With the rumor going around that CNN is about to buy Mashable, a lot of people are of course debating whether the value of this social media news site is accurate. $200 million could seem like a lot of money for a website, but we have seen this before. Huffington Post and TechCrunch were also sold for amounts that seemed astronomical. The common misconception is that you might think it is just a website, but there is a lot more that goes into it. To simplify it, it is the ability to reach millions of readers each and every day, and that means increased revenue for whatever you intend for the site. It doesn’t stop there, there are domain name evaluations, media evaluations and of course social media evaluations that go into the price tag.

There is endless dedication and effort that goes into launching, running and keeping a news site up-to-date, and we here at Bit Rebels can definitely vouch for that. You have to remember that Mashable was founded in 2005, 7 years ago, and for Pete Cashmore and his staff, it has certainly been anything but an easy trip to success. The price tag that was thrown around for TechCrunch when AOL bought it some time ago was $25 million, which is quite a lot lower than the price tag for Mashable.

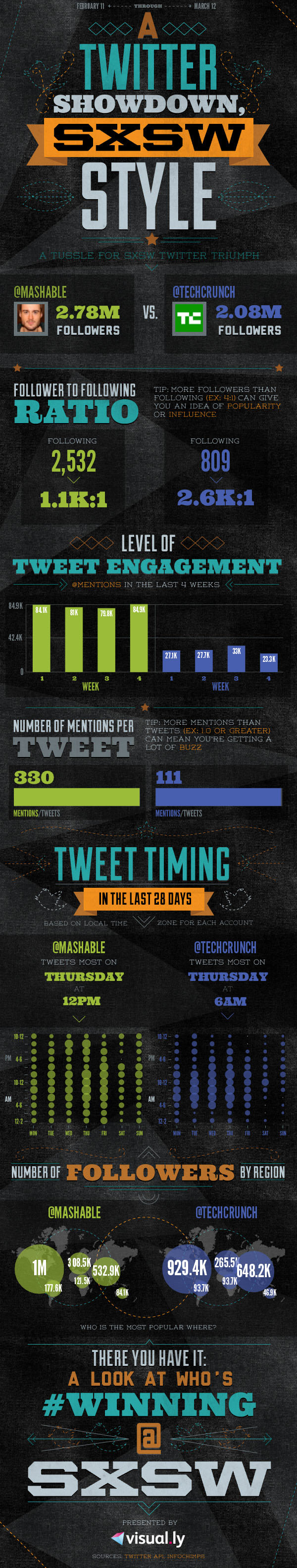

So one might wonder why that is. The sites have pretty similar content even though TechCrunch is more tech directed, but their social media presence is almost identical when you start looking at Twitter for example. The reason why the price tags might vary so much is due to the fact that Mashable has a broader approach, and that CNN simply values Mashable as an acquisition and addition to their media outlet, which is worth $200 million.

Have a look at this showdown infographic presented by Visual.ly, and you will get a better view of these giant media outlets’ social media presences, and how they compare. But as mentioned, to compare these sites is difficult based on their acquisition price tags since it has everything to do with how much the buyer values the acquisition based on what they think they will gain on it. Some people have said that Pete Cashmore is an overnight success, but I think the time it took Pete and his staff to get to this point busts that assumption wide open. Besides, I think that Pete said it best himself in an interview recently when asked about the success of Mashable.

COMMENTS