Americans have a complicated relationship with debt. In fact, the Americans today are drowning in debt. More than 80% of American adults drown in debt. Before the economy declined, the Americans were solely treading water in dangerous seas.

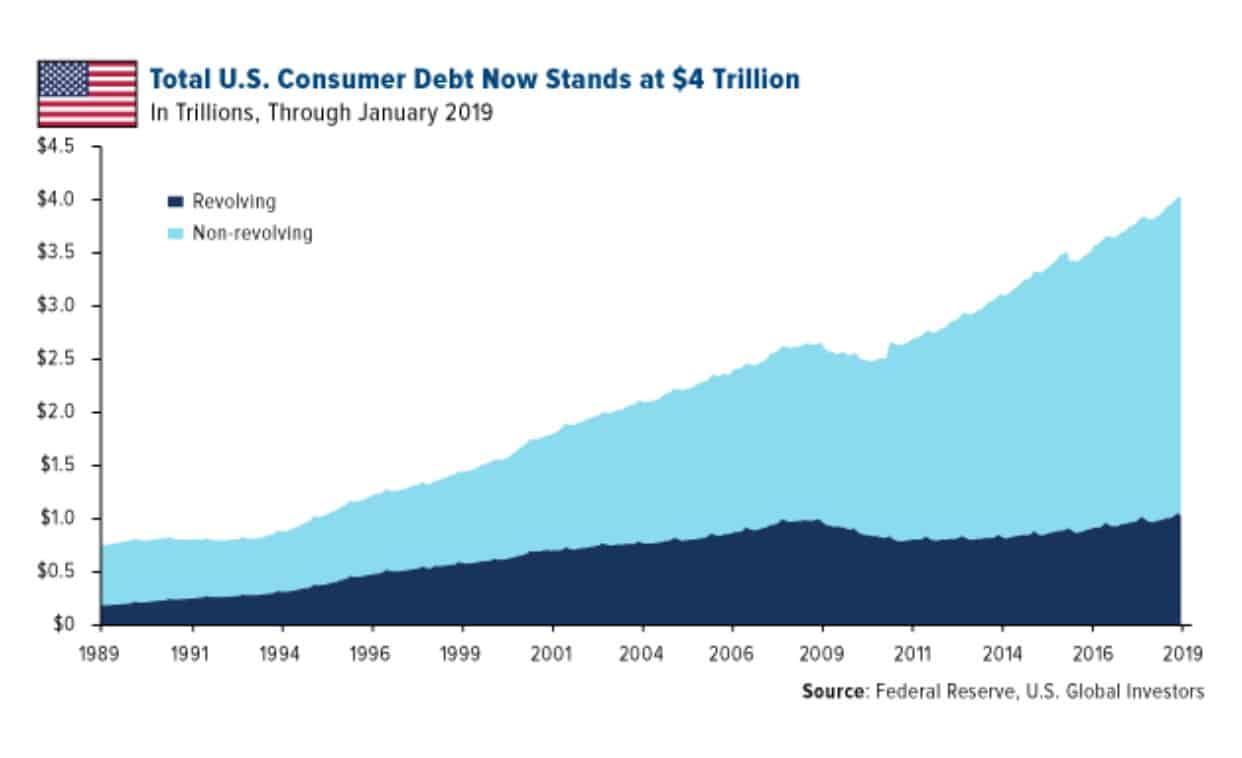

However, once the economy started to decline, many Americans end up jobless and those people having the most debt would sink, forcing them into foreclosure or making them not to pay their debts, which results to the inability to provide the needs of their family and not being able to pay their obligations. The Americans hit $3 trillion in consumer debt for the past five years and yet, the Americans’ consumer debt surpassed $4.052 trillion just recently.

According to Pew Research study, more than half of the Americans would spend their money more than their actual earnings every month. For those people with the most debt, they would find owing money to other people as dangerous and too much to face.

From January to September 2018, the Americans had a growing debt of $3.93 trillion, the $1 trillion of which is from credit cards and the $2.93 trillion of which comes from other sources, such as holiday spending, student loans, and auto loans.

According to Lending Tree, due to strong holiday spending, there is an increase of at least 5% of the Americans’ credit card bills which added more than $41 billion of the outstanding balance during the end of 2018. The increasing amount of student loans, as well as the increasing cost of automobile loans, contributed $80 billion in the outstanding balance.

IMAGE: PEXELS

The $2.995 trillion rose 5%, and it was non-revolving debt. Last March 2019, the student loans totaled $1.598 trillion and the auto loans totaled %1.161 trillion.

There are four reasons why the debt in America is so high:

- Credit Card Debt. Credit card debt, considered a rotating debt because it is meant to be paid off on a monthly basis is only 26.2% of the total debt (after accounting for 38% of the total debt in 2008).

- Auto Loans. For Americans, owning an automobile is a must and a necessity. Auto loans have become another way of getting involved in the credit system.

- Student loan. They keep increasing, rising to a record $ 1.44 billion, up to $ 64 billion from the same juncture in 2017. Student loans now snatch around 70% of people going to college, often at the very beginning of their adult lives. Outstanding student debt has tripled over the past decade and now stands at $ 1.5 billion.

- Medical Bills. America’s medical expenditure accounts for about 20 percent of the nation’s GDP, almost twice as much as other developed nations. The number one cause of bankruptcies in the United States is medical bills and many are looking for bankruptcy lawyers for help.

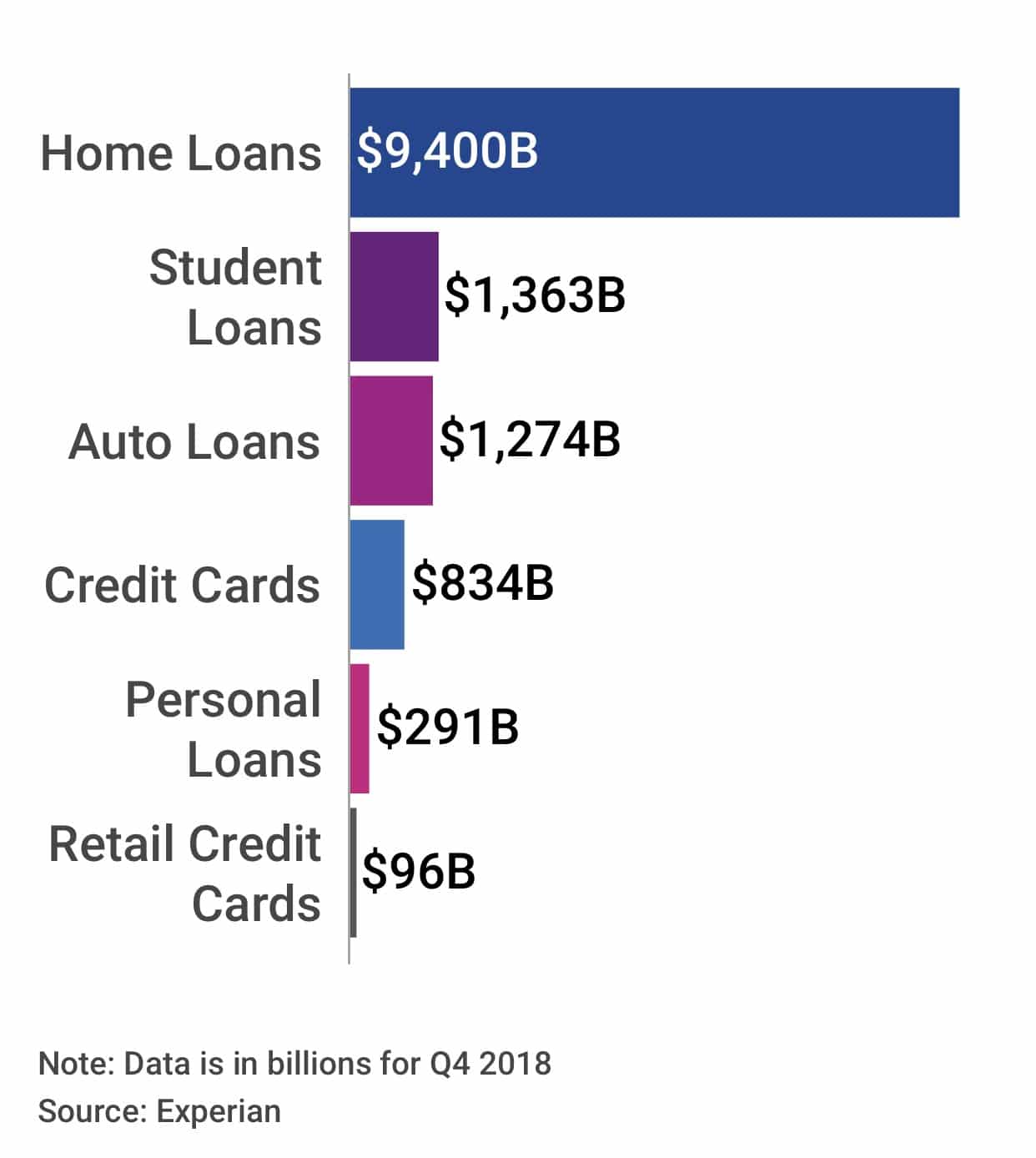

U.S Consumer Debt Balances by Credit Product

IMAGE: FEDERAL RESERVE

However, debt can be catastrophic. If you lose your job and the economy goes into recession, it may cause into nonpayment of your debts. That may ruin your credit rating, as well as your potential to lend money from other people.

Unfortunately, getting out from your debt takes a lot of tears and hard work, and space between acknowledging your debt are uncontrollable. It takes years or even decades to pay your debts, no matter what debts you are actually in.

Continuing to live in debt is easy if you never have to face the reality of your situation. But when catastrophe hits, in a rush you can acquire a brand fresh perspective. No matter what sort of debt you are in — whether it’s credit card debt, student loan debt, auto loan payment, or something else — it’s essential to know that there is always a way out. Knowing the way out is important to achieve a debt-free future to help us rebuild our lives.

These are some techniques that can render debt payouts faster — and much less painful. Some Americans get out of their debts through these tried-and-true methods.

- Paying more than the minimum payments. Whether you’re holding loan card debt, private credits, or college credits, making more than the minimum monthly deposit is one of the finest ways to settle them down earlier.

- Picking up a side hustle. Earning more money can increase your efforts even more. Each one of us has a talent or ability that we can use in order to earn from it and convert it into something with transferrable value.

- Selling the things that are not necessary. Most of us have things that we rarely use and could live without if we really required to. Selling your additional items is a good way to earn resources and use it to pay down your bills.

- Dropping expensive habits. If you’re in debt and are constantly brief every month, it might be the greatest concept to evaluate your practices yet. That way, you can assess whether those acquisitions are worth it — and find methods to minimize them or get disposed of them.

- Stepping away from the temptations. Avoid temptation wherever you are, even if that implies going a separate route back, avoiding the internet, or maintaining the refrigerator stored so you’re not inclined to splurge. And if you need to put those loan cards back for the time being in a sock cabinet, you can always take them out once you are debt-free.

You might consider filing bankruptcy and relief from your debt as an option to help you easily get out of it. If you have serious financial debt problems, might as well consider filing for bankruptcy to help you resolve and pay your debts, but you should also expect that you will lose some of your properties during the process. However, before considering these options ask yourself first whether you are qualified to file for bankruptcy and relief your debt.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS