In most cases, real-world change, designed to improve the economic conditions of the world’s poorest, is only possible through grassroots efforts. For regions struggling with poverty, the problem must be addressed first at the individual level. To improve the overarching economy, grassroots efforts are critical. According to Gregory Casagrande, that’s where microfinance has shown proven and consistent results.

As a social entrepreneur and founder of SPBD Microfinance Network, Gregory Casagrande has seen firsthand how these grassroots efforts can change individual lives and transform entire communities. Through SPBD, Casagrande has provided more than $160M in micro-enterprise financing to over 75,000 aspiring women entrepreneurs in the highly under-developed countries of Samoa, Tonga, Fiji, the Solomon Islands, and Vanuatu. As part of its microfinancing initiative, SPBD also provides small business training services to help these women micro-entrepreneurs grow and sustain profitable business.

For the impacts he has made in the South Pacific, Gregory Casagrande has been named “Person of the Year” in Samoa. He was also honored as a United Nations Global Advisor for its International Year of Microfinance. Here, he outlines how microfinance programs are continuing to create positive change in the world.

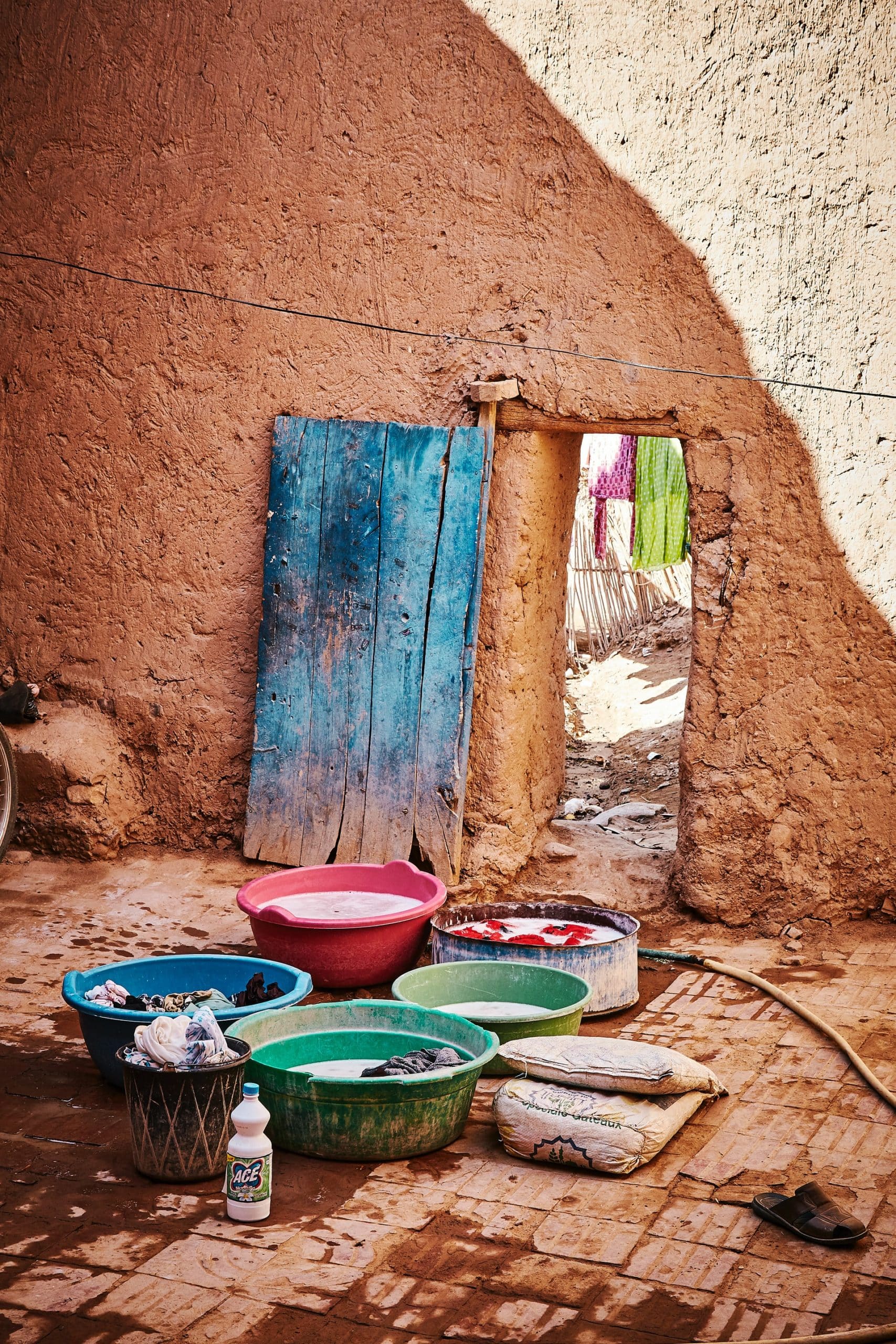

IMAGE: UNSPLASH

Microfinance Defined

Before diving into the positive impact microfinance has had on poor communities, it is helpful to understand what microfinance programs offer. At the most basic level, Gregory Casagrande describes it as a “specialized type of banking service which aims to directly empower poor families and to boost local economies. It does this through making a range of affordable and convenient credit, savings, training, and insurance services available to those traditionally excluded from the formal financial system.”

While many of us may take traditional banking services like these for granted, many families in undeveloped poor countries around the world still live without access to them. Microfinance programs make these services available to small-scale businesses. The micro-entrepreneurs can use these services to start and grow their micro-businesses so that in turn they can work their way up and permanently out of poverty. As these programs have become more common around the world, the positive shifts they create have become increasingly apparent.

How Microfinance Is Mobilizing Change

Casagrande explains that “Microfinance is about providing the proverbial hand up and not a handout. It is about economic development through the direct empowerment of one single woman micro-entrepreneur at a time. And then it is about doing that at scale, by building microfinance institutions whose sole business purpose is to help thousands of women micro-entrepreneurs each develop life changing micro-businesses that will positively change the economic trajectory of their families forever.

This creates systemic change on a large scale and the positive impact it catalyzes are significant. To spotlight the positive impacts that microfinance programs are driving, Gregory Casagrande highlights a few.

Aiding Impoverished Communities

When it comes to assisting poor populations, large-scale initiatives consistently underdeliver. Government aid programs and charity efforts may temporarily ease the symptoms of poverty, but they rarely create consistent, sustainable change. Rather than attempting to find solutions for fighting poverty through macro, trickle-down initiatives, microfinance uses practical measures to create shifts through directly empowering poor families though sustained and specifically tailored grassroots outreach.

In providing direct grassroots solutions (such as microloans for businesses, housing improvements and education as well as savings accounts, insurance accounts, money transfer services, microbusiness development services and more) on an individual basis, microfinance programs help create strong, successful, sustainable small businesses in struggling communities. In addition to fostering a single family’s climb out of poverty, these businesses generate new employment opportunities for other community members.

With more possibilities to find work and to earn a steady income, these efforts benefit the local economy by creating additional jobs. In other words, the resources provided by microfinance programs do more than improve individual situations; they create a chain of reactionary change that boosts the local economy, creates employment opportunities, and helps economically uplift entire communities.

Making Education Possible

In poor areas, children often do not have the opportunity to obtain a quality education. Either the family cannot afford the fees or resources necessary to send the child to school, or the child’s labor is required to help the family meet its financial needs. This is especially true for families with girls; female children are far more likely to be taken out of school before graduation to attend to the family’s needs.

With the help of microfinancing programs, however, many families are able to launch successful small businesses. This affords struggling families the option of education. For young women especially, finishing school increases the likelihood that they will grow up, obtain a fair-paying job, and lead an empowered life.

Fostering Equality

An estimated 90% of those who directly benefit from microfinance services are women. Often, women living in poor communities must rely on their husbands for support. The resources provided by microfinance companies like SPBD, however, help bring meaningful economic opportunity to the women of these communities by helping them to launch, grow and sustain small business ventures. These microbusinesses enable them to permanently support themselves and their entire family.

Creating Sustainable Change

Microfinance programs consistently prove that it takes extraordinarily little to create real, durable change. Even a loan of $400, in many cases, is enough to launch a successful business venture in an undeveloped country that will continue to create employment opportunities and boost the local economy for years to come.

Because the resources required for a single life-changing micro-business are so small, and because the social impact comes from the self-interested efforts of the woman micro-entrepreneur herself, this makes microfinance programs especially sustainable and impactful.

And ultimately, this is why microfinance programs are almost always a much more effective solution to addressing poverty than are unsustainable and unscalable charity measures and one-time aid initiatives. Because of the change that microfinancing fosters is enduring, repeatable, and scalable, there is no limit to the positive impact it can create.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS