In 2020, technology is evolving at a very fast pace. This couldn’t be more true speaking of innovations in the field of Artificial Intelligence, Machine Learning, and Big Data. Financial organizations and banks are always at the forefront of cutting-edge technologies and there is no wonder they are AI/ML innovators too. Artificial Intelligence provides capabilities beyond human effort that automates essential tasks of the financial industry, improves security, and ultimately helps to generate more revenue.

IMAGE: UNSPLASH

Plenty of financial institutions already changed their processes forever, as the number of impressive AI in Fintech use cases is only increasing. However, the true revolution is only emerging if the prediction by Autonomous is true. This company claims that in ten years traditional financial institutions with the help of Artificial Intelligence can save up to 22% of costs, which is astonishing.

Of course, if you want to be a part of that statistic and truly embrace AI/ML technology, you need to implement it right now. In this article, we discuss the most prominent use cases in Fintech, exploring how Artificial Intelligence in Banking is already effecting significant change.

A key aspect of this transformation is in the realm of customer support. To understand this better, consider the insights provided on fintech customer support, which highlight practical applications and real-world examples of AI in action.

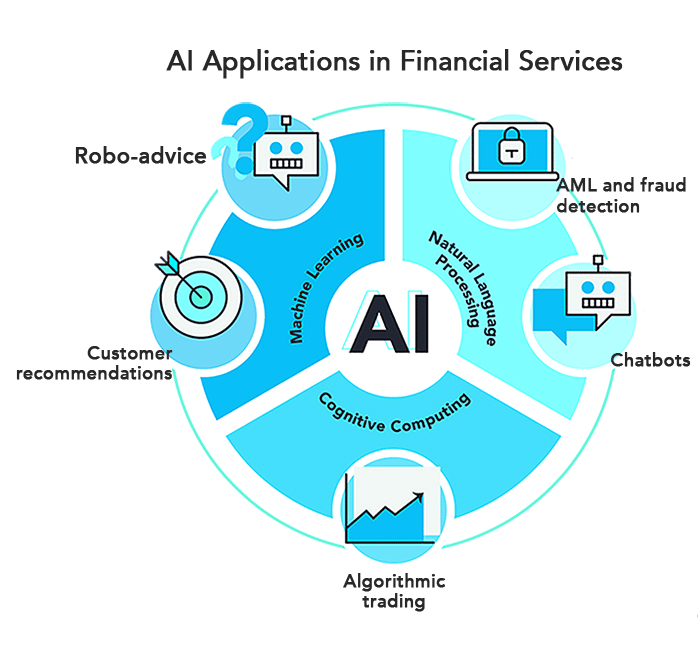

Top 8 Applications Of AI In Fintech

Let’s dive deep in the most interesting use cases to find out why Artificial Intelligence is the paradigm-shift for the industry!

Digital Financial Advisor

You probably heard about chatbots, as they are the most common application of AI in any industry. The heart of a chatbot is a Natural Language Processing technology, which is basically a type of ML responsible for converting human language into information that computers can digest.

If we take it up a notch and add another ML model that will advise certain actions, services, or products based on user’s transaction history we can have a Digital Financial Advisor. These advisors can be used for a variety of scenarios, including calculating benefits and pensions, dividend management, or alerting on possible transaction limits.

Transaction Search & Visualization

Another extension to the functions of chatbots is to give them some responsibility for search functions. Once again a chatbot must leverage NLP to understand what the customer wants and access to the database must be provided. A great example of this is Erica – a bot introduced by the Bank of America to help its clients with the various search requests and account information.

Algorithmic Trading – Machine Learning Fintech prime example

Here is where Machine Learning Fintech technology really shines through. Trading is built on making the right decisions at the right time with an astonishing amount of data. ML can do this way better than any human ever could, but there is a catch. Machine Learning algorithms need to have plenty of historical financial data to train properly. If your company has this information – you can benefit from the technology and uncover hidden patterns in data you had never thought of before.

Churn Prediction

This is required for companies in many industries, as every organization will benefit from the ability to retain customers. This is exactly what AI can help with by providing your employees with information on customers who are expected to leave, for example. Like in the previous case – historical data is required for AI to make the conclusions, but once algorithms have enough informational “fuel”, your managers will receive a brand-new level of insights on this matter.

Underwriting, Pricing & Credit Risk Assessment

Which client you can actually trust? Managers in insurance companies are hired to answer this question, but with AI innovation their work could be much more effective. Not only can AI provide a more detailed assessment but also do it almost instantly which makes the process more convenient to the customer and cost-efficient for the organization. Look up the success story of Manulife, the pioneering company that provides AI underwriting service in Canada for more details on this.

Client Risk Profile

Along with the insurance companies, any other financial organization is interested in knowing how to rate their clients in terms of risks. This can be achieved for every company indeed by having a database of customer’s information and implementing Machine Learning models like Artificial Neural Network (ANN) or XGBoost.

Automated Claims Processes

There is a common procedure for processing insurance claims that contains a lot of routine steps. Why don’t make it easier? With technologies like image recognition and advanced fraud detection ML algorithms are perfect for the job. The whole process could become automated leaving only the most complex cases to human experts.

Automated Contract Analysis

This is another repetitive task that can be easily handled by Machine Learning combined with Natural Language Processing. There are use cases of freeing over 300,000 hours a year by automating contract analysis.

“Banking has to work when and where you need it. The best advice and the best service in financial services happens in real-time and is based on customer behavior, using principles of Big Data, mobility and gamification.” – Brett King

Artificial Intelligence And Machine Learning In Banking

The number of ways to implement Artificial Intelligence in Banking is quite impressive. While we will mention just a couple of most common usages, the possibilities will expand as the technology evolves.

Customer Support

This is one of those areas that require constant improvement and with Machine Learning in Banking it changed the expectation of the client. You just can’t imagine a modern bank without some kind of chatbot running the client service operations. Well, if you can imagine a bank without a chatbot it means that institution is far behind the competitors.

Kasisto is famous for its own conversation AI platform called KAI. This software allows banks to build and design their own virtual assistants for internal operation, far more complex than other solutions available on the market.

Affectiva made a significant improvement on Pepper robot, one of the most well-known robots on the planet. It happened in 2018 when the company used AI technology to make him recognize human emotion. Since that moment, Pepper robots with newly acquired abilities are successfully at HSBC Banks helping customers with all basic banking operations and lifting their spirits with appropriate jokes.

Fraud Protection

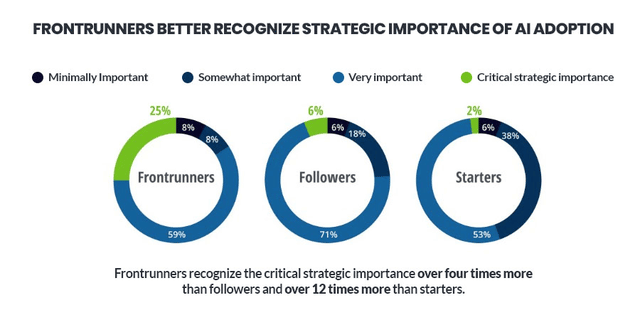

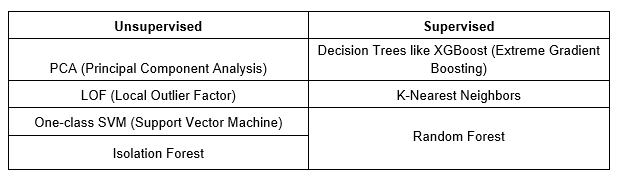

Probably one of the most powerful Artificial Intelligence and Machine Learning in Banking functions you can imagine. AI can check the identity of a customer, uncover plenty of fraud scenarios, including preventing credit card fraud. Fraud Detection with AI and Machine Learning is a very big topic that deserves a separate article. But we can say that everything is built on two fraud identification methods:

Keep in mind that software development companies like SPD Group already have technological solutions for Banking and Finance sectors that might help you save money on figuring out the nuances on AI/ML by yourself.

Lending

According to some researches, Fintech lenders are about 30% more precise in credit underwriting than traditional lenders. AI has the potential to improve the lending process for banks even more with a condition that the algorithms will be trained on the correct information and a certain amount of it.

JP Morgan Chase Case

This bank four years ago leveraged unsupervised Machine Learning algorithms for another interesting function – extracting essential information from their internal documents which in the first year saved nearly 400,000 hours of manual work. Their next target is working with cryptocurrencies, and they will definitely make the best of it!

Conclusion

Artificial Intelligence and Machine Learning are the future for Fintech companies, banks, and financial institutions. According to the survey by Accenture, nearly 90% of executives believe they will fail to achieve the goals of their respective companies without investing in AI, while three-quarters of them think their companies will vanish from existence in the next five years if they ignore AI/ML at all.

There are different opinions, there are challenges for Artificial Intelligence in general, but one thing it’s true – it is important to keep a finger on the pulse of the latest innovation. If you want to make your company the market leader it makes sense to do everything you can to leverage cutting-edge technologies. AI/ML is the technology that is definitely worth your attention in 2020 and beyond.

If you are interested in even more technology-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS