When it comes to mobile shopping, I think the years 2011 and 2012 will always be remembered as the time when it really took off. I remember a decade ago when my mother told me, “Don’t ever type your credit card number into the computer because you’ll get scammed.” We’ve come a long way since then. Not only do we all shop online, we shop on our mobile devices also. One thing we don’t talk about a lot though are the different mobile payment options.

I remember one day a few years ago when I was stuck in a downtown Atlanta traffic jam, and I pulled over and ordered a pizza on my iPhone. It was delivered about 45 minutes later, which was about the same time I got home. In that moment, I was officially hooked on mobile shopping. Mobile shopping is longer a trend. It’s now something that is just part of our everyday lives, at least for a lot of people.

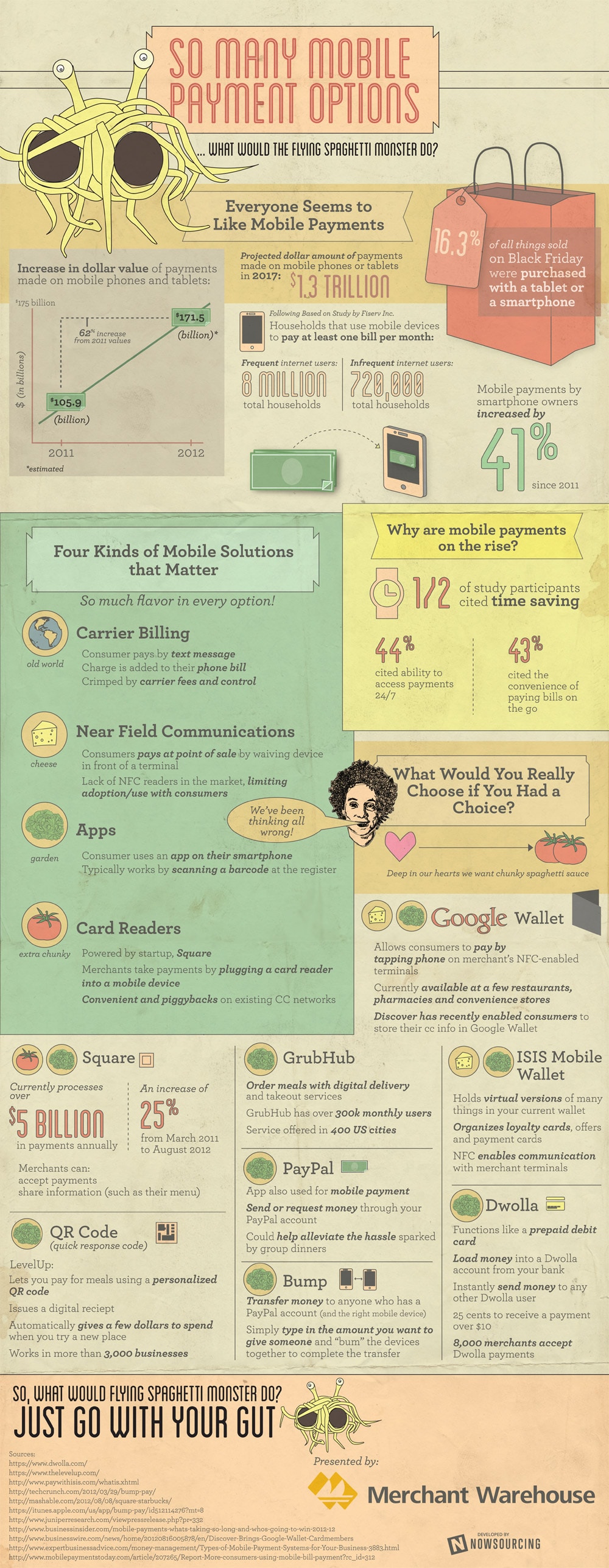

Whether you are a merchant, a consumer, or just someone who enjoys the flexibility of paying your bills on the go, it’s worthwhile to look at the different mobile payment options available. There are so many very different types of mobile payment options (NFC readers, card readers, apps, QR codes, Google Wallet, Square, PayPal, etc.) that sometimes it’s even hard to narrow down which way would be the most convenient for your customers or for yourself.

This infographic called So Many Mobile Payment Options…What Would The Flying Spaghetti Monster Do? by Merchant Warehouse will walk you through a basic comparison of the most popular payment options available. At the end of the day, they are all very good in their own ways. It really comes down to a personal choice. These payment options are like smartphones meaning you can’t really make a mistake since they are all good. So, as this infographic suggests, just go with your gut!

A Comparison Of Mobile Payment Options

With A Little Help From The Flying Spaghetti Monster

(Click Infographic To Enlarge)

Header Image Credit: [Shopability]

COMMENTS