SaaS customer lifetime value – it has nothing to do with being sassy and everything to do with being savvy. You can be both at once, though. Why not?

What Is SaaS?

First of all, you may be wondering what SaaS is. In short, it stands for Software-as-a-Service. What this means, in practice, is that software applications are delivered remotely over the internet instead of on-premises. SaaS is web-based, on-demand, and hosted.

Instead of being a product you download once, software becomes a service that is offered by a company. Instead of the IT person installing software on your computers and regularly getting called in to fix, maintain, and update the software (plus all the hassle with licensing), with SaaS, applications are stored on the providers’ servers.

This has the benefit of freeing up space on your devices, ending the need for licenses, and doing away with the individual device-updating rituals of yesteryear.

IMAGE: UNSPLASH

What Is Customer Lifetime Value?

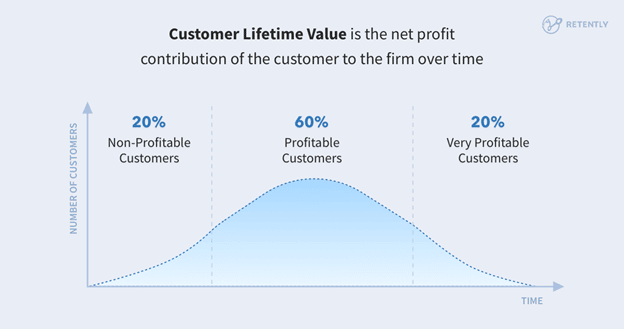

So now that we’ve covered SaaS, let’s delve into the concept of customer lifetime value. It’s basically the entire monetary value of a customer to a business throughout the entire lifetime of their customer-business relationship.

The longer the customer remains in the relationship (keeps making purchases), the greater the customer lifetime value. If someone makes a one-off purchase, then their CLV will be relatively low compared to someone who makes repeat purchases.

IMAGE: RETENTLY

What Is SaaS Customer Lifetime Value?

What SaaS customer lifetime value is, simply put, is the total value of a SaaS customer. It’s the same thing as an ordinary customer lifetime value calculation but applied to a customer of Software-as-a-Service.

Why Should We Care About This?

So why does any of this matter? Well, there are many benefits to calculating your CLV, including:

- It helps you measure whether your business is viable. A high CLV shows that your product works in today’s market and that your customers are exhibiting loyalty to your brand, which offers a clear indication of how well your product is faring.

- It helps plan for the future. Customer lifetime value is very useful for monitoring the growth and success of your business and for projecting future growth patterns.

- It gives you some insight into your ROI (return on investment). The amount you spend on your customer acquisition activities and running of the business should not exceed your CVL. While it might be more than the value of your customer’s initial spend, that customer could become a repeat customer.Figuring out your CLV allows you to see what your ROI is. So the cost of running an Amazon fulfillment center, for example, could be compared to the CLV.

- It can inform your marketing endeavors. Figuring out how your clients behave, such as whether they come back for more or just make a quick one-off purchase, can help you figure out your marketing strategies. You can gear your efforts toward retaining your most loyal (and valuable) customers and make decisions about budgets for attracting new ones.Perhaps your customers are more likely to be one-hit-wonders. Maybe they’re in it for the long haul. This is useful information for figuring out which reward systems work best for your customers.

How Does One Go About Calculating This?

The calculation is fairly simple and straightforward:

|

Customer lifetime value = Monthly recurring revenue per customer X number of months average customer subscribes |

You also need to calculate your monthly recurring revenue per customer like this:

| Monthly recurring revenue per customer

= Total recurring revenue in a month / Number of customers in that same month |

This is a pretty simple calculation you can make, but it doesn’t take into account other factors like account upgrades, downgrades, or unsubscribing and then resubscribing. You can create multiple different customer profiles or categories and calculate the CLV for these for a more accurate picture.

Historical vs. Predictive Customer Lifetime Value

With historical CLV, we look at past purchasing data to calculate the value of a customer, focusing on the average order value. It’s useful when your customers only subscribe to your service for a limited period of time, but it doesn’t account for variance in customer journeys (like unsubscribing and resubscribing or upgrading and downgrading), which can lead to not-so-useful results.

The predictive CLV model uses predictive modeling to forecast the spending of new and existing customers. It’s possibly better suited to companies that have more resources because it’s more complicated, but it’s a useful way to identify who your most valuable customers are. It’s also a good way to see which of your products are the hottest on the market right now.

What About Return On Investment?

You might be thinking, “Well, great, now I know roughly what the average customer is worth to my business in terms of CLV, but how does that compare to how much money I’m spending on that customer?” (or something like that).

You need to figure out how much you’re spending on marketing, infrastructure, employee salaries, etc., to see how much you’re making per customer in comparison to how much you’re spending to GET and KEEP that customer. Figuring this out will shed light on whether your business is working or not.

So what you want to do is find the ratio of your CLV to CAC (customer acquisition cost) and see if it tracks with the industry standard. In SaaS, this should be greater than 3:1. These are two of the key SaaS metrics to be aware of.

How Can I Improve My CLV?

You might be wondering how to improve your CLV or your CLV to CAC ratio. If you find that the ratio is off and that your business just isn’t sustainable (your profit margins are too low, you’re spending more than you’re bringing in), then there are a bunch of things you can do.

We will look at how we could potentially reduce the CAC and increase the effectiveness of the customer acquisition tactics. If we can improve the customers’ experience, this could reduce churn, increase acquisition rates, and increase your CLV.

Review Your Marketing Strategy

What has been working for your company, and what hasn’t? Are you spending a ton of money on ads only to get one-off customers who never return for more? Do you have a marketing plan, a strategy, and a fixed budget based on proven methods and strategies?

Creating a solid marketing plan that doesn’t go above your budget is a good place to start and will help you to spend better in your business.

Ask For Feedback

Sometimes, you just don’t know why people are leaving. If your company is young, you might not have a ton of reviews and customer interactions to better understand what’s causing churn. Asking your customers for direct feedback at various stages of their customer relationship with you can help you get a clearer picture of what’s happening.

Companies usually ask for feedback when a customer leaves, but you can ask for feedback about the different parts of your service, such as onboarding, customer service, marketing, and sales teams before customers get to the stage where they want to leave,.

Review Your Customer Onboarding Experience

You’ve got the customers, but how does their experience fare now that they’re on board? Do they have everything they need? Is the software intuitive and user-friendly? Will they give positive reviews for your company for others to see, or will they dissuade others from trying out your service?

You want to get the onboarding experience right because this first taste can either send people packing or encourage people to stay with your company. You want the experience to be fast, easy, and simple. Personalize your onboarding system by using the information you have on each customer. Include easy-to-follow video tutorials, FAQs, and tours.

Review Your Customer Service

Are you able to provide consistent, fast, and useful support to your customers? Is there any way of improving the quality of the customer service with, for example, omnichannel customer services? Is there an option to decrease the cost of customer service with automation?

You can include a vast number of communication channels for your customers, including social media, chatbots, email, phone, apps, and live chat, all at a minimal cost to your company.

Some Final Thoughts

There are many SaaS metrics out there to help you figure out how your business is going, and customer lifetime value is just one, albeit very useful, metric for this purpose. If you’re part of a big organization, you might have the resources and time to pull in different information and details for your calculations, but if you’re a small startup, then it’s okay to keep things simple.

CLV not only shows you how viable your business is but also helps you pinpoint the methods which are working and the methods that need to be improved.

IMAGE: UNSPLASH

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS