If you’re like most people, you probably have a love-hate relationship with credit cards. On the one hand, they’re incredibly convenient; on the other hand, they can also be a major source of financial stress. But what if there was a way to use credit cards without all the hassle? Enter virtual credit cards.

Virtual credit cards are a relatively new innovation that allows you to enjoy all the benefits of credit cards without any of the downsides. A virtual credit card is a credit card that exists only in digital form. It is generated by a financial institution and can be used for online payments. Virtual credit cards are also known as e-cards or disposable credit cards.

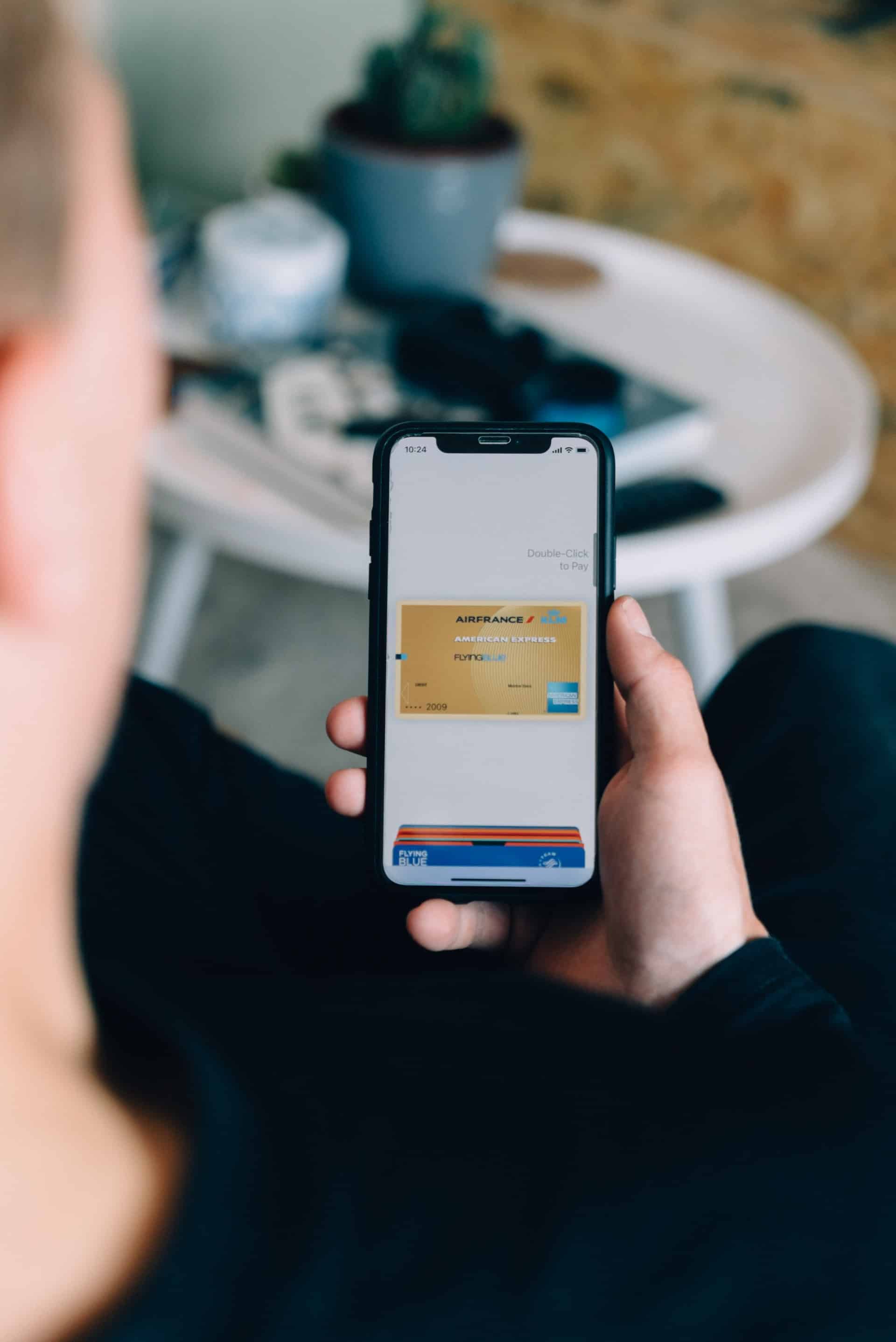

IMAGE: UNSPLASH

How Do Virtual Credit Cards Work?

To understand how a virtual credit card works, you first need to know how a regular credit card works. A regular credit card is issued by a bank and is linked to your bank account. When you make purchases with your regular credit card, the money is transferred from your bank account to the merchant’s account.

When you sign up for a virtual credit card, you’re assigned a randomly generated credit card number. This number is linked to your actual credit card, but it isn’t printed on the card itself. Instead, it’s stored in the issuer’s computer system. When you make a purchase online, you’ll enter the virtual credit card number, expiration date, and security code just as you would with a regular credit card.

Types Of Virtual Credit Cards

There are three primary types of virtual credit cards: single-use, limited use, and reloadable cards. As the name suggests, single-use cards are only good for one transaction. Once you’ve used them, they’re no longer any use to you and you can’t reload them with more money.

Limited use virtual credit cards are a bit more flexible. You can set a spending limit and expiration date when you create the card. These cards are great for online shopping because you can generate a new card number for each website you shop on (more on that later). And, if your card number is ever compromised, you can cancel that one card without affecting your other limited use cards.

Reloadable virtual credit cards work just like prepaid debit cards. You can load money onto the card and use it as needed. Some reloadable cards even come with benefits like rewards points or cash back.

How To Choose The Best Virtual Credit Card

When choosing the best virtual credit card, you need to consider a few things:

- The type of card you need (prepaid, debit, or credit)

- The fees associated with the card

- The features offered by the card issuer

- The level of customer service provided by the issuer

- The security features offered by the issuer

What Are The Risks Associated With Virtual Credit Cards?

There have been a few isolated incidents of fraud associated with virtual credit cards, but for the most part, they are considered to be very secure. The main risk is that if your computer is hacked or your account is compromised, the hacker could access your virtual credit card information and make unauthorized charges.

How Can Businesses Use Virtual Credit Cards?

There are many ways businesses can use virtual credit cards. To make online purchases, to pay vendors, to manage employee expenses, to earn rewards, to improve security. These are a few good reasons associated with using virtual credit cards for businesses. By using virtual credit cards, businesses can improve their security by ensuring that their physical credit card is not stolen or lost. Additionally, businesses can set limits on how much money can be spent using a virtual credit card, which can help prevent fraud and overspending.

Why Are Virtual Credit Cards Getting Popular?

There are several reasons why virtual credit cards are becoming popular among businesses:

- They offer greater control over spending: With a virtual credit card, businesses can set limits on how much can be spent per transaction or per day/month. This helps businesses to better manage their finances and avoid overspending.

- They improve security: Virtual credit cards add an extra layer of security to online transactions as they can be used for one-time payments only. This means that even if a fraudster gets hold of your card details, they will not be able to use it for future transactions.

- They are easier to use: Virtual credit cards are very easy to use and this is one of the main reasons why they are becoming popular among businesses. All you need to do is generate a new card number for each online transaction. There is no need to carry a physical card or remember your PIN.

- They are more secure than debit cards: Debit cards are linked to your bank account and if a fraudster gets hold of your card details, they could access your funds and cause serious financial damage. With a virtual credit card, there is no such risk as the card is not linked to your bank account.

They can help you save money: Some businesses offer discounts when you pay with a virtual credit card. This could help you save money on your business expenses.

IMAGE: UNSPLASH

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS