The ability to kick start a business today has profoundly changed how new ideas are brought to the market. Previously, it took a whole lot of effort and negotiation with a bank and investors in order to lock down the funding necessary to realize an idea. But with today’s crowdsourcing platforms like Kickstarter, Indie Go Go and a whole lot more, a business can spawn almost instantly. But your startup fundraising efforts could be scuffled quite easily if you don’t avoid the most common traps.

To successfully launch a kick starter project (not necessarily using Kickstarter per say), you need to stay aware of a whole lot of variables. The simplest mistake most startup fundraising efforts make is neglecting the fact that pledgers want information about what they are pledging for. They not only want to know about the end product, but also what the money will be used for. It’s quite an interesting ecosystem that is calibrated in such a way that it allows for an optimized format to successfully fund an idea more times than not.

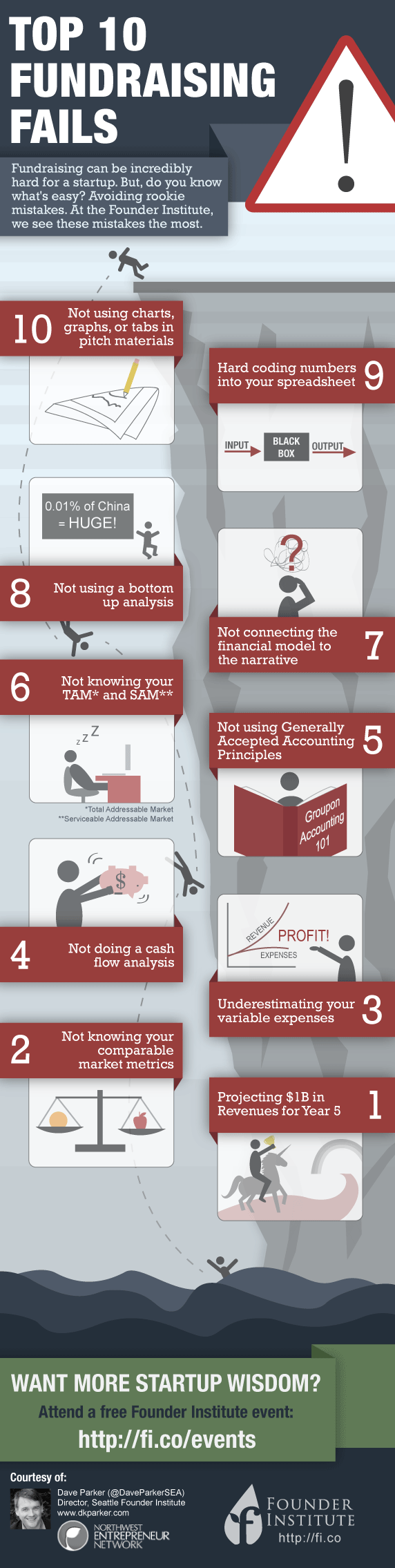

By consulting a fresh infographic called Top 10 Fundraising Fails, presented by Founder Institute (they should know, right?), you can potentially (as the infographic says), avoid rookie mistakes in your startup fundraising efforts. As I mentioned above, not providing a full cash flow analysis is one of the most eye-catching mistakes you can possibly make. Investors and pledgers (if you’re using a crowdsourcing platform that is) want to know how the money will be spent, and what each step of the product realization will cost. There are many levels of cash flow analysis which you will need to supply. Don’t neglect this, or you will most likely feel the turmoil of a startup fundraising failure.

Another rookie mistake is to overestimate, also called “dream building,” your future revenue projection to an almost ridiculous level. If an investor has shown interest in your startup fundraising campaign, they have done so because they have some sense of its possible future success. They probably also know enough about the industry to know it will work. Don’t commit the mistake of over projecting your own idea to ludicrous levels, which will only come across as a desperate attempt to convince investors to invest. But, at the same time, don’t underestimate your level of success either. A professional startup fundraising campaign pitch has an average level of success data combined with in-depth information about the idea around it, and how it is to be realized. Consult this infographic (design by Andrea Chen) and make sure to crosscheck your own pitch so you don’t stump yourself out of a successful startup fundraising campaign.

Startup Fundraising Rookie Mistakes

Via: [visual.ly]