It’s one thing being a Bitcoin millionaire, but if you can’t spend your crypto on a buy a beer, for example, then you may as well be on Skid Row.

What can you really do with your bitcoin riches?

1. Transfer Your Crypto To A Bank Account

Log in to your crypto wallet and change your crypto into fiat currency at the click of a mouse. Your dollars, euro or sterling appears in your bank account in a few days. Your wallet must be linked to your bank account and sometimes you need to send crypto to a third party (checked and authorized by the wallet site).

Xapo and Wav are two multi-currency wallets that let you transfer crypto to fiat and either hold the fiat in your wallet or transfer it to your bank account.

2. Look For A Visa Debit Card

You can look, but you aren’t going to find one anytime soon. A Visa debit card will be the game-changer. It will let you spend bitcoin at the bar, pizza parlor or online store.

But, it isn’t here yet. You could get a Visa debit card back in 2015, but Visa pulled its authorization without warning in 2017, leaving thousands of bitcoin holders holding a useless piece of plastic. ‘Soon’ is all you will hear when you ask, even though these cards are touted as being available immediately.

Your tax liability using a crypto visa debit card is complex beyond belief. Capital gains are calculated on the date you change your virtual currency for fiat. If you use a bitcoin or similar card for doing the grocery shopping, gas, and other everyday spendings, you will have thousands of tiny capital gains calculations to make when you file your annual tax returns.

3. Find A Bitcoin Retailer

Some main street retailers will accept cryptocurrency.

IMAGE: COINMAP

You can visit Coinmap.org you can zoom in on their map to find stores near you that accept bitcoin. However, most real-world stores don’t, as you can see from the blank space in the American Mid-West and most of Africa.

If you prefer a list, then 99Bitcoins.com has one here.

Online retailers are similarly split. Top line companies including Microsoft, Overstock and Reeds Jewellers take at least some cryptocurrencies. Smaller operations using Shopify have an option to accept bitcoin, but many see accepting bitcoin as a risk too far because of the conversion rate volatility.

4. Buy Gift Cards

Gift cards are the best alternative in the short term. They have the advantages of a debit card, but your tax situation is more manageable because you make a smaller number of transactions that are larger.

Gift cards operate like a branded currency that you can only spend with one retailer, but that retailer could be Amazon or Costa.

Some gift card companies such as Zeex are launching blockchain-based gift cards which are as secure and convenient as a store credit card but with no fees. You exchange your crypto for a gift card at your leisure where you can compare the rate, rather than sending bitcoin wherever you see the ‘Bitcoin welcome’ sign but where you may be hit with 10% service fees and reduced rates.

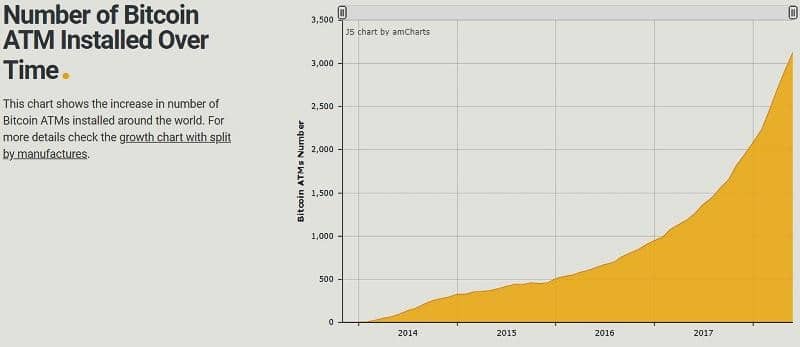

5. Find a Bitcoin ATM

Cryptocurrency ATMs are becoming more common. There are six installed worldwide every day.

IMAGE: COIN ATM RADAR

Some crypto ATMs require you to have a verified account that you have previously set up, this way nobody can accuse you of money-laundering or hiding money from the IRS. Most cryptocurrency ATMs will let you buy Bitcoin, Ethereum, and other virtual currencies; fewer will let you sell crypto for fiat currency.

Check for transaction fees as high as 10% before you press ‘Accept’ on the ATM screen.

Can You Avoid Tax?

There is no way to withdraw your crypto without paying tax on your gains. You will always leave a trail, so get used to the idea of forking out the tax. Consult an accountant who is familiar with local cryptocurrency regulations and find out what your tax liability is. It’s not going to go away if you ignore it, and you can go to prison for tax evasion.

Long Story Short

Cryptocurrency is harder to spend than cash. That situation is likely to continue because of the antipathy generated by the attitude central banks have towards crypto, where they speak of anyone holding it as on a par with drug dealers and terrorists.

New developments such as crypto ATMs and gift cards will start to move bitcoin in particular into mainstream acceptance.

When you consider how many shoppers still love their checks, it’s going to be a while before cryptocurrency is accepted by everybody everywhere.

If you are interested in even more cryptocurrency-related articles and information from us here at Bit Rebels then we have a lot to choose from.

COMMENTS