While you’re sure to avoid a lot of the issues people have with standard brick and mortar banks no matter which online bank you choose, it’s still essential to examine each virtual bank’s offerings to make sure you’re getting the best deal.

Here is a short list of the services and benefits you should be looking for from an online bank.

IMAGE: PEXELS

Low Or No Fees

People frequently cite this and the next entry as the two most important reasons for switching to an online bank, and while almost all virtual banks offer lower fees than conventional banks, some offer lower fees than others.

Make sure you read through the fine print on each bank’s website and note any hidden fees they don’t mention in the marketing materials.

High-Interest Rates On Deposit Accounts

Like fees, interest rates vary widely between banks. However, understand that often the banks that offer the highest returns do this by sacrificing services.

If you’re looking for a place to put excess money, an online bank may be perfect for you. Otherwise, make sure you balance interest rates with the other services you need.

A Commitment To Security

As virtual banks proliferate, it’s inevitable that one or more of them will eventually fall prey to hackers. Generally, the larger the bank, the more money they spend on cybersecurity. As long as you structure your accounts within the FDIC guidelines, your deposits are insured. However, FDIC insurance does not protect you if your personal information is stolen. Companies like Bauer Financial provide safety ratings and are available free of charge.

Customer Service

Many virtual banks offer 24/7 customer support. Look for one that provides this both over the phone and via chat.

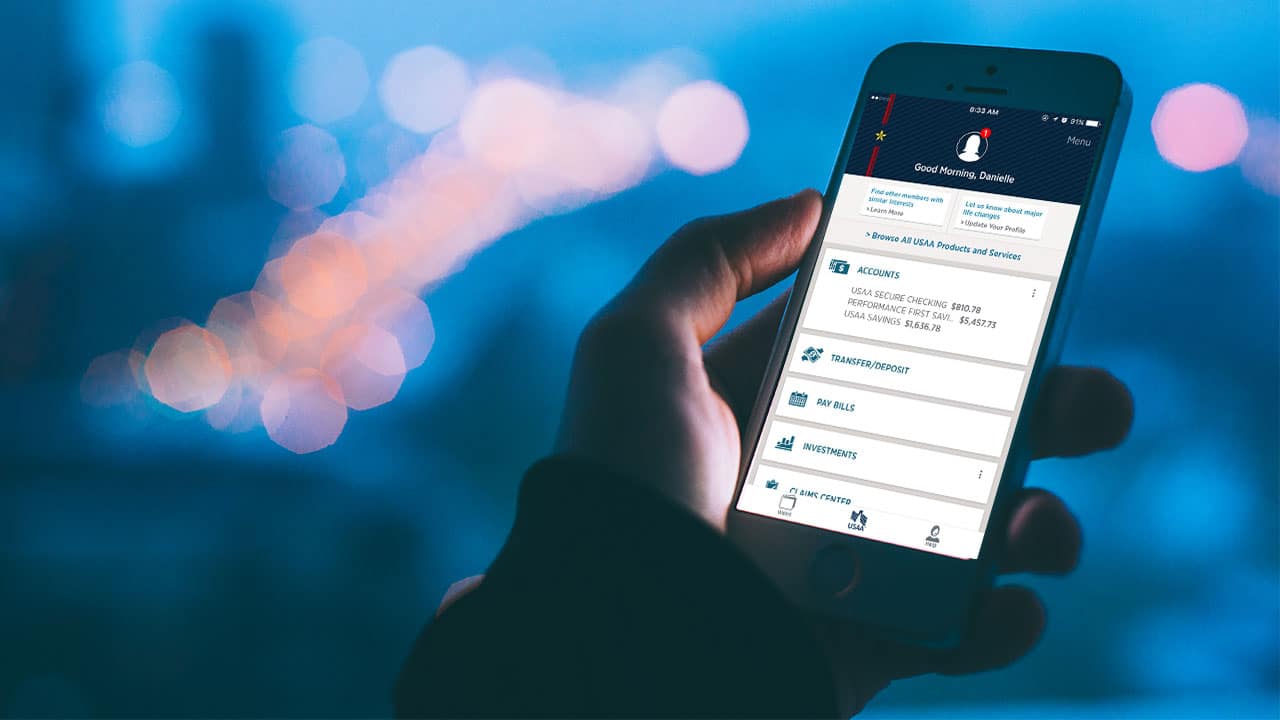

Easy Mobile Banking

Most virtual banks offer a convenient mobile banking app. Look for a full-featured app or at least one that supports all of the features that are important to you.

A Wide Range Of Services

Most online banks offer checking accounts, CDs and other higher-yielding investment vehicles. You may also want access to credit cards, home and auto loans, and investment accounts. Make sure you research the services provided and decide which are essential to you.

A Large Network Of Free ATMs

Because virtual banks don’t have brick and mortar locations, you’ll be relying on ATMs for deposits and withdrawals far more than you would with conventional banks. Verify that the online bank you’re considering allows free access to an extensive network of ATMs around your home and work. A smaller number of available machines will dampen your virtual banking experience.

A Strong BauerFinancial Rating

A high rating indicates a quality, stable bank with good customer support and better than average service. BauerFinancial is an independent company that’s been generating impartial bank ratings for 35 years.

Even The Best Banks Aren’t Right For Everyone

Remember that your needs are unique. There may be services you don’t care about, that might be deal breakers for others. Consider what’s important to you, and not just what others have said about the banks you’re considering.

Author Bio: Rory Brown was named by Ernst & Young as Financial Services Entrepreneur of the Year and has also been featured in several well-known industry publications, including Money Magazine and The Economist and companies he has managed have been included in the Inc. 500 multiple Times. Rory Brown is currently working on a new app that will help consumers navigate online banking. The app will connect clients with the best virtual banks in the world, where they can get comparisons on rates for home loans, auto loans, and more.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS