We ascribe a high sentimental value to many of the items we own and use, but we are, of course, all keenly aware of the high monetary value attached to them. However, things can happen to where they can get damaged, lost, or stolen. The question is: is it insured?

Depending on how valuable the items are, they may need their own standalone insurance rather than be covered by a homeowner or rental insurance policy. There are many different types of valuables that can be insured against damages, theft, and everything in between.

So, what items can – and, of course, should – be covered? Let’s take a look at the list.

IMAGE: UNSPLASH

1. Video/Photography Equipment

Whether you are a professional or do it as a hobby, equipment that helps you take professional quality pictures or videos will be worth thousands. Even repairs for damage can cost you quite a lot of money. While some people assume that their existing homeowners or rental policy will be sufficient, it may be the case that you require specific camera equipment insurance in order to cover loss or damage. That’s because your equipment itself could be more valuable than the items normally covered in a standard homeowners or rental policy.

This kind of valuable equipment may be ripe for theft given its overall value, so make sure that the insurance you get for this equipment covers theft as well.

2. Jewelry

You spent a lot of time choosing that engagement ring – not to mention working yourself up to popping the question. Similarly, every necklace and bracelet in your jewelry box tells a unique story – and boasts a high value.

Some jewelry will fall under your existing policy. However, if you spent a pretty penny on them, it may be enough for it to be covered by its own insurance. Most jewelry pieces will value out anywhere between $1500 to $2000+ in order for it to be insured on its own.

Jewelry is one of those priceless valuables that can have a price tag worth thousands of dollars. And it is considered to be one of the most targeted valuables for burglars next to the next item on the list.

3. Electronic Devices (TVs, Computers, Smartphones, Etc.)

Electronics are usually swiped from homes during a burglary. This includes televisions, laptop or desktop computers, and smartphones (including the more recent models). The newer the model, the more money it can be fetched for.

Another thing to be concerned about is Internet safety. Is your identity protected from would-be thieves and cyber criminals?

However, electronics can be covered for things other than theft. Your electronics can short circuit, or be damaged by water, fire, or even accidental roughhousing. If your electronics malfunction, stop working, or break, you can be able to get it replaced so long as the damage was through no fault of your own.

4. Artwork

You probably may not own a Van Gogh or Monet, but artwork holds a certain type of value for someone who loves to display it in their homes. If you own a piece of artwork that is appraised at an extraordinarily high value, you may want to get it insured just in case the unthinkable happens.

Art insurance policies will usually cover different types of fine art including paintings and sculptures. This is what you might need if you are an art collector or need something shipped from somewhere to your home.

5. Appliance Insurance

Typically, your usual home appliances may fall under your home insurance policy if anything gets damaged. But if you only get the most basic coverage, that might not be the case. For that reason, you may want to purchase appliance insurance as a standalone.

This can cover items such as your refrigerators, stoves, ovens, and more. Appliance insurance may be needed to cover for damages including fires, leaks, and other malfunctions.

6. Pet Insurance

Yes, pets are family. And therefore, they are valuable to us. So they will not be covered under such policies like homeowner’s or renter’s insurance. Your dog or cat could get sick or hurt at any given time.

When that happens, you may need to rush to the vet for any emergency procedures. Pet insurance won’t just cover just cats and dogs. Do you have fish or birds?

Yes, they can be covered under pet insurance. This can cover their healthcare costs in the same way we get insured for healthcare ourselves. Pretty cool, huh?

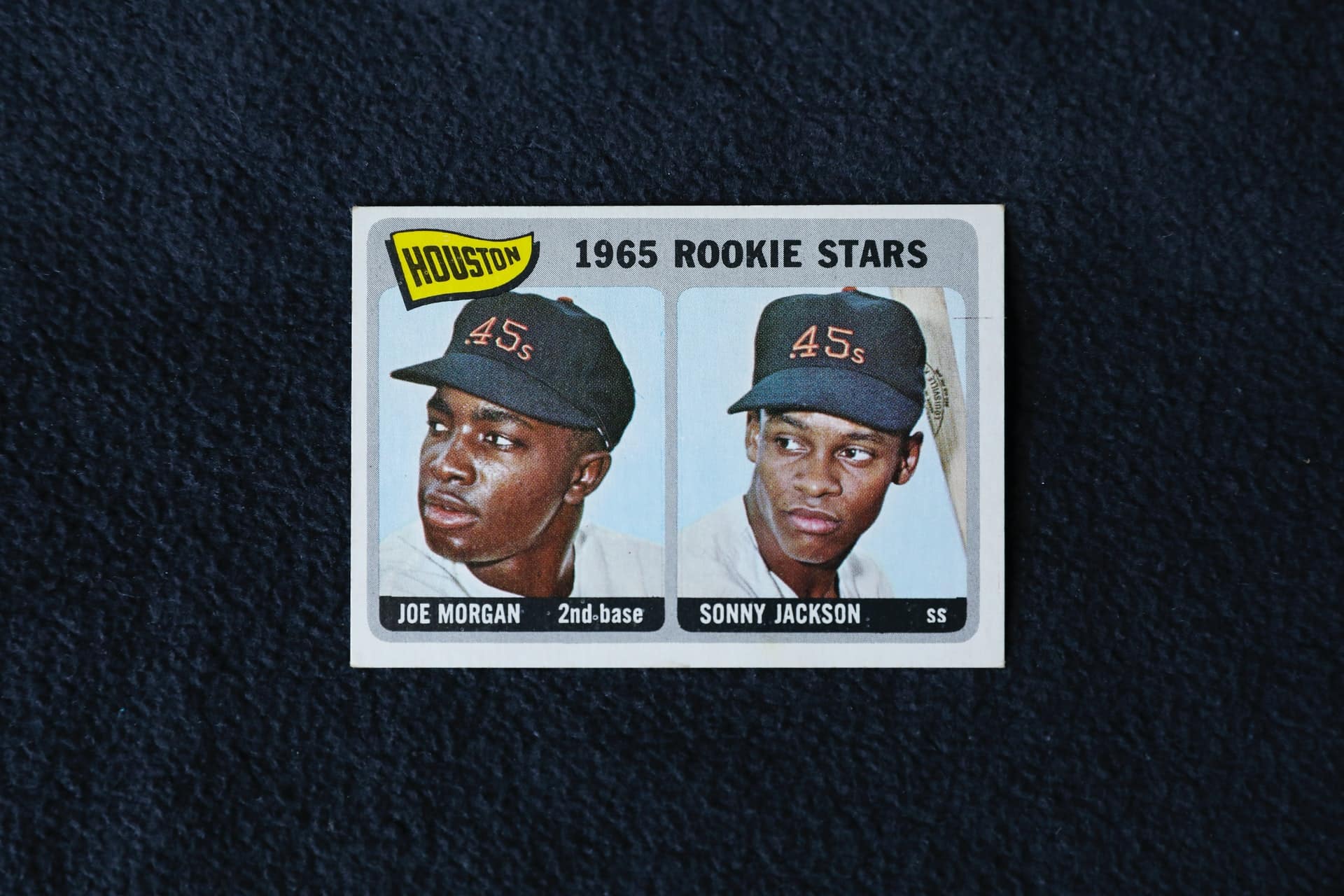

7. Collectibles

Got a Tom Brady trading card that might be worth a lot of money? What about an autographed baseball from your grandpa with Ted Williams signature that’s worth thousands? If you have collectible items that are worth thousands, you are going to need insurance that can cover damage or loss.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS