring up continuously. From the customer’s point of view, different potential payment methods have never been that ubiquitous.

Just consider the fact that Facebook users can make a financial transaction on Messenger. They have to link their account to the bank. Of course, this isn’t available in all of the regions. But it goes to show how far online payment technologies have come. In the following paragraphs, we will take an in-depth look at the trending digital payment methods in 2021.

IMAGE: UNSPLASH

Trend 1 – Mobile-Point-Of-Sale (mPOS)

Flexible and streamlined digital payments are brought to vendors and customers in the form of mPOS payments. This technology allows them to receive customers’ payments in various locations. For instance, a sandwich shop can open a food truck at a music festival without facing complications from the payment side.

That’s only the beginning, though. The mPOS approach allows vendors to revamp the regular checkout areas. Especially innovative companies could even close these areas altogether. That’s because it’s possible to equip the sales area staff with mPOS-supported devices. The industry analysts have forecasted that mPOS reaches a compound annual growth rate of 19% between 2020 and 2026.

Trend 2 – Home Assistant Payments

Do you have a smart speaker or digital home assistant? Many big tech companies have created these outstanding products, including Amazon, Apple, and Google. At first, these devices were quite primitive compared to the ones we can purchase today. Since the consumer expectation is growing automation of everyday lives, payments need that upgrade as well.

A growing consumer base is using smart speakers and similar devices for digital payments. This is a sector that is expected to expand in the coming years. More people are using digital home assistants to pay for services and products or send and receive money from sending some cash to your friends to ordering a courier-delivered meal.

Trend 3 – Mobile Wallets

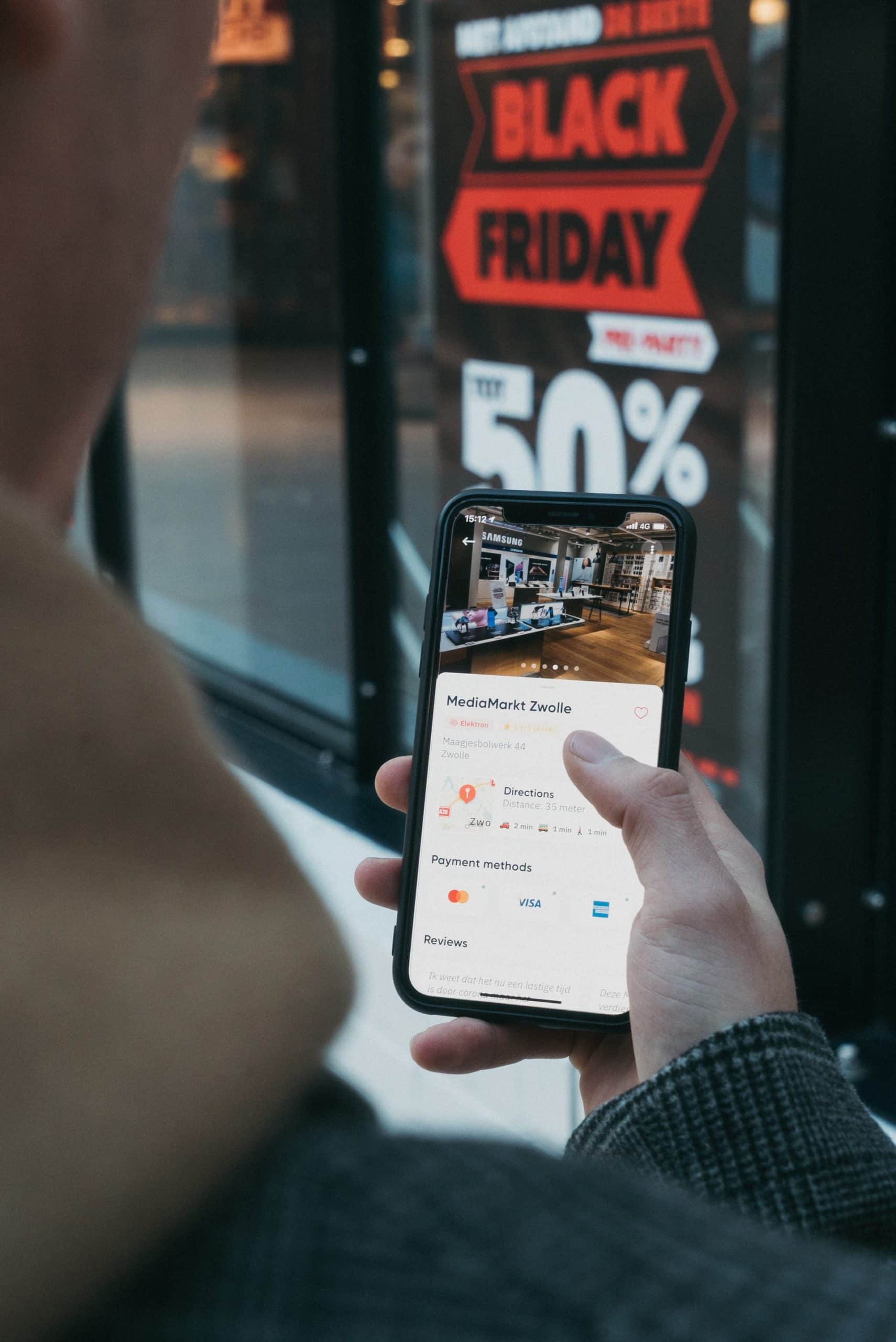

Payments with mobile wallets are skyrocketing. Every year more and more people discover how easy it is to pay for things with your smartphone. Essentially, it’s nothing other than a mobile app working as a physical wallet. For instance, both Samsung and Apple have started creating mobile wallets. They want a piece of this emerging financial trend.

Many merchants readily accept mobile wallets in developed countries. But even in the developing world, mobile payments have conquered a surprising market share. The smart payment terminals popping up in supermarkets and shopping centers worldwide allow the continuing onslaught of mobile wallet use. A significant percentage of service and product payments may be done with mobile wallets by 2030.

Trend 4 – Crypto Payments

Some industries have readily welcomed cryptocurrencies. For example, the online gambling and sports betting sector is increasingly adopting Bitcoin and altcoins. Just five years ago, a Paypal casino was a regular approach in the online gambling industry. Nowadays, bet-happy customers are getting comfortable making their transactions with the use of crypto wallets.

It’s not only the gambling sector that has received a healthy dose of innovation from blockchain tech. Some experts predict that more regular online merchants will start accepting well-known alt currencies in the coming years. If there’s no bubble to pop, we could even see some major online retailers trying to get in on the action.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS