The financial climate around the world is changing by the day and people find themselves out of a job and sometimes even out on the street. It’s a situation that is not only causing a lot of stress, but also a lot of lost opportunities. It’s hard to fend off a financial disaster in your life when the rug is tugged from underneath you seemingly from out of nowhere. I was once told that it’s during the financially stable moments in our life that determines your financial fitness when the unexpected hits. If the opportunity presents itself it’s important to understand the excess, however little it may be, is the exit out of any future financial hardships.

There are however a lot of small changes you can make in your life to make sure that your financial fitness is at the peak when you see tougher times approaching. These are things that doesn’t really affect the way you are living, or at least in a very mild way.

In this article, we are going to have a look at ten different tips that might help secure a less stressful time when you’re fighting the unexpected. These tips are easy to incorporate into your life but could have a significant impact when it comes to financial fitness. To recognize the problem ahead of time is, of course, preferable, however, most of the times when financial hardship hit us they are just that, unexpected. Let’s go through them one by one…

1. Work Out Your Wallet

Make your spending work for you by setting spending limits for different areas. A couple of healthy lifestyle changes can not only help the bank balance, but your body too – try swopping the car for a bicycle, or making a lunch at home.

2. Target The Flab With Goals

Set small achievable goals to get you going, you’ll soon turn a saunter into a sprint by making little spending changes that make a big difference thus increasing your financial fitness overall.

3. Cut Back And Take Control

Don’t feel helpless if you don’t earn a huge amount, the journey to wealth takes many shapes and taking control is the first step. Try not to run before you can walk, start cutting back things you won’t miss first, every little bit helps.

4. Target Problem Areas

Just like poor food choices can head straight to the belly, bad spending choices can fatten credit card debt and be hard to shift. Realizing where spending needs reeling in is the first step towards avoiding temptation, a healthy financial fitness and trimming down the spending.

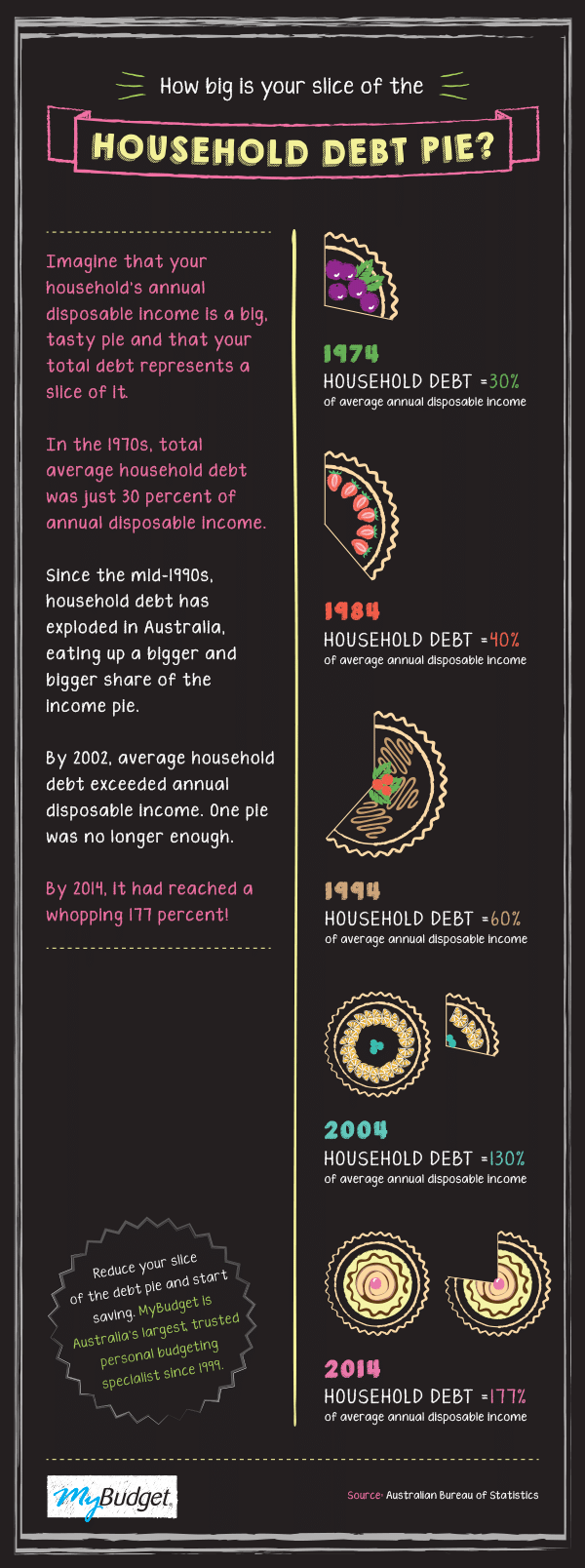

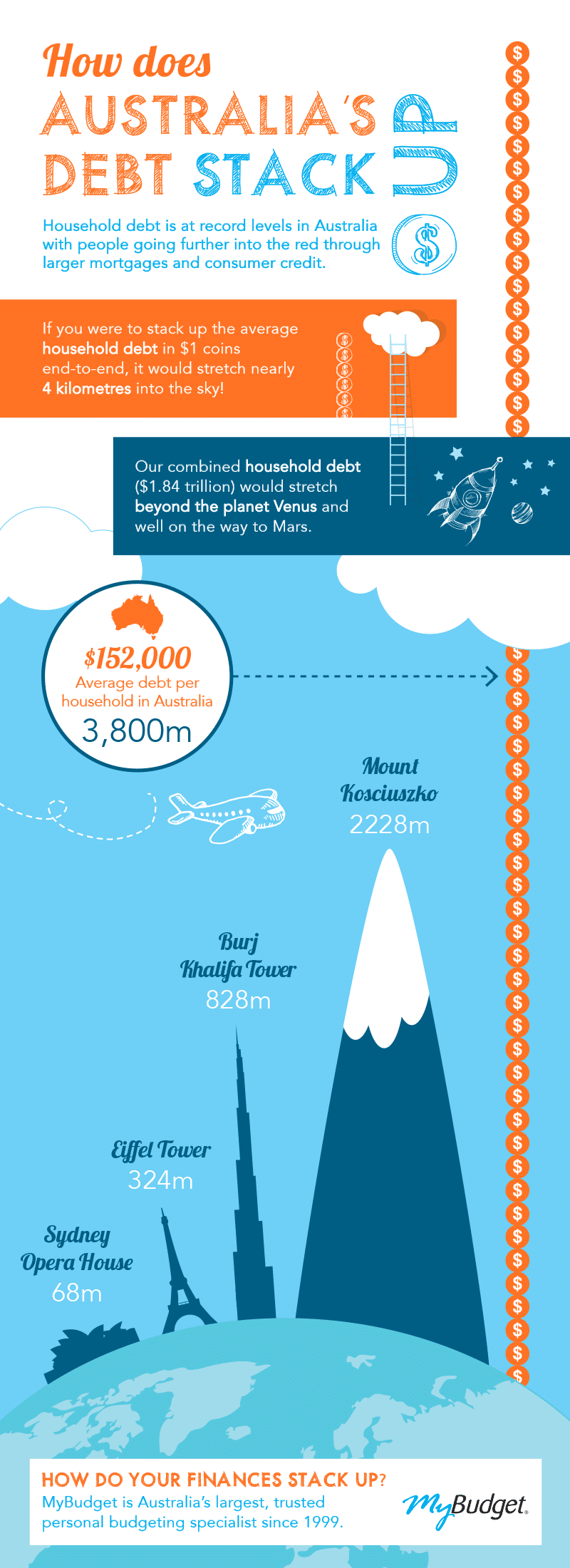

5. Debt Health Check

Not all debt is the same. Just like fructose versus sucrose, and complex carbs versus their simple cousins, there are types of debt that increase your credit rating and those that you want to cut out of your debt diet as soon as possible.

6. Slim Down The Plastic

Too much plastic exposure can be a recipe for out of control spending. Take the cash challenge and banish the credit cards from your wallet for 30 days, you’ll soon know where your money is going.

7. Stick To The Regime

Just like the gym, counting cents isn’t the most fun activity for most of us. Getting into a routine is key here as soon as spending less becomes part of the everyday – and the results are always worth it.

8. Invest In The Right Gear

Just like the perfect pair of runners, so your feet don’t falter round the track, invest in a robust wallet to carry the cash after ditching the cards. Also, choose accounts wisely, if you’re always dipping into any savings you make, try a limited access account for savings and a transaction account for the everyday. This will surely increase your financial fitness.

9. Build A Bad-Luck Contingency

Emergencies happen, so saving a rainy day fund just makes sense. Aim for two months salary to cover surprises expenses in a hurry and avoid borrowing.

10. Team Up

Everything is easy with a buddy or two, so don’t take on the saving marathon alone – share the wins and the woes.

As you can see, there are quite a lot of things you can do to secure a financial fitness that will stand up to even the most unexpected situations. If you recognize the holes in your financial master plan early, you are better equipped to take on whatever comes your way in the future. Little goes a long way, especially if it’s done continuously and dedicatedly. To those stuck in the starting blocks, you can find more advice on the internet on how to save money and start your journey to financial fitness today.

COMMENTS