Your credit score is a representation of your financial history and responsibility. This score determines how financially stable you have been in the past.

A credit score is one of the most important factors that is used to calculate your eligibility for loans, credit cards, and even some job opportunities.

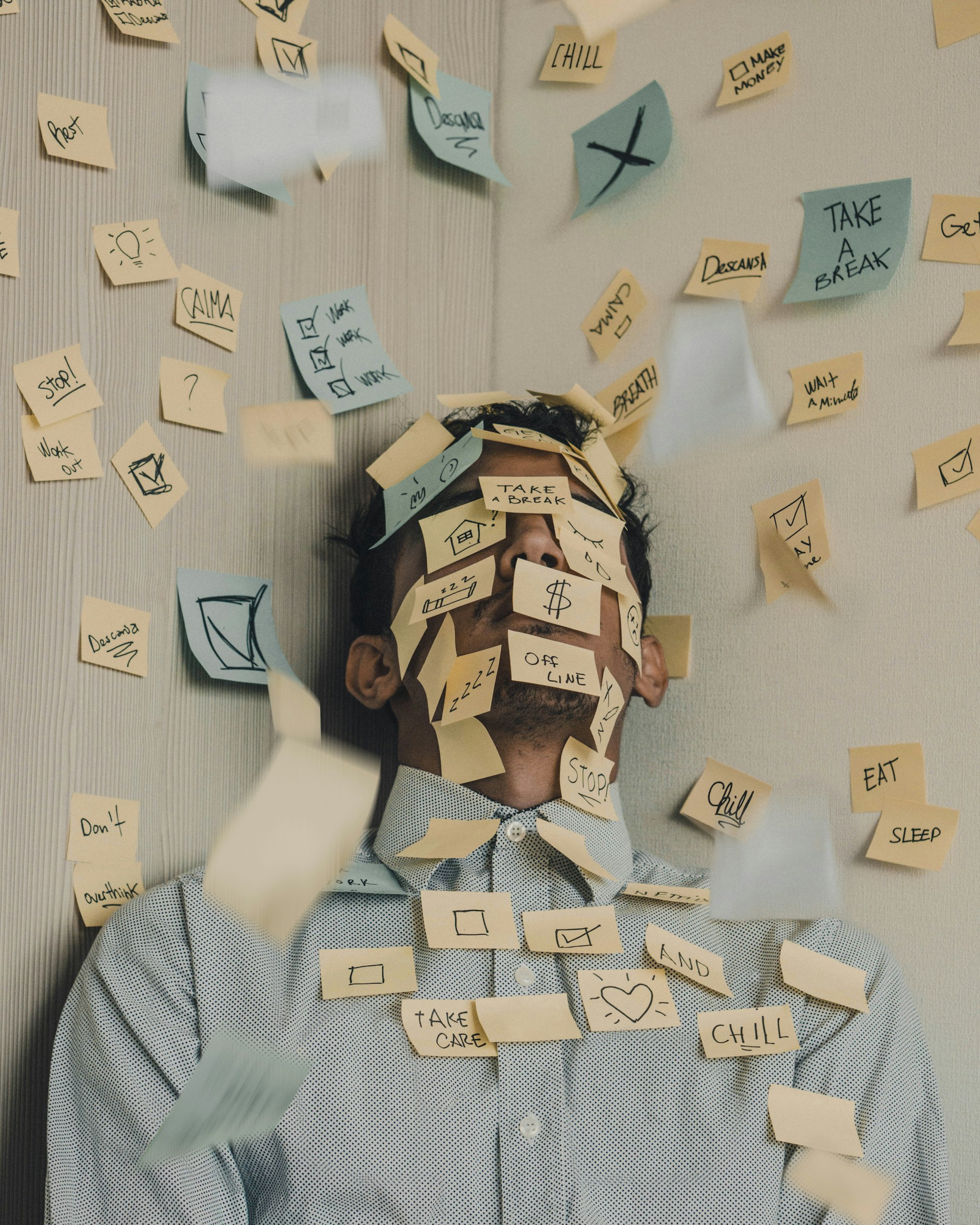

However, life is full of uncertain challenges, and sometimes, your financial situation gets so unstable that your credit score will fall down. Increasing your credit score is an uphill battle, but there are some strategic ways you can follow to improve your financial situation gradually.

In this guide, we will explore the reasons behind a bad credit score and what you can do to rebuild this score and regain financial stability.

IMAGE: UNSPLASH

Prioritize And Tackle Outstanding Debts

Outstanding high-interest debts are the biggest reason for the downfall of your credit score. If you will be able to repay these loans as quickly as you can, your credit score can improve right away.

That’s why it is advised to prioritize debts based on high interest rates and amounts you own.

Consider reaching out to creditors to negotiate more favorable terms or set up a realistic repayment plan. Tackling smaller debts first can make you realize that you have accomplished something, which will then enable you to free up additional funds for addressing larger loans and financial obligations.

Create A Realistic Budget

A realistic budget is not too tight nor too loose. If you want to pay off your outstanding debts faster, you will need to create a realistic budget and then follow it regularly. Assess your monthly income, fixed expenses, and additional spending to know where your income is going.

Identify areas where you can cut back and allocate more funds towards paying off outstanding debts. A well-structured budget not only helps you manage your current financial situation but also shows creditors that you are actively working to improve your financial health. This ultimately increases their trust in you.

Explore Credit-Building Options

If your bad credit score is due to a lack of credit history, you can always consider exploring credit-building options. Secured credit cards, for example, allow you to make small deposits as collateral and build credit with responsible use.

Alternatively, you can also become an authorized user on someone else’s credit card or explore credit-builder loans to help establish or rebuild your credit history. It is also advised to take out a small personal loan to quickly pay off the installments on other loans.

However, you will first need to explore your options. Lantern by SoFi mentions some personal loans for bad credit and a detailed guide on how you can explore them to improve your financial condition.

Bad Credit Score – Get Professional Guidance

Sometimes, understanding the complexities of credit repair can be challenging. In this case, you will need to get professional guidance to do some good to your overall financial situation. There are many credit counseling agencies that can provide personalized advice and assistance in creating a debt management plan.

Also, there are individual professionals who can guide you with the right information on how to pay off your debts and be debt-free in an easier way.

Just be sure when choosing reputable agencies, and be wary of any that promise quick fixes or charge extra high fees.

Stay Current On The Bills

Consistent and on-time payments are the basic things to improving your credit score. Set up reminders for payment due dates, automate payments where possible, and focus on staying current on all bills.

Timely payments show financial responsibility and contribute positively to your credit history over time. When you pay off all your bills on time, creditors and lenders see that you are performing well financially.

Disclaimer: The above references an opinion of the author and is for information purposes only. It is not intended to be investment advice. Seek a duly licensed professional for investment advice. Invest responsibly and never invest more than you can afford to lose.

IMAGE: UNSPLASH

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS