Senior precious metals analyst at Goldsilver.com, Jeff Clark stated in an interview with Kitco News, “There are so many reasons to own gold. I mean, there are more catalysts for gold right now, than there are hairs on my head,” he said. “If you were the God of gold and you designed an environment that was conducive for gold, you couldn’t dream up any more of a perfect environment than what we have right now.”

IMAGE: PEXELS

Daily Time Frame

On the daily time frame of MT4 platform, we get to see three different moving averages. Firstly, there is a 50-day simple moving average followed by a 100-day simple moving average and then finally the 200-day simple moving average. Clearly, the price of gold did not respect the particular area of respect and we got to see a small bounce.

The price is now coming very close to its next area of support. Here the chances are again that the prices will bounce. Here a possible consolidation could occur, but if the prices start to consolidate then it will not be that positive.

When more consolidation starts to happen that means the prices are more likely to break to the downside. The thing to remember is that if we look into this particular action then we could see that the next area of support is really going to be just below the area of support.

Gold Prices After September 2001

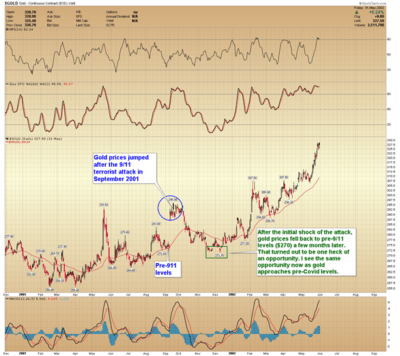

After the underlying stun of the 911 assault, gold costs fell back to pre-9/11 levels ($270) a couple of months after the fact. That ended up being one hell of a chance. We consider that to be arrangement now as gold methodologies pre-Covid levels.

Gold Now

We accept we could be near a base in gold. Costs could spike lower throughout the next few days if the financial exchange auctions, yet we believe that would be brief. In the event that we think back a long time from now, we accept we will consider the present costs an astounding long haul opportunity.

In synopsis, Covid-19 was a critical defining moment across the globe. There is significantly more cash available for use however a similar measure of gold. Actually like there was a short chance to purchase gold at pre-911 costs a couple of months after the occasion, financial backers are accepting a comparable possibility in gold at this point. It is high time to invest in gold.

Why Put Resources Into Gold?

Financial backers and investors decide to add gold to their portfolio for a few reasons, these can include:

- Abundance conservation: Gold and has been trusted by numerous financial backers for its abundance of safeguarding characteristics. Consider the examination between claiming £50 worth of gold in 1980 and possessing a £50 note. Gold has since gone up in esteem, so the estimation of the gold far continues the first £50 speculation. Be that as it may, the £50 note has not expanded in esteem and because of expansion, can’t accepting however much it could have in 1980.

- Hedge: Gold costs regularly appreciate close by increasing swellings rates and a devaluing dollar. Thus, financial backers may hope to purchase gold as a supporting resource when they understand they are losing cash. This follows the overall rationale that gold frequently keeps up its worth or even values when the estimation of the dollar falls.

- Safe refuge: In contrast to monetary standards, gold isn’t straightforwardly affected by loan fee choices and can’t be printed to control its organic market. Gold is a scant resource that has kept up its incentive over the long run and has demonstrated its value to go about as a protection strategy during unfriendly monetary occasions. Along these lines, gold is viewed as a place of refuge by numerous financial backers.

- Portfolio broadening: A reasonable portfolio will regularly incorporate enhancement resources like gold as they are ordinarily contrarily corresponded to the financial exchange. Having a different speculation portfolio assists with lessening danger and unpredictability for financial backers.

- Gold stock freedoms: The estimations of gold stocks are typically incompletely reflected by the value developments of the valuable metal, gold. Notwithstanding, gold stocks can keep up their productivity in any event, when the cost of gold is low. Furthermore, numerous gold mining organizations deliver solid profits, which can help give further motivating force to financial backers to purchase gold stocks rather than gold.

Gold As An Investment

Prior to getting on board with the gold fad, let us previously put down the energy around gold and at the start analyze a few reasons why putting resources into gold has some central issues. The primary issue with gold is that, not normal for different wares like oil or wheat, it doesn’t get spent or devoured. Whenever gold is mined, it stays on the planet.

A barrel of oil, then again, is transformed into gas and different items that are exhausted in your vehicle’s fuel tank or a plane’s stream motors. Grains are devoured in the food we and our creatures eat. Gold, then again, is transformed into gems, utilized in craftsmanship, put away in ingots secured away vaults, and put to an assortment of different employments.

Despite gold’s last objective, its substance structure is with the end goal that the valuable metal can’t be spent – it is perpetual. Along these lines, the stock/request contention that can be made for items like oil and grains, and so on, doesn’t hold so well for gold. At the end of the day, the inventory will just go up over the long run, regardless of whether interest for the metal evaporates.

What Does It Have To Offer In Future?

You can’t disregard the impact of human brain science with regards to putting resources into gold. The valuable metal has consistently been go-to speculation during seasons of dread and vulnerability, which will in general go connected at the hip with monetary downturns and despondencies.

Low-loan fees and monetary vulnerability following the Covid market decline made gold enter a positively trending market, transcending £36 a gram to over £45 a year ago. On the off chance that monetary vulnerability proceeds, probably pushed by the debilitating in financial development following the pandemic, we could see gold hit new highs in 2021.

If you are interested in even more business-related articles and information from us here at Bit Rebels, then we have a lot to choose from.

COMMENTS