An old friend reached out to me in the wake of the AP Twitter hack that coldcocked the Dow Jones Industrial Average, precipitating a temporary panic throughout the financial markets. “Has social media as a corporate strategy now become a liability?” he asked. “Is this the beginning of the end of Corporate America’s love affair with Twitter?” he wondered. Hmm. Deep thoughts. My friend and I were early adopters, social media hippies, back in the nascent dawn of Twitter.

We called ourselves the Canary Club as we huddled offsite from our own Twitter-resistant corporate headquarters to discuss the potential of the fledgling social media network. Fast-forward five years. Jeep’s Twitter account was hacked. Burger King was next. The Twittersphere laughed off these Twitter hacks as practical jokes, not as corporate espionage, much less cyber-terrorism. These were harmless hoaxes – like the parody account for JLo’s left nipple.

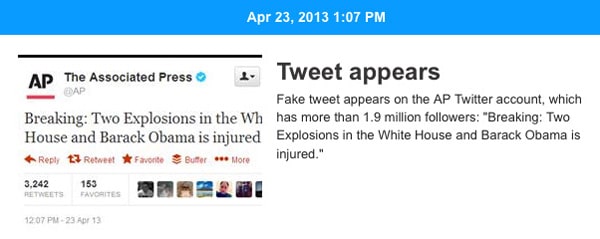

Then, in the aftermath of the Boston Marathon Massacre, a week to the day after two terrorists set off pressure-cooker bombs killing three innocent people and injuring 260 more, AP’s official Twitter account was hijacked. On April 22, the Twitter hackers posted a fake report on Twitter about a bombing at the White House. A group calling itself the Syrian Electronic Army claimed responsibility.

Compounding the seriousness of this breach is the recent ruling by the Securities and Exchange Commission allowing businesses to disclose important financial information through Twitter and Facebook, in effect, legitimizing the social nets as officially sanctioned news sources.

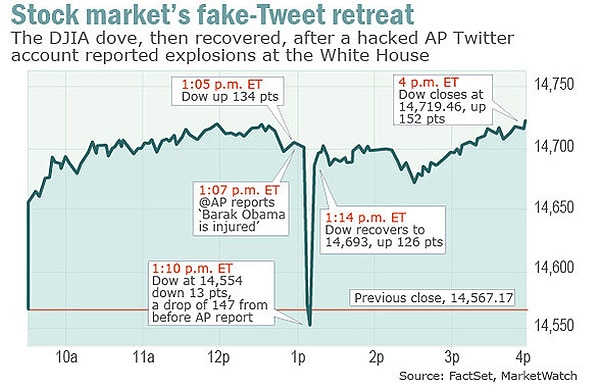

The much-maligned Efficient Market Hypothesis states that there is equal information available to investors so stocks are always fairly valued, making it impossible to beat the market. This never made sense to me in B-School. With this newest Twitter hack, social media just disproved the theory yet again. Timely information is invaluable financial currency. Social media has brought information dissemination to warp speed.

The first investors to act on breaking news have a distinct advantage. The risk is that the data is flawed or even fabricated. But savvy investors have always known that risk and reward go hand in hand. Social media just raises the risk. Welcome to the Wild, Wild West of Wall Street, where it’s every tweeter for himself.

Word has it that Twitter is now working on a double-top-secret two-factor authentication process in an effort to stop Twitter hackers. That’s good news, ’cause hackers gonna hack. Enhanced security to verify trusted digital news sources is critical. However, the inherent inefficiency of Twitter’s uneven news coverage is an opportunity. Businesses can do the right thing for all stakeholders – customers, employees and investors alike – via timely transparent communications.

Cautious CEOs may be patting themselves on the backs for dodging the Twitter bullet and just saying no to social media. Since no is not really an option, let’s look at ways to communicate constructively, verify sources and make informed decisions. Cheers to the Canary Club. #TweetTweet

Twitter Hacks Make Twitter The Wild Wild West Of Wall Street

Via: [USA Today] [CNN Money] [V3] [Social Fresh]

COMMENTS