Financial firms have sometimes experienced a poor public image. Consumers at the individual and corporate level do not always trust financial services firms to take care of their private information and to move their program development into the future at an accelerated pace. The negative aspects of FinTech are exposed when companies endure scandals or hacking attempts.

What is the real evil of finance? How should the government work with the major players in the market? Vladimirs Remi, CEO with many years of experience in the FinTech industry, answers these questions while providing a background on the weaknesses of traditional financial service companies and FinTech firms alike.

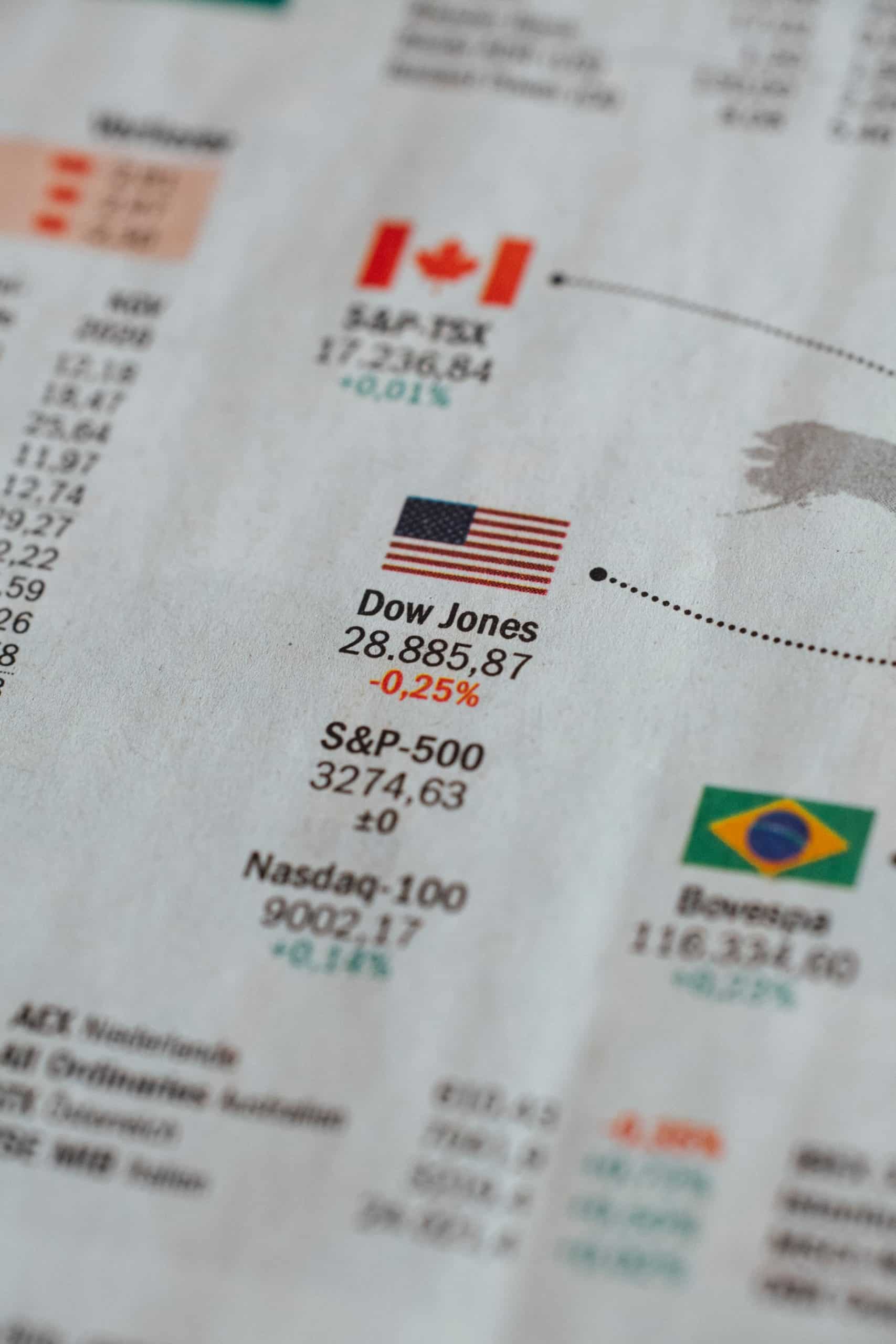

IMAGE: UNSPLASH

Challenges Facing The Financial Industry

Finance is an ever-changing field with many moving parts. Technological developments are making waves in the FinTech world, and some companies have been left behind in this information revolution.

Some of the biggest challenges facing the financial industry boil down to security and trust. When companies do not have adequate security requirements, they open themselves up to lawsuits and government regulatory actions. Sensitive financial information can be lost, and unlucky clients could be cheated out of thousands of dollars.

Consumers at the personal and corporate level need to have a high level of trust in their financial institutions. Inexperienced, unprofessional managers and employees are one of the biggest problems facing the financial industry today.

Regulatory Issues

FinTech companies have largely been able to avoid much regulatory oversight. This changes when they apply to become stand-alone banks or investment firms rather than simply providing their technology to an established financial services company. Becoming a bank or investment firm means that FinTech companies are exposed to the risk of regulation on the state and federal level, and they must comply with the rules of the FDIC, Federal Reserve Bank, and other agencies.

Some people may believe that the real evil of finance lies in regulatory issues, but this is a misconception. The regulations themselves are necessary to create an atmosphere of trust between the company and the customer. If the regulations are not followed, the consumer could lose money and the company could lose its reputation. This is one of the main arguments when it comes to decentralized finance (DeFi).

Digital currency being used to make purchases continue to gain traction as cryptocurrency prices increase across a number of main coins. This is getting the attention of regulators who want to control the currencies as more and more businesses and consumers use them.

Dishonest Players

One of the biggest problems in the financial sector is the dishonest manager. There needs to be a high level of trust in this relationship, and when managers are unprofessional or not trustworthy, the bond between the financial company and the consumer will erode. Dishonesty will lead to an immediate loss of business and the company will be forced to go through many onerous tasks in order to rebuild its reputation.

Outdated Standards

Vladimirs Remi understands that financial companies are often stuck in the past, working toward outdated standards. This situation can result in financial companies moving at a glacial pace, unable to keep up with the changes happening in the industry and in the sectors it serves. These standards show just how far the financial services industry needs to go in order to match its activities to the shifting conditions of today’s business world.

Taking Care Of Customers

Too often, FinTech and financial services companies take their customers for granted. The concept of personal service goes by the wayside, and automated systems replace the human touch. Even when a customer calls a bank on a traditional phone line, they often have to deal with several layers of automated prompts before they can access a human operator. FinTech companies have the opportunity to change this paradigm for the better, offering better tech support to their customers than the traditional banking services can manage.

Raising the bar on customer service means that financial service companies will need to change the way they do business. They will need to discover how to connect with the individual customer on their terms. Live chat programs are a great way to provide human contact at a convenient time and place since many Gen X and Millennial consumers prefer to text rather than talk on the phone.

Government Interactions

The banking industry is closely regulated. People need to know that they can trust banks with their money. However, many of these restrictions hamper true business innovation. Investment firms are well-regulated also. FinTech firms have fewer administrative restrictions on their activities. Ideally, the government will let financial services and FinTech firms manage their own affairs with some level of oversight.

The Real Evil Of Finance

Vladimirs Remi understands how the financial market works. Financial firms can easily lose the trust of their valued customers. The true evils of finance are incompetence, a lack of professionalism, and outdated standards. The fear of violating government standards also holds financial service and FinTech companies back from achieving major growth.

In order to serve all of their customers well, FinTech and financial services companies need to be willing to innovate and to push the envelope. Innovation will set these companies apart from the crowd and bring in a more prosperous and tech-savvy clientele.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS