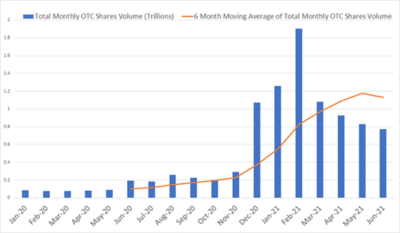

Recent data by FINRA (Financial Industry Regulatory Authority) has revealed significant increases in penny stock trading volume over the first half of 2021. According to their data, total monthly OTC shares volume (most of which are penny stocks) has increased by more than 1,000% over the last several months.

That is, in the first half of 2020 the average monthly penny stock trading volume was around 0.1 trillion, whereas in the first half of 2021 it has exploded to 1.1 trillion. Here’s what the data looks like since the start of 2020:

IMAGE: FINRA; BUSINESS INSIDER

Why The Explosion In Penny Stock Trading?

A more than tenfold increase in trading activity can be attributed to a significant rise in retail interest in trading and investing throughout the COVID-19 induced market volatility. According to some sources, retail traders, at some point, accounted for a quarter of the stock market following COVID-driven volatility in the US. That is almost equal to the volume of mutual funds and hedge funds combined.

The new phenomena of retail investors and traders flocking the equity markets have taken Wall Street by storm, as major players in the business are forced to adjust to the new trading and investing environment.

Is This A Positive Development?

While certain people will have different opinions on the matter, based on their own interests, from a retail trader’s perspective, this is undoubtedly a positive development. Here’s why. First, penny stocks are usually heavily criticized for being particularly prone to the attacks of large market manipulators.

With an increasing retail presence in the penny stock markets, this is becoming less of a concern as retail traders, by nature, also own more shares in the market, which can translate into lower volatility potential for market manipulators.

Second, many OTC shares have been criticized for not having enough liquidity. With retail traders flocking the penny stock markets, a 1,000% increase in trading activity is surely going to help get this critical point out of the way.

Third, many traders will turn to communities and trading coaches, which will help increase the transparency of OTC markets through more conversations and more questions within the trading community.

This, in turn, can have positive effects on overall penny stock profitability in both trading and investing and will encourage many retail traders who are looking to start out, to ask the ultimate question: can you nowadays reasonably make money trading penny stocks. On an additional note, such an increase in retail interest in investing is also beneficial for smaller companies and also retail investors themselves.

For smaller companies, this is a great chance to attract more funding and gain traction with the spark of the public interest. In addition, as more of the population owns more of the stock market, this is going to help increase their share of the wealth and in turn, help reduce wealth inequality at least somewhat.

How Long Is This Going To Last?

Such a strong interest in penny stocks is unprecedented. According to data by FINRA, in the last five years to date, total yearly trading volume in the OTC markets has never crossed a 3 trillion mark. Whereas just in the first half of 2021, the total OTC trading volume has come to pass 6.7 trillion.

That is more than half of the volume that has ever incurred over any year in the past, and this happened in just half of the year. This is a strong indicator that, even if the volume has already reached its peak, for the time being, it is not going to vanish overnight.

In addition, while it is uncertain exactly how long this development is going to last, one thing is highly likely: as long as the prospect of new variants of COVID-19 is present, we are likely to see more people end up spending more time at home.

With the increased likelihood of additional government stimulus, we are bound to see more trading activity from the average retail trader, at least for some time to come. For some, this perhaps will be the perfect storm and the perfect time to get into penny stock trading.

Unprecedented times require unprecedented decisions and ways of dealing with new situations. This is why they often bring about unprecedented results and developments. Therefore, it is not a coincidence that the COVID-19 pandemic has attracted so many more penny stock retail investors and traders than ever before.

While uncertain and unprecedented times are here to stay, at least for a while, it is important to be able to adjust and make the right decisions based on the new information and new developments within the markets. It is up to us to decide whether that means taking on new ways of dealing with your finances or taking the same road.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS