There are several things that might get a crypto investor into trouble, one of which is the tendency to see crypto as nothing more than a mere quick and large cash grab. If a certain currency did extremely well in a certain year, it does not indicate that the trend will continue in the following year.

It is important to understand that you cannot expect your investment to start bearing fruit in a matter of a few hours. In fact, it is possible that you might not generate a return before several years have passed. It is also possible that you might not enjoy a return, ever. Hence, you need to be clear about your crypto-trading expectations.

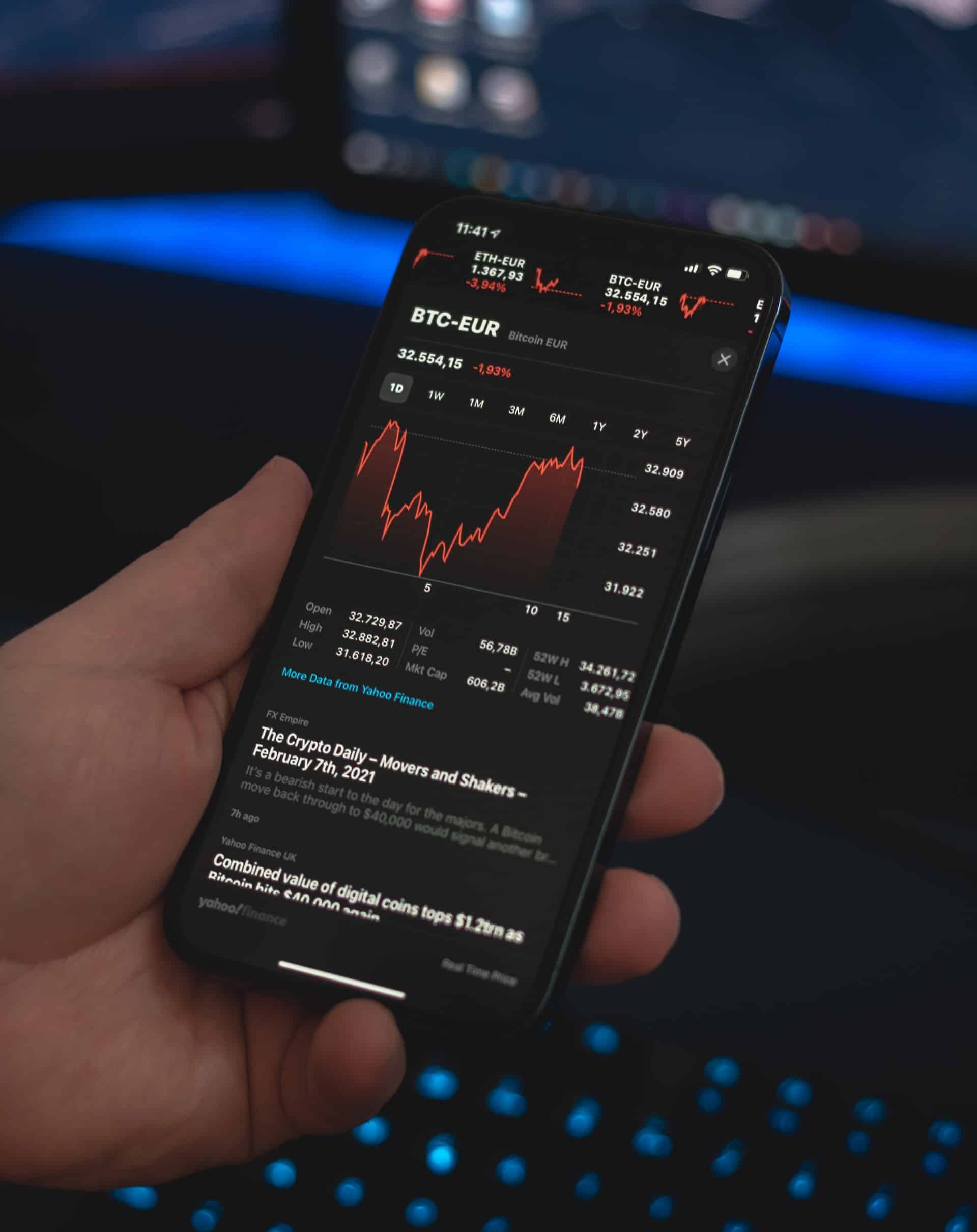

IMAGE: UNSPLASH

Defining Realistic Crypto-Trading Goals

1. Can You Expect To Become A Millionaire?

The primary reason that crypto investors commit small portions of their overall portfolio to the digital currency is so that they have the potential for considerable upside if crypto –specifically their chosen crypto – goes on and becomes a viable currency in the future. In other words, there is the possibility of making a 5000 percent return. On the flipside, you might also end up losing 70 percent or more of your investment.

You should use this scale to determine potential outcomes. You must understand that, if the scale is tipped towards the negative scenario you want to invest since you expect it to tip towards the other, positive side in the future. However, you must never pin all your hopes on such an outcome.

2. Are You In It For The Long Run?

It is impossible to determine exactly when the scales will tip for the better. For this reason, you must prepare a solid plan, and make sure to stick to it – even when market hiccups tempt you otherwise. If you think that your reason behind investing is your confidence in the technology and concept, then you need to keep in mind that it is years – and not days or weeks – in the making.

So, if you step in the game, do it with a long-term timeframe. This means that you should avoid looking for a quick market exit until and unless the price of your chosen currency rises beyond a point that you never expected it to. Having said that, wanting a quick exit is still okay as long as you remember that this approach is like making a bet on a specific number on the roulette wheel. It is excellent if the wheel stops at your number, but there is no method or rationale behind it.

3. Understand Your Goals, And The Risks Involved

Rather than playing roulette, you should focus more on what you want out of your investment. Ideally, your crypto investments should be a tool for the best-case scenario. If you approach it in this fashion, the results of your investment decisions might prove thrilling, a few years down the road. However, if you are merely in the quest to look for concealed gold, you might find yourself on a long, exhausting, and likely unsuccessful, search.

Final Word

To sum up, before you take the all-important step, you must answer some essential questions about the reasons and objectives behind your investment decision, as well as your financial situation. This will solidify your reasons for the venture and help you learn the extent to which you will be able to handle and endure the overall volatility of this experience. If you are looking for assistance in understanding your crypto-trading objectives or if you feel that you are ready to move forward with investing, please feel free to visit https://cryptogroupsoftware.com/.

IMAGE: UNSPLASH

If you are interested in even more geek-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS