The cryptocurrency market is volatile and risky. With that in mind, it’s important to do your research before investing in any cryptocurrency.

There are thousands of cryptocurrencies on the market, which are different. Some are designed as payment systems that allow people to buy things with them. Others are designed as stores of value that people can invest in for the long term.

Here are some of the most common ways to invest in cryptocurrency:

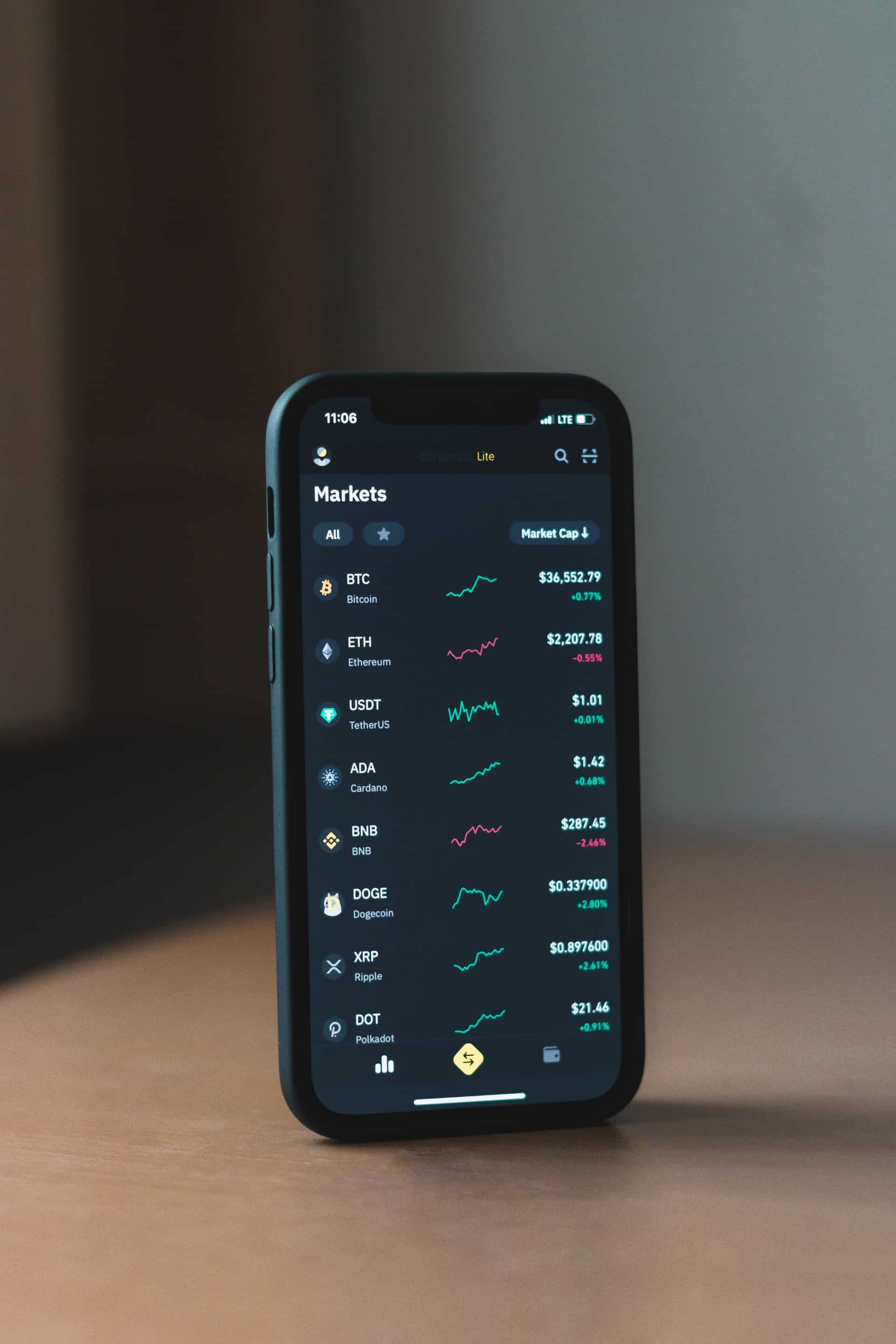

IMAGE: UNSPLASH

Long-Term Buy & Hold

The most popular method of cryptocurrency trading is the long-term buy and hold. This is when you invest in a coin and hold it for a long time. Also, wait for it to appreciate in value. You can also do this with stocks or any other asset class.

The idea behind this strategy is that you’re waiting for the market to take off. Afterward, sell your holdings later when they are worth much more. If you’re lucky enough to catch the next Bitcoin bull run, you’ll be able to make some serious money with this method.

However, there’s some risk involved if you don’t know what you’re doing. You could end up holding onto one coin for years. This is only to realize its value had dropped significantly compared to how much it was worth when you started buying it.

ICO Investing

ICOs are a great way to make money in the cryptocurrency market. These are fundraising events where a company will issue its digital currency in exchange for other cryptocurrencies like Bitcoin or Ethereum. If you buy into an ICO early on, the chances are that you’re going to see some great gains over time.

However, there are also risks that come with ICOs as well. Some companies fail to deliver on their promises. Others never even make it off the ground before shutting down and taking investor funds with them.

So while ICO investing can be lucrative, you must do plenty of research before putting any money into one of these projects so that you don’t lose all your capital on a failed business model.

Active Short-Term Speculation

Day trading is a style of trading where you buy and sell cryptocurrencies within the same day. This is different from long-term investing, which involves buying and holding coins for months or years.

Active traders trade on multiple exchanges at once and usually focus on short-term price movements instead of long-term trends. They believe that if you buy low and sell high enough times per month, you can make money consistently over time. Even though individual trades may not be profitable.

Day traders typically place trades for less than 24 hours before closing them out. Hence, the term “day” trader. However, some may hold positions for longer, depending on their strategy and risk tolerance level.

Swing Trade For Medium-Term Gains

Swing trading is one of the most popular forms of trading in the crypto markets. It involves buying and holding an asset for some time. Afterward, sell it when you believe its value has increased beyond your buy-in price.

Swing traders typically use longer time frames to make their trades. Thus, it means they will hold onto their assets for several days or weeks before selling them back at a profit.

Finding good swing trading opportunities in the crypto markets cannot be easy. This is because so few coins offer sufficient liquidity. However, if you find a coin with enough volume to allow for swings in value, you may be able to make some good money trading it this way without worrying too much about market movements or trends. As long as they aren’t too drastic.

Short-Sell Negative Markets

Short-selling is a trading strategy involving selling an asset you do not own with the expectation of buying it back at a lower price. When you short-sell, you borrow money from your broker to buy something and immediately sell it on the market. If the price falls below your purchase price, you can buy back the stock at a lower price and return it to your broker.

Short-selling has been around since the 16th century and was known as “putting up collateral against loans.” It was also called “going short” or “margin trading.”

How to Short Bitcoin? To short bitcoin, you must first open an account with an exchange that offers leverage trading. You will need to deposit funds into this account before placing a trade for bitcoin.

Next, place a limit sell order for bitcoin at a price below its current price. Your limit order will execute when the price drops to or below this level. Your profit will equal what you paid for bitcoin minus what you earned by selling it at a higher price than originally paid.

Margin Trade

Margin trading is one way to trade the markets and increase your gains. Margin trading allows you to borrow money from a broker to trade with more capital than what you have in your account balance.

The broker will charge interest on the amount you borrow and allow you to leverage up your trades by using this borrowed money as collateral against your assets. You’re borrowing against yourself since the broker has no ownership of your assets or account balance.

The downside of margin trading is that if the price of an asset falls below its original price plus interest owed on borrowed funds, then your account will be liquidated by the broker at whatever price they choose.

As long as you aren’t leveraged too high (which can be very dangerous), then trading on margin can benefit those who want to ride out huge price swings without putting down a lot of their capital upfront.

EFT Passive Investing

ETF passive investing is a way of investing in crypto by buying shares in an ETF (exchange-traded fund). An ETF is a company that buys shares in companies and then sells them to investors.

An ETF passive investor buys shares directly from the ETF company rather than dealing directly with individual companies.

Here are some advantages of ETF passive investing:

- Leverage: You can invest more than you have by using leverage. This allows you to gain more exposure without having to buy more coins.

- Lower Cost: It costs money to trade on exchanges, while ETFs are usually free of charge or much less expensive than trading on exchanges.

- Passive Investing: ETFs allow you to invest passively, meaning you don’t have to spend time trading cryptocurrencies manually daily.

IMAGE: UNSPLASH

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS